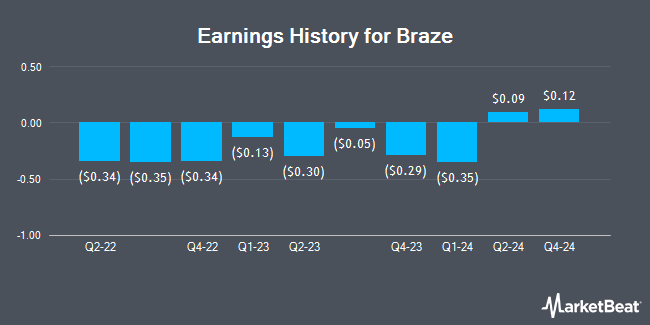

Braze (NASDAQ:BRZE - Get Free Report) announced its quarterly earnings results on Thursday. The company reported $0.07 EPS for the quarter, beating the consensus estimate of $0.05 by $0.02, Briefing.com reports. The company had revenue of $162.06 million for the quarter, compared to analyst estimates of $158.60 million. Braze had a negative net margin of 20.41% and a negative return on equity of 24.88%. Braze's revenue was up 19.6% compared to the same quarter last year. During the same quarter last year, the business earned ($0.05) earnings per share. Braze updated its FY 2026 guidance to 0.150-0.180 EPS and its Q2 2026 guidance to 0.020-0.030 EPS.

Braze Price Performance

Shares of BRZE traded down $6.37 during mid-day trading on Friday, hitting $29.73. The company's stock had a trading volume of 7,732,131 shares, compared to its average volume of 1,270,181. The firm has a 50-day moving average price of $32.78 and a 200 day moving average price of $37.98. Braze has a fifty-two week low of $27.45 and a fifty-two week high of $48.33. The stock has a market capitalization of $3.11 billion, a price-to-earnings ratio of -26.08 and a beta of 1.22.

Insider Activity at Braze

In other news, General Counsel Susan Wiseman sold 4,167 shares of the firm's stock in a transaction on Friday, April 4th. The stock was sold at an average price of $30.98, for a total transaction of $129,093.66. Following the completion of the sale, the general counsel now directly owns 248,999 shares of the company's stock, valued at $7,713,989.02. This trade represents a 1.65% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, CTO Jonathan Hyman sold 9,197 shares of Braze stock in a transaction on Monday, May 19th. The stock was sold at an average price of $35.88, for a total value of $329,988.36. Following the completion of the transaction, the chief technology officer now owns 214,024 shares in the company, valued at $7,679,181.12. The trade was a 4.12% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 71,150 shares of company stock valued at $2,540,814 over the last ninety days. Insiders own 18.20% of the company's stock.

Hedge Funds Weigh In On Braze

A hedge fund recently raised its stake in Braze stock. Intech Investment Management LLC boosted its stake in shares of Braze, Inc. (NASDAQ:BRZE - Free Report) by 18.8% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 40,281 shares of the company's stock after buying an additional 6,379 shares during the period. Intech Investment Management LLC's holdings in Braze were worth $1,453,000 at the end of the most recent reporting period. 90.47% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on the company. UBS Group decreased their price objective on Braze from $51.00 to $48.00 and set a "buy" rating for the company in a report on Friday. Raymond James reduced their price target on Braze from $48.00 to $43.00 and set an "outperform" rating for the company in a research report on Friday. Loop Capital decreased their price target on Braze from $75.00 to $45.00 and set a "buy" rating for the company in a research note on Friday. Barclays cut their price objective on shares of Braze from $70.00 to $47.00 and set an "overweight" rating on the stock in a research note on Friday, May 16th. Finally, Stephens reduced their price objective on shares of Braze from $51.00 to $41.00 and set an "overweight" rating for the company in a report on Friday. One research analyst has rated the stock with a hold rating and twenty have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $46.60.

Check Out Our Latest Analysis on BRZE

About Braze

(

Get Free Report)

Braze, Inc operates a customer engagement platform that provides interactions between consumers and brands worldwide. The company offers Braze software development kits that automatically manage data ingestion and deliver mobile and web notifications, in-application/in-browser interstitial messages, and content cards; REST API that can be used to import or export data or to trigger workflows between Braze and brands' existing technology stacks; Partner Data Integrations, which allow brands to sync user cohorts from partners; Data Transformation, in which brands can programmatically sync and transform user data; and Braze Cloud Data Ingestion that enables brands to harness their customer data.

Recommended Stories

Before you consider Braze, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Braze wasn't on the list.

While Braze currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.