Flywire (NASDAQ:FLYW - Free Report) had its price objective reduced by B. Riley from $17.00 to $15.00 in a research report report published on Monday,Benzinga reports. B. Riley currently has a buy rating on the stock. B. Riley also issued estimates for Flywire's Q2 2025 earnings at ($0.03) EPS, Q3 2025 earnings at $0.26 EPS, Q4 2025 earnings at $0.08 EPS, FY2025 earnings at $0.28 EPS and FY2026 earnings at $0.56 EPS.

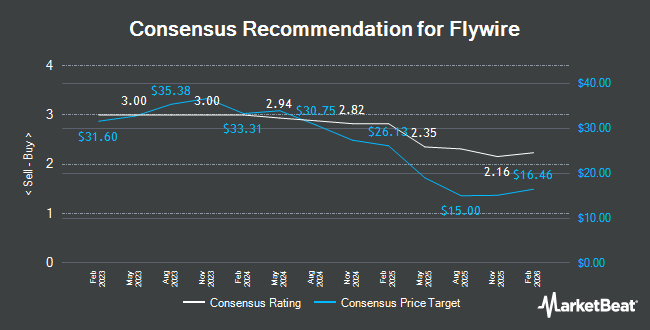

Several other analysts have also weighed in on the stock. Royal Bank Of Canada decreased their target price on shares of Flywire from $20.00 to $17.00 and set an "outperform" rating on the stock in a research report on Wednesday, May 7th. Stephens lowered Flywire from an "overweight" rating to an "equal weight" rating and lowered their price objective for the company from $26.00 to $15.00 in a research note on Wednesday, February 26th. BTIG Research downgraded Flywire from a "buy" rating to a "neutral" rating in a research report on Wednesday, February 26th. Wolfe Research reiterated a "peer perform" rating on shares of Flywire in a research report on Wednesday, April 23rd. Finally, Deutsche Bank Aktiengesellschaft lowered Flywire from a "buy" rating to a "hold" rating and dropped their price objective for the stock from $26.00 to $16.00 in a research note on Wednesday, February 26th. One equities research analyst has rated the stock with a sell rating, nine have given a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, Flywire has a consensus rating of "Hold" and an average price target of $15.00.

Read Our Latest Analysis on FLYW

Flywire Stock Performance

Shares of FLYW stock traded down $0.02 during mid-day trading on Monday, reaching $11.34. The stock had a trading volume of 2,344,515 shares, compared to its average volume of 1,878,052. Flywire has a one year low of $8.20 and a one year high of $23.40. The firm has a market cap of $1.38 billion, a PE ratio of 283.50, a P/E/G ratio of 1.63 and a beta of 1.27. The firm's 50 day simple moving average is $10.46 and its 200 day simple moving average is $13.84. The company has a quick ratio of 2.02, a current ratio of 2.02 and a debt-to-equity ratio of 0.08.

Flywire (NASDAQ:FLYW - Get Free Report) last issued its earnings results on Tuesday, May 6th. The company reported $0.03 EPS for the quarter, beating analysts' consensus estimates of $0.01 by $0.02. Flywire had a return on equity of 1.57% and a net margin of 0.97%. The business had revenue of $128.70 million during the quarter, compared to analyst estimates of $124.18 million. During the same period in the prior year, the company posted ($0.05) earnings per share. Flywire's revenue was up 17.0% on a year-over-year basis. On average, analysts forecast that Flywire will post 0.14 EPS for the current year.

Insider Activity

In related news, Director Edwin J. Santos sold 5,466 shares of the company's stock in a transaction dated Thursday, June 5th. The shares were sold at an average price of $10.04, for a total transaction of $54,878.64. Following the transaction, the director now owns 21,990 shares in the company, valued at $220,779.60. This represents a 19.91% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. 4.40% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Flywire

Large investors have recently modified their holdings of the stock. Global Retirement Partners LLC acquired a new stake in shares of Flywire in the fourth quarter valued at approximately $30,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in shares of Flywire in the 4th quarter valued at $77,000. Venturi Wealth Management LLC acquired a new stake in shares of Flywire in the 4th quarter valued at $104,000. JT Stratford LLC bought a new stake in shares of Flywire during the first quarter worth $109,000. Finally, Dakota Wealth Management lifted its stake in shares of Flywire by 8.7% during the first quarter. Dakota Wealth Management now owns 13,334 shares of the company's stock valued at $127,000 after acquiring an additional 1,066 shares during the period. 95.90% of the stock is currently owned by institutional investors and hedge funds.

About Flywire

(

Get Free Report)

Flywire Corporation, together with its subsidiaries, operates as a payments enablement and software company in the United States and internationally. Its payment platform and network, and vertical-specific software help clients to get paid and help their customers to pay. The company's platform facilitates payment flows across multiple currencies, payment types, and payment options, as well as provides direct connections to alternative payment methods, such as Alipay, Boleto, PayPal/Venmo, and Trustly.

Read More

Before you consider Flywire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flywire wasn't on the list.

While Flywire currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.