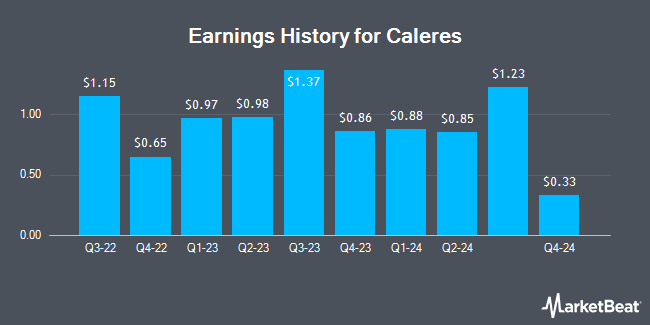

Caleres (NYSE:CAL - Get Free Report) released its earnings results on Thursday. The textile maker reported $0.22 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.37 by ($0.15), Briefing.com reports. The company had revenue of $614.22 million during the quarter, compared to analysts' expectations of $622.93 million. Caleres had a net margin of 5.69% and a return on equity of 22.71%. Caleres's revenue for the quarter was down 6.8% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.88 earnings per share.

Caleres Stock Down 1.6%

Shares of CAL traded down $0.22 during trading on Monday, reaching $13.24. The company's stock had a trading volume of 483,911 shares, compared to its average volume of 795,478. The company has a market cap of $444.85 million, a price-to-earnings ratio of 2.95 and a beta of 1.11. The company has a fifty day moving average of $16.02 and a two-hundred day moving average of $19.53. Caleres has a twelve month low of $13.03 and a twelve month high of $44.51.

Caleres Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Thursday, June 5th will be issued a dividend of $0.07 per share. The ex-dividend date of this dividend is Thursday, June 5th. This represents a $0.28 annualized dividend and a yield of 2.12%. Caleres's dividend payout ratio is presently 11.67%.

Insider Activity

In related news, Director Lori Greeley purchased 9,000 shares of the business's stock in a transaction that occurred on Thursday, March 27th. The shares were purchased at an average cost of $17.77 per share, with a total value of $159,930.00. Following the completion of the acquisition, the director now directly owns 10,000 shares of the company's stock, valued at approximately $177,700. The trade was a 900.00% increase in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Company insiders own 4.10% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in CAL. AQR Capital Management LLC raised its stake in shares of Caleres by 143.2% in the 1st quarter. AQR Capital Management LLC now owns 90,546 shares of the textile maker's stock valued at $1,560,000 after purchasing an additional 53,320 shares in the last quarter. Empowered Funds LLC boosted its stake in Caleres by 4.2% in the first quarter. Empowered Funds LLC now owns 162,814 shares of the textile maker's stock valued at $2,805,000 after acquiring an additional 6,502 shares during the period. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its holdings in shares of Caleres by 4.1% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 105,137 shares of the textile maker's stock valued at $1,812,000 after purchasing an additional 4,175 shares during the last quarter. 98.44% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Loop Capital cut their price target on shares of Caleres from $16.00 to $14.00 and set a "hold" rating on the stock in a report on Friday.

Read Our Latest Analysis on CAL

Caleres Company Profile

(

Get Free Report)

Caleres, Inc engages in the retail and wholesale of footwear business in the United States, Canada, East Asia, and internationally. It operates through Famous Footwear and Brand Portfolio segments. The company offers licensed, branded, and private-label athletic, casual, and dress footwear products. The company provides brand name athletic, casual, and dress shoes, including Nike, Skechers, adidas, Vans, Crocs, Converse, Puma, Birkenstock, New Balance, Under Armour, Dr.

Featured Articles

Before you consider Caleres, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caleres wasn't on the list.

While Caleres currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.