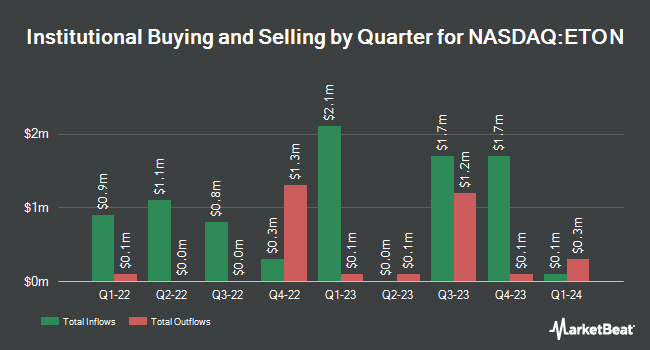

Barclays PLC acquired a new stake in Eton Pharmaceuticals, Inc. (NASDAQ:ETON - Free Report) in the 4th quarter, according to its most recent disclosure with the SEC. The fund acquired 54,886 shares of the company's stock, valued at approximately $731,000. Barclays PLC owned approximately 0.21% of Eton Pharmaceuticals at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in ETON. Raymond James Financial Inc. acquired a new position in Eton Pharmaceuticals during the fourth quarter valued at approximately $147,000. Jane Street Group LLC bought a new stake in Eton Pharmaceuticals during the 3rd quarter worth $90,000. Hillsdale Investment Management Inc. bought a new stake in Eton Pharmaceuticals during the 4th quarter worth $226,000. Envestnet Asset Management Inc. bought a new stake in Eton Pharmaceuticals during the 4th quarter worth $236,000. Finally, Baader Bank Aktiengesellschaft bought a new stake in Eton Pharmaceuticals during the 4th quarter worth $373,000. 27.86% of the stock is owned by institutional investors and hedge funds.

Eton Pharmaceuticals Price Performance

Shares of ETON stock traded up $0.01 on Monday, reaching $16.80. 33,191 shares of the company were exchanged, compared to its average volume of 182,788. The company has a market cap of $450.41 million, a price-to-earnings ratio of -75.60 and a beta of 1.22. The company has a 50-day moving average of $14.45 and a 200-day moving average of $13.63. Eton Pharmaceuticals, Inc. has a one year low of $3.18 and a one year high of $18.41.

Eton Pharmaceuticals (NASDAQ:ETON - Get Free Report) last released its quarterly earnings data on Tuesday, March 18th. The company reported ($0.02) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.02). The company had revenue of $11.65 million for the quarter, compared to analysts' expectations of $10.53 million. Eton Pharmaceuticals had a negative net margin of 15.81% and a negative return on equity of 36.29%. As a group, sell-side analysts predict that Eton Pharmaceuticals, Inc. will post -0.14 EPS for the current year.

Analyst Ratings Changes

Several brokerages recently weighed in on ETON. Craig Hallum boosted their price objective on shares of Eton Pharmaceuticals from $23.00 to $26.00 and gave the stock a "buy" rating in a research note on Wednesday, March 19th. B. Riley reissued a "buy" rating and issued a $24.00 price objective (up from $21.00) on shares of Eton Pharmaceuticals in a research note on Wednesday, March 19th. Finally, HC Wainwright reissued a "buy" rating and issued a $33.00 price objective on shares of Eton Pharmaceuticals in a research note on Wednesday, March 19th.

Check Out Our Latest Report on ETON

About Eton Pharmaceuticals

(

Free Report)

Eton Pharmaceuticals, Inc, a specialty pharmaceutical company, focuses on developing, acquiring, and commercializing pharmaceutical products for rare diseases. The company offers ALKINDI SPRINKLE, a replacement therapy for adrenocortical insufficiency in children under 17 years of age; Carglumic Acid for the treatment of acute and chronic hyperammonemia due to N-acetylglutamate Synthase deficiency; Betaine Anhydrous for the treatment of homocystinuria; and Nitisinone for the treatment of tyrosinemia type 1.

Further Reading

Before you consider Eton Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eton Pharmaceuticals wasn't on the list.

While Eton Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.