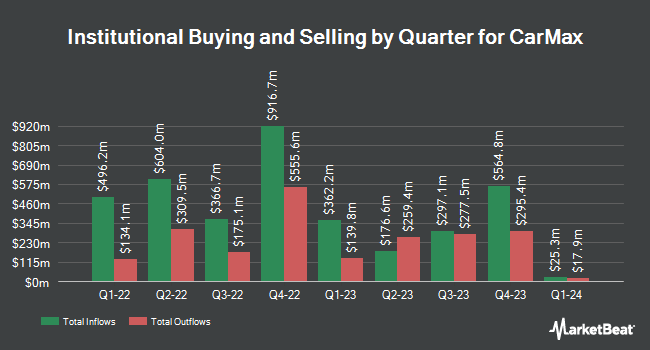

Bank of America Corp DE raised its holdings in CarMax, Inc. (NYSE:KMX - Free Report) by 9.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,535,828 shares of the company's stock after buying an additional 130,653 shares during the period. Bank of America Corp DE owned about 1.00% of CarMax worth $125,569,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also made changes to their positions in the business. First Hawaiian Bank acquired a new position in CarMax in the fourth quarter valued at $273,000. Sequoia Financial Advisors LLC boosted its position in shares of CarMax by 10.6% in the 4th quarter. Sequoia Financial Advisors LLC now owns 3,191 shares of the company's stock valued at $261,000 after purchasing an additional 307 shares during the period. Jones Financial Companies Lllp increased its position in CarMax by 36.6% during the fourth quarter. Jones Financial Companies Lllp now owns 5,211 shares of the company's stock worth $426,000 after buying an additional 1,396 shares during the period. HF Advisory Group LLC lifted its stake in CarMax by 12.6% in the fourth quarter. HF Advisory Group LLC now owns 28,793 shares of the company's stock valued at $2,354,000 after buying an additional 3,222 shares during the last quarter. Finally, Merit Financial Group LLC acquired a new stake in shares of CarMax in the fourth quarter valued at approximately $600,000.

CarMax Stock Performance

Shares of KMX stock opened at $66.29 on Friday. The company has a debt-to-equity ratio of 2.92, a quick ratio of 0.55 and a current ratio of 2.30. The stock has a market cap of $10.12 billion, a PE ratio of 22.47, a P/E/G ratio of 1.67 and a beta of 1.45. CarMax, Inc. has a 1 year low of $61.67 and a 1 year high of $91.25. The stock has a fifty day moving average price of $70.82 and a 200 day moving average price of $77.99.

Analyst Upgrades and Downgrades

Several analysts recently commented on the stock. Cfra Research upgraded shares of CarMax to a "strong-buy" rating in a research report on Thursday, April 10th. Evercore ISI decreased their target price on shares of CarMax from $107.00 to $105.00 and set an "outperform" rating for the company in a research note on Tuesday, March 11th. Wedbush restated an "outperform" rating and issued a $90.00 price target on shares of CarMax in a research report on Monday, April 21st. Needham & Company LLC decreased their price objective on CarMax from $101.00 to $92.00 and set a "buy" rating for the company in a research report on Friday, April 11th. Finally, Robert W. Baird dropped their target price on CarMax from $95.00 to $90.00 and set an "outperform" rating on the stock in a report on Friday, April 11th. Three investment analysts have rated the stock with a sell rating, four have given a hold rating, seven have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $87.73.

Check Out Our Latest Research Report on CarMax

Insider Activity at CarMax

In related news, Director Mitchell D. Steenrod purchased 1,300 shares of the company's stock in a transaction on Thursday, April 24th. The stock was bought at an average price of $65.49 per share, with a total value of $85,137.00. Following the completion of the transaction, the director now owns 33,577 shares of the company's stock, valued at approximately $2,198,957.73. This represents a 4.03 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 1.66% of the stock is owned by corporate insiders.

CarMax Profile

(

Free Report)

CarMax, Inc, through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. It operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

Further Reading

Want to see what other hedge funds are holding KMX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CarMax, Inc. (NYSE:KMX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CarMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarMax wasn't on the list.

While CarMax currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.