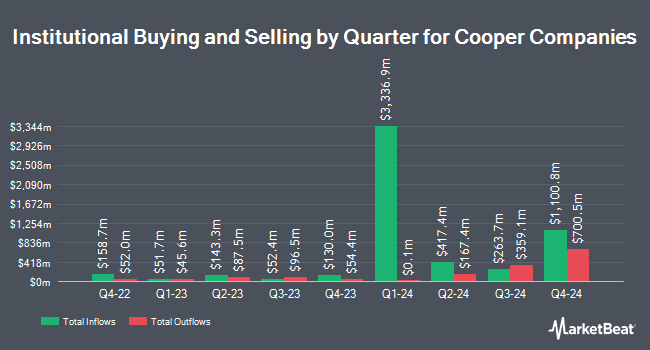

Boothbay Fund Management LLC cut its position in The Cooper Companies, Inc. (NASDAQ:COO - Free Report) by 21.1% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 80,875 shares of the medical device company's stock after selling 21,565 shares during the quarter. Boothbay Fund Management LLC's holdings in Cooper Companies were worth $7,435,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also bought and sold shares of the company. Price T Rowe Associates Inc. MD increased its position in Cooper Companies by 517.0% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 3,529,477 shares of the medical device company's stock worth $324,466,000 after acquiring an additional 2,957,421 shares during the period. Norges Bank acquired a new position in shares of Cooper Companies during the fourth quarter valued at about $217,906,000. FMR LLC lifted its stake in shares of Cooper Companies by 97.6% in the fourth quarter. FMR LLC now owns 2,218,112 shares of the medical device company's stock valued at $203,911,000 after buying an additional 1,095,805 shares during the period. Raymond James Financial Inc. acquired a new stake in Cooper Companies during the fourth quarter worth about $64,826,000. Finally, Victory Capital Management Inc. increased its stake in Cooper Companies by 14.6% during the fourth quarter. Victory Capital Management Inc. now owns 4,525,018 shares of the medical device company's stock valued at $415,985,000 after acquiring an additional 574,899 shares during the period. 24.39% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of analysts have commented on COO shares. JPMorgan Chase & Co. reduced their price objective on Cooper Companies from $120.00 to $110.00 and set an "overweight" rating for the company in a research report on Friday, March 7th. Robert W. Baird decreased their price target on shares of Cooper Companies from $117.00 to $107.00 and set an "outperform" rating on the stock in a research note on Friday, March 7th. Piper Sandler reiterated an "overweight" rating and set a $115.00 target price (down from $120.00) on shares of Cooper Companies in a research report on Friday, March 7th. Needham & Company LLC reissued a "hold" rating on shares of Cooper Companies in a research note on Friday, March 7th. Finally, Citigroup decreased their price objective on Cooper Companies from $115.00 to $110.00 and set a "buy" rating on the stock in a report on Friday, March 7th. Four analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $110.25.

Get Our Latest Report on COO

Cooper Companies Price Performance

Shares of COO traded up $1.20 on Friday, hitting $82.34. The company's stock had a trading volume of 600,799 shares, compared to its average volume of 1,425,361. The company has a 50 day moving average price of $81.60 and a 200 day moving average price of $92.09. The Cooper Companies, Inc. has a fifty-two week low of $69.81 and a fifty-two week high of $112.38. The company has a market capitalization of $16.47 billion, a PE ratio of 42.25, a PEG ratio of 2.25 and a beta of 1.01. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.91 and a quick ratio of 1.12.

Cooper Companies (NASDAQ:COO - Get Free Report) last issued its quarterly earnings results on Thursday, March 6th. The medical device company reported $0.92 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.92. Cooper Companies had a net margin of 10.07% and a return on equity of 9.38%. The business had revenue of $964.70 million for the quarter, compared to the consensus estimate of $981.25 million. On average, research analysts anticipate that The Cooper Companies, Inc. will post 3.98 earnings per share for the current fiscal year.

Cooper Companies Company Profile

(

Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

See Also

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.