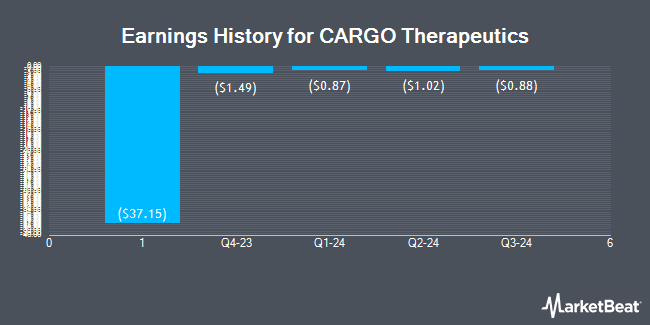

CARGO Therapeutics (NASDAQ:CRGX - Get Free Report) is anticipated to issue its Q1 2025 quarterly earnings data before the market opens on Tuesday, May 13th. Analysts expect the company to announce earnings of ($0.70) per share for the quarter.

CARGO Therapeutics Price Performance

Shares of CRGX traded down $0.10 during midday trading on Friday, hitting $4.02. 312,388 shares of the company traded hands, compared to its average volume of 521,550. The firm has a market cap of $185.36 million, a P/E ratio of -0.94 and a beta of 0.47. CARGO Therapeutics has a one year low of $3.00 and a one year high of $25.45. The stock has a 50-day moving average of $4.21 and a 200-day moving average of $9.96.

Analyst Ratings Changes

Several equities analysts recently issued reports on the stock. Jefferies Financial Group cut shares of CARGO Therapeutics from a "buy" rating to a "hold" rating and reduced their price target for the company from $32.00 to $3.00 in a research report on Thursday, January 30th. Piper Sandler downgraded CARGO Therapeutics from an "overweight" rating to a "neutral" rating and dropped their price target for the stock from $34.00 to $4.00 in a research note on Thursday, January 30th. HC Wainwright lowered CARGO Therapeutics from a "buy" rating to a "neutral" rating in a research report on Thursday, January 30th. JPMorgan Chase & Co. cut CARGO Therapeutics from an "overweight" rating to an "underweight" rating in a research note on Thursday, January 30th. Finally, Truist Financial downgraded CARGO Therapeutics from a "buy" rating to a "hold" rating and dropped their price target for the stock from $32.00 to $7.00 in a research report on Thursday, January 30th. One investment analyst has rated the stock with a sell rating and six have issued a hold rating to the company. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $15.00.

Read Our Latest Analysis on CRGX

CARGO Therapeutics Company Profile

(

Get Free Report)

CARGO Therapeutics, Inc, a clinical-stage biotechnology company, develops chimeric antigen receptor (CAR) T-cell therapies for cancer patients. The company's lead program is CRG-022, an autologous CD22 CAR T-cell product candidate designed to address resistance mechanisms by targeting CD22, an alternate tumor antigen that is expressed in B-cell malignancies.

Read More

Before you consider CARGO Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CARGO Therapeutics wasn't on the list.

While CARGO Therapeutics currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.