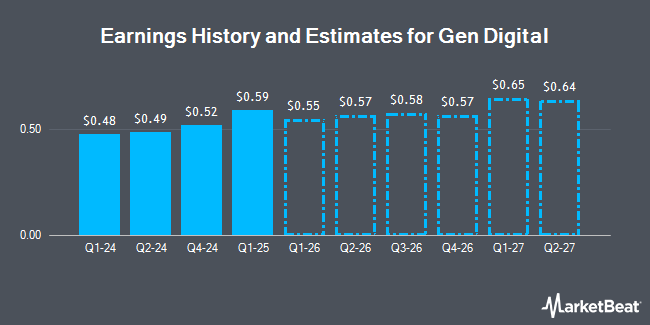

Gen Digital Inc. (NASDAQ:GEN - Free Report) - Zacks Research issued their FY2028 earnings per share estimates for shares of Gen Digital in a note issued to investors on Tuesday, May 27th. Zacks Research analyst R. Department anticipates that the company will earn $2.81 per share for the year. The consensus estimate for Gen Digital's current full-year earnings is $2.05 per share.

Several other analysts have also recently issued reports on GEN. Royal Bank of Canada boosted their price objective on shares of Gen Digital from $28.00 to $30.00 and gave the company a "sector perform" rating in a research note on Wednesday, May 7th. Morgan Stanley reduced their target price on Gen Digital from $27.00 to $25.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 16th.

Read Our Latest Report on Gen Digital

Gen Digital Trading Down 1.5%

GEN stock traded down $0.43 on Thursday, hitting $28.06. 1,131,189 shares of the company were exchanged, compared to its average volume of 3,832,683. The company has a debt-to-equity ratio of 3.29, a current ratio of 0.35 and a quick ratio of 0.35. The stock has a market capitalization of $17.40 billion, a price-to-earnings ratio of 27.51, a price-to-earnings-growth ratio of 1.19 and a beta of 1.00. Gen Digital has a twelve month low of $22.74 and a twelve month high of $31.72. The business's fifty day moving average is $26.33 and its two-hundred day moving average is $27.52.

Gen Digital (NASDAQ:GEN - Get Free Report) last announced its quarterly earnings data on Tuesday, May 6th. The company reported $0.59 earnings per share for the quarter, topping the consensus estimate of $0.58 by $0.01. Gen Digital had a net margin of 16.32% and a return on equity of 58.83%. The business had revenue of $1.01 billion for the quarter, compared to analyst estimates of $999.48 million. During the same period in the prior year, the firm posted $0.53 EPS. The company's revenue was up 4.4% on a year-over-year basis.

Institutional Investors Weigh In On Gen Digital

Several institutional investors and hedge funds have recently modified their holdings of GEN. Catalyst Capital Advisors LLC lifted its position in Gen Digital by 117.6% during the 1st quarter. Catalyst Capital Advisors LLC now owns 1,580 shares of the company's stock worth $42,000 after acquiring an additional 854 shares in the last quarter. Geneos Wealth Management Inc. boosted its stake in shares of Gen Digital by 221.5% in the first quarter. Geneos Wealth Management Inc. now owns 1,717 shares of the company's stock valued at $46,000 after purchasing an additional 1,183 shares during the period. Tsfg LLC purchased a new position in shares of Gen Digital in the first quarter valued at $52,000. Rise Advisors LLC grew its holdings in Gen Digital by 19.2% during the 1st quarter. Rise Advisors LLC now owns 2,361 shares of the company's stock valued at $63,000 after purchasing an additional 381 shares in the last quarter. Finally, Capital Analysts LLC purchased a new stake in Gen Digital during the 1st quarter worth $85,000. Hedge funds and other institutional investors own 81.38% of the company's stock.

Insider Buying and Selling at Gen Digital

In related news, Director Nora Denzel sold 31,646 shares of the stock in a transaction on Friday, May 16th. The stock was sold at an average price of $28.76, for a total value of $910,138.96. Following the completion of the sale, the director now directly owns 34,860 shares in the company, valued at approximately $1,002,573.60. This represents a 47.58% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 12.20% of the stock is currently owned by corporate insiders.

Gen Digital Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, June 11th. Investors of record on Monday, May 19th will be issued a $0.125 dividend. The ex-dividend date of this dividend is Monday, May 19th. This represents a $0.50 annualized dividend and a yield of 1.78%. Gen Digital's payout ratio is 48.08%.

Gen Digital Company Profile

(

Get Free Report)

Gen Digital Inc engages in the provision of cyber safety solutions for consumers in the United States, Canada, Latin America, Europe, the Middle East, Africa, the Asia Pacific, and Japan. The company offers security and performance products under Norton, Avast, Avira, AVG, and CCleaner brands that provide real-time protection and maintenance for PCs, Macs, and mobile devices against malware, viruses, adware, and other online threats.

Recommended Stories

Before you consider Gen Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gen Digital wasn't on the list.

While Gen Digital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.