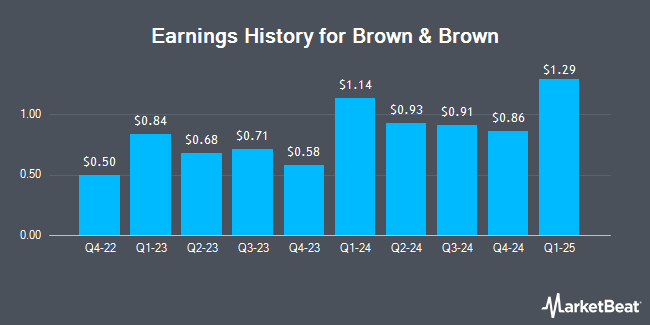

Brown & Brown (NYSE:BRO - Get Free Report) issued its earnings results on Monday. The financial services provider reported $1.29 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.30 by ($0.01), Zacks reports. Brown & Brown had a return on equity of 17.81% and a net margin of 20.68%. The company had revenue of $1.40 billion during the quarter, compared to analyst estimates of $1.41 billion. During the same quarter in the previous year, the firm earned $1.14 earnings per share. The business's revenue was up 11.6% compared to the same quarter last year.

Brown & Brown Stock Performance

NYSE BRO traded up $1.28 during midday trading on Friday, hitting $110.30. The company had a trading volume of 420,191 shares, compared to its average volume of 1,814,032. The firm has a fifty day simple moving average of $117.91 and a two-hundred day simple moving average of $110.62. The stock has a market cap of $31.61 billion, a price-to-earnings ratio of 31.86, a P/E/G ratio of 2.93 and a beta of 0.75. The company has a quick ratio of 1.79, a current ratio of 1.79 and a debt-to-equity ratio of 0.56. Brown & Brown has a fifty-two week low of $81.79 and a fifty-two week high of $125.68.

Brown & Brown Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, May 21st. Stockholders of record on Monday, May 12th will be paid a $0.15 dividend. The ex-dividend date is Monday, May 12th. This represents a $0.60 annualized dividend and a dividend yield of 0.54%. Brown & Brown's payout ratio is 16.71%.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the stock. Edward Jones started coverage on shares of Brown & Brown in a research report on Wednesday, April 16th. They issued a "buy" rating on the stock. Keefe, Bruyette & Woods upped their price target on Brown & Brown from $97.00 to $102.00 and gave the company an "underperform" rating in a research report on Wednesday, April 9th. Wells Fargo & Company raised their price objective on Brown & Brown from $115.00 to $125.00 and gave the stock an "overweight" rating in a research report on Wednesday, January 29th. Bank of America increased their price target on shares of Brown & Brown from $116.00 to $117.00 and gave the stock a "neutral" rating in a research report on Tuesday, January 28th. Finally, Barclays upped their price objective on shares of Brown & Brown from $119.00 to $121.00 and gave the company an "equal weight" rating in a research note on Friday, April 11th. One investment analyst has rated the stock with a sell rating, six have given a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $116.83.

Get Our Latest Stock Report on Brown & Brown

About Brown & Brown

(

Get Free Report)

Brown & Brown, Inc is an insurance agency, wholesale brokerage, insurance program and service organization. It engages in the provision of insurance brokerage services and casualty insurance underwriting services. It operates through the following segments: Retail, National Programs, Wholesale Brokerage, and Services.

Featured Articles

Before you consider Brown & Brown, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brown & Brown wasn't on the list.

While Brown & Brown currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.