Brevan Howard Capital Management LP lessened its holdings in shares of Advance Auto Parts, Inc. (NYSE:AAP - Free Report) by 45.4% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 60,502 shares of the company's stock after selling 50,260 shares during the period. Brevan Howard Capital Management LP owned about 0.10% of Advance Auto Parts worth $2,861,000 at the end of the most recent quarter.

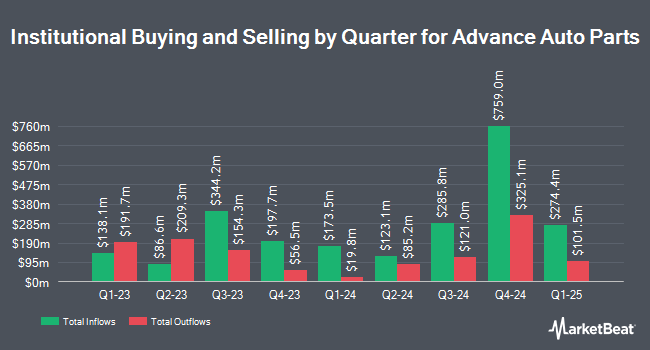

Other hedge funds also recently made changes to their positions in the company. CIBC Asset Management Inc grew its position in Advance Auto Parts by 3.9% during the fourth quarter. CIBC Asset Management Inc now owns 5,865 shares of the company's stock worth $277,000 after buying an additional 221 shares in the last quarter. Yousif Capital Management LLC grew its holdings in shares of Advance Auto Parts by 1.1% during the 4th quarter. Yousif Capital Management LLC now owns 26,258 shares of the company's stock worth $1,242,000 after purchasing an additional 281 shares in the last quarter. Ingalls & Snyder LLC increased its position in shares of Advance Auto Parts by 5.0% in the fourth quarter. Ingalls & Snyder LLC now owns 6,680 shares of the company's stock worth $316,000 after purchasing an additional 317 shares during the period. Versant Capital Management Inc increased its position in shares of Advance Auto Parts by 207.4% in the fourth quarter. Versant Capital Management Inc now owns 541 shares of the company's stock worth $26,000 after purchasing an additional 365 shares during the period. Finally, Blue Trust Inc. raised its stake in Advance Auto Parts by 38.9% in the fourth quarter. Blue Trust Inc. now owns 1,674 shares of the company's stock valued at $79,000 after purchasing an additional 469 shares in the last quarter. 88.75% of the stock is owned by institutional investors.

Advance Auto Parts Stock Down 4.8 %

Shares of NYSE AAP opened at $31.80 on Tuesday. Advance Auto Parts, Inc. has a 52-week low of $28.89 and a 52-week high of $77.49. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.62 and a current ratio of 1.34. The company's 50 day moving average price is $34.99 and its 200-day moving average price is $40.63. The company has a market capitalization of $1.90 billion, a P/E ratio of 43.57, a price-to-earnings-growth ratio of 1.98 and a beta of 0.93.

Advance Auto Parts Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, April 25th. Shareholders of record on Friday, April 11th were issued a dividend of $0.25 per share. The ex-dividend date was Friday, April 11th. This represents a $1.00 dividend on an annualized basis and a yield of 3.14%. Advance Auto Parts's payout ratio is currently -17.86%.

Insider Transactions at Advance Auto Parts

In other news, CEO Shane M. Okelly acquired 1,500 shares of Advance Auto Parts stock in a transaction on Tuesday, March 11th. The stock was purchased at an average price of $36.79 per share, with a total value of $55,185.00. Following the completion of the purchase, the chief executive officer now owns 183,121 shares of the company's stock, valued at approximately $6,737,021.59. The trade was a 0.83 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Eugene I. Lee, Jr. bought 14,640 shares of the stock in a transaction dated Thursday, March 6th. The shares were purchased at an average cost of $34.15 per share, for a total transaction of $499,956.00. Following the completion of the transaction, the director now directly owns 34,070 shares of the company's stock, valued at $1,163,490.50. This trade represents a 75.35 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 0.35% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on AAP shares. Wedbush restated an "outperform" rating and issued a $55.00 target price on shares of Advance Auto Parts in a research report on Monday, March 3rd. Citigroup lowered their price objective on shares of Advance Auto Parts from $47.00 to $40.00 and set a "neutral" rating for the company in a research report on Thursday, February 27th. BMO Capital Markets reduced their target price on Advance Auto Parts from $45.00 to $40.00 and set a "market perform" rating on the stock in a report on Thursday, February 27th. Wells Fargo & Company upped their price objective on Advance Auto Parts from $40.00 to $45.00 and gave the stock an "equal weight" rating in a research report on Monday, January 6th. Finally, Royal Bank of Canada decreased their target price on Advance Auto Parts from $50.00 to $44.00 and set a "sector perform" rating on the stock in a research report on Thursday, February 27th. One investment analyst has rated the stock with a sell rating, sixteen have issued a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat, Advance Auto Parts presently has an average rating of "Hold" and a consensus price target of $45.13.

Get Our Latest Research Report on AAP

Advance Auto Parts Profile

(

Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.