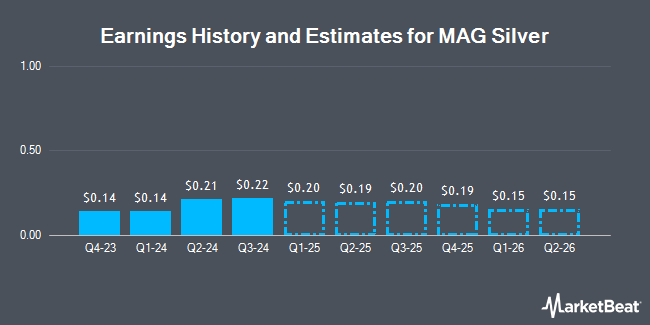

MAG Silver Corp. (NYSEAMERICAN:MAG - Free Report) - Equities researchers at National Bank Financial issued their Q1 2025 earnings per share (EPS) estimates for MAG Silver in a research note issued on Tuesday, April 22nd. National Bank Financial analyst D. Demarco anticipates that the company will post earnings of $0.30 per share for the quarter. The consensus estimate for MAG Silver's current full-year earnings is $0.73 per share.

Several other analysts have also recently weighed in on MAG. HC Wainwright reissued a "buy" rating and set a $22.00 price objective on shares of MAG Silver in a report on Thursday, April 24th. Roth Mkm dropped their price target on shares of MAG Silver from $16.50 to $16.00 and set a "neutral" rating for the company in a research note on Tuesday, March 25th. TD Securities raised shares of MAG Silver to a "strong-buy" rating in a research note on Monday, March 10th. Scotiabank reaffirmed a "sector perform" rating on shares of MAG Silver in a report on Monday, April 14th. Finally, Roth Capital set a $16.00 price target on MAG Silver in a research note on Tuesday, March 25th. Five investment analysts have rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $18.60.

Check Out Our Latest Report on MAG

MAG Silver Price Performance

Shares of MAG stock traded down $0.18 on Thursday, reaching $15.49. 152,775 shares of the stock were exchanged, compared to its average volume of 674,538. MAG Silver has a one year low of $11.29 and a one year high of $18.27. The stock has a market cap of $1.60 billion, a PE ratio of 21.82 and a beta of 1.09. The stock has a 50 day moving average price of $15.45 and a 200 day moving average price of $15.27.

Hedge Funds Weigh In On MAG Silver

A number of hedge funds have recently bought and sold shares of MAG. Aigen Investment Management LP bought a new stake in MAG Silver during the fourth quarter worth about $156,000. D. E. Shaw & Co. Inc. bought a new stake in shares of MAG Silver during the 4th quarter worth approximately $156,000. D.A. Davidson & CO. acquired a new stake in shares of MAG Silver during the 1st quarter worth approximately $167,000. Susquehanna Fundamental Investments LLC acquired a new stake in shares of MAG Silver during the 4th quarter worth approximately $188,000. Finally, Tradition Wealth Management LLC bought a new position in MAG Silver in the fourth quarter valued at approximately $222,000. 52.50% of the stock is owned by institutional investors.

MAG Silver Announces Dividend

The company also recently declared a -- dividend, which was paid on Monday, April 21st. Investors of record on Friday, April 4th were paid a $0.18 dividend. The ex-dividend date was Friday, April 4th. This represents a yield of 1.5%. MAG Silver's dividend payout ratio (DPR) is presently 101.41%.

MAG Silver Company Profile

(

Get Free Report)

MAG Silver Corp. develops and explores for precious metal properties in Canada. It explores for silver, gold, lead, copper, and zinc deposits. The company's flagship property is the 44% owned Juanicipio property located in the Fresnillo District, Zacatecas State, Mexico. MAG Silver Corp. is headquartered in Vancouver, Canada.

Featured Articles

Before you consider MAG Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MAG Silver wasn't on the list.

While MAG Silver currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.