Bellevue Group AG raised its position in shares of TransMedics Group, Inc. (NASDAQ:TMDX - Free Report) by 13.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 192,718 shares of the company's stock after buying an additional 22,874 shares during the period. Bellevue Group AG owned about 0.57% of TransMedics Group worth $12,016,000 as of its most recent filing with the Securities and Exchange Commission.

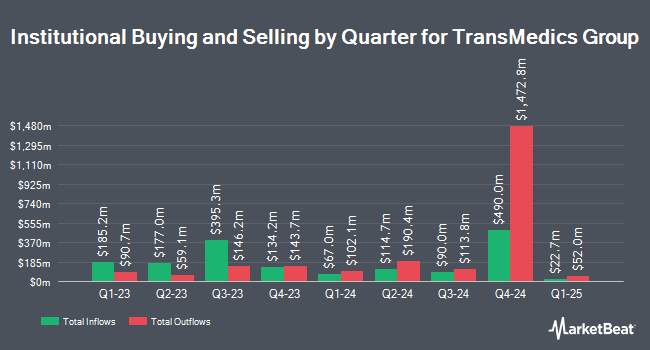

Several other institutional investors and hedge funds have also modified their holdings of the business. Virtu Financial LLC acquired a new position in TransMedics Group in the third quarter worth $436,000. Wilmington Savings Fund Society FSB acquired a new stake in shares of TransMedics Group in the third quarter valued at $149,000. Principal Financial Group Inc. lifted its position in TransMedics Group by 260.1% during the 3rd quarter. Principal Financial Group Inc. now owns 202,287 shares of the company's stock worth $31,759,000 after buying an additional 146,115 shares in the last quarter. APEIRON CAPITAL Ltd bought a new stake in TransMedics Group during the 4th quarter worth about $468,000. Finally, Fiduciary Alliance LLC acquired a new stake in TransMedics Group in the 4th quarter valued at about $247,000. 99.67% of the stock is owned by institutional investors and hedge funds.

TransMedics Group Trading Up 21.6 %

Shares of NASDAQ:TMDX traded up $20.11 during mid-day trading on Friday, reaching $113.31. The stock had a trading volume of 3,795,109 shares, compared to its average volume of 1,341,812. The firm has a 50 day simple moving average of $77.68 and a two-hundred day simple moving average of $75.80. TransMedics Group, Inc. has a twelve month low of $55.00 and a twelve month high of $177.37. The firm has a market cap of $3.83 billion, a PE ratio of 120.54 and a beta of 1.91. The company has a current ratio of 8.20, a quick ratio of 7.33 and a debt-to-equity ratio of 2.42.

TransMedics Group (NASDAQ:TMDX - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The company reported $0.70 earnings per share for the quarter, topping analysts' consensus estimates of $0.29 by $0.41. TransMedics Group had a net margin of 8.14% and a return on equity of 18.74%. The company had revenue of $143.54 million for the quarter, compared to analysts' expectations of $123.39 million. During the same period last year, the firm posted $0.35 earnings per share. The business's quarterly revenue was up 48.2% compared to the same quarter last year. On average, research analysts predict that TransMedics Group, Inc. will post 1 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities analysts have weighed in on the stock. Piper Sandler reaffirmed an "overweight" rating and issued a $125.00 target price (up from $105.00) on shares of TransMedics Group in a research note on Friday. Oppenheimer boosted their price objective on shares of TransMedics Group from $125.00 to $130.00 and gave the stock an "outperform" rating in a research report on Friday. Canaccord Genuity Group reiterated a "buy" rating and issued a $104.00 price objective on shares of TransMedics Group in a research report on Tuesday, March 11th. Finally, Needham & Company LLC reaffirmed a "hold" rating on shares of TransMedics Group in a research note on Wednesday, April 23rd. Three investment analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $126.70.

Read Our Latest Stock Analysis on TMDX

TransMedics Group Profile

(

Free Report)

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

Featured Articles

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.