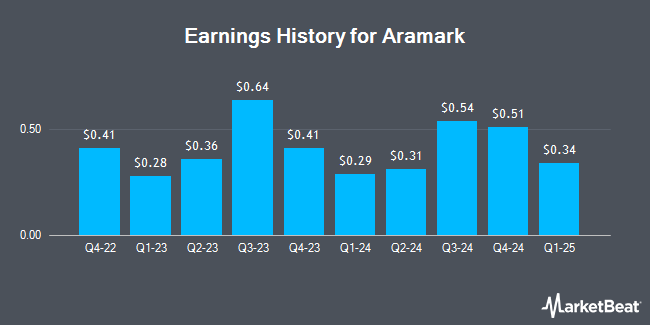

Aramark (NYSE:ARMK - Get Free Report) will likely be announcing its Q2 2025 earnings results before the market opens on Tuesday, May 6th. Analysts expect the company to announce earnings of $0.33 per share and revenue of $4.35 billion for the quarter. Aramark has set its FY 2025 guidance at 1.910-1.980 EPS and its FY25 guidance at $1.91-1.98 EPS.

Aramark (NYSE:ARMK - Get Free Report) last released its quarterly earnings results on Tuesday, February 4th. The company reported $0.51 earnings per share for the quarter, topping analysts' consensus estimates of $0.48 by $0.03. Aramark had a return on equity of 14.72% and a net margin of 1.94%. The firm had revenue of $4.55 billion during the quarter, compared to the consensus estimate of $4.61 billion. During the same quarter in the prior year, the firm posted $0.41 EPS. The business's revenue was up 3.3% on a year-over-year basis. On average, analysts expect Aramark to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Aramark Trading Up 0.3 %

NYSE:ARMK opened at $33.02 on Tuesday. Aramark has a twelve month low of $29.82 and a twelve month high of $42.49. The company has a quick ratio of 0.84, a current ratio of 0.94 and a debt-to-equity ratio of 1.61. The business has a 50 day moving average price of $34.19 and a two-hundred day moving average price of $37.10. The company has a market cap of $8.75 billion, a P/E ratio of 26.00 and a beta of 1.37.

Wall Street Analyst Weigh In

A number of research firms have weighed in on ARMK. Royal Bank of Canada reaffirmed an "outperform" rating and set a $47.00 price target on shares of Aramark in a research report on Thursday, February 6th. StockNews.com downgraded Aramark from a "buy" rating to a "hold" rating in a report on Tuesday, January 7th. Citigroup began coverage on Aramark in a report on Monday, February 24th. They issued a "buy" rating and a $48.00 price objective for the company. Finally, UBS Group cut their price objective on Aramark from $45.00 to $40.00 and set a "buy" rating for the company in a report on Friday, April 11th. Three investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. Based on data from MarketBeat, Aramark presently has a consensus rating of "Moderate Buy" and a consensus target price of $43.08.

Get Our Latest Analysis on Aramark

Aramark Company Profile

(

Get Free Report)

Aramark provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally. It operates through two segments, Food and Support Services United States, and Food and Support Services International. The company offers food-related managed services, including dining, catering, food service management, and convenience-oriented retail services; non-clinical food and food-related support services, such as patient food and nutrition, retail food, environmental services, and procurement services; and plant operations and maintenance, custodial/housekeeping, energy management, grounds keeping, and capital project management services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aramark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aramark wasn't on the list.

While Aramark currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.