Fuller & Thaler Asset Management Inc. trimmed its stake in shares of Assured Guaranty Ltd. (NYSE:AGO - Free Report) by 5.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,059,691 shares of the financial services provider's stock after selling 64,423 shares during the quarter. Fuller & Thaler Asset Management Inc. owned 2.08% of Assured Guaranty worth $95,383,000 as of its most recent filing with the Securities and Exchange Commission.

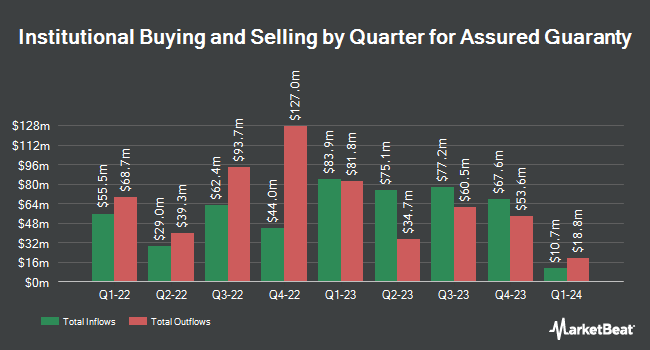

Other institutional investors also recently added to or reduced their stakes in the company. Barclays PLC lifted its position in shares of Assured Guaranty by 214.0% during the 3rd quarter. Barclays PLC now owns 24,879 shares of the financial services provider's stock worth $1,980,000 after buying an additional 16,956 shares during the period. Allianz Asset Management GmbH lifted its holdings in shares of Assured Guaranty by 10.2% during the fourth quarter. Allianz Asset Management GmbH now owns 719,249 shares of the financial services provider's stock valued at $64,740,000 after acquiring an additional 66,487 shares during the period. Merit Financial Group LLC acquired a new stake in shares of Assured Guaranty in the 4th quarter valued at $250,000. First Eagle Investment Management LLC acquired a new stake in shares of Assured Guaranty during the 4th quarter worth about $2,367,000. Finally, Raymond James Financial Inc. acquired a new stake in shares of Assured Guaranty during the 4th quarter worth about $28,060,000. 92.22% of the stock is owned by institutional investors and hedge funds.

Assured Guaranty Price Performance

NYSE:AGO traded up $0.46 on Monday, reaching $87.26. The stock had a trading volume of 57,292 shares, compared to its average volume of 349,691. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.29. The company has a market capitalization of $4.36 billion, a P/E ratio of 6.78 and a beta of 0.84. Assured Guaranty Ltd. has a 1-year low of $72.57 and a 1-year high of $96.50. The stock has a fifty day moving average price of $85.52 and a 200-day moving average price of $88.18.

Assured Guaranty (NYSE:AGO - Get Free Report) last released its quarterly earnings results on Thursday, February 27th. The financial services provider reported $1.27 earnings per share for the quarter, missing analysts' consensus estimates of $1.34 by ($0.07). The business had revenue of $199.00 million for the quarter, compared to analyst estimates of $199.56 million. Assured Guaranty had a net margin of 70.37% and a return on equity of 11.58%. Research analysts forecast that Assured Guaranty Ltd. will post 7.3 EPS for the current year.

Assured Guaranty Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, March 19th. Investors of record on Wednesday, March 5th were given a dividend of $0.34 per share. This is an increase from Assured Guaranty's previous quarterly dividend of $0.31. The ex-dividend date of this dividend was Wednesday, March 5th. This represents a $1.36 annualized dividend and a yield of 1.56%. Assured Guaranty's dividend payout ratio is 19.94%.

About Assured Guaranty

(

Free Report)

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Featured Articles

Before you consider Assured Guaranty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assured Guaranty wasn't on the list.

While Assured Guaranty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.