NewEdge Advisors LLC raised its holdings in CAVA Group, Inc. (NYSE:CAVA - Free Report) by 24.6% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 15,666 shares of the company's stock after acquiring an additional 3,094 shares during the period. NewEdge Advisors LLC's holdings in CAVA Group were worth $1,767,000 at the end of the most recent reporting period.

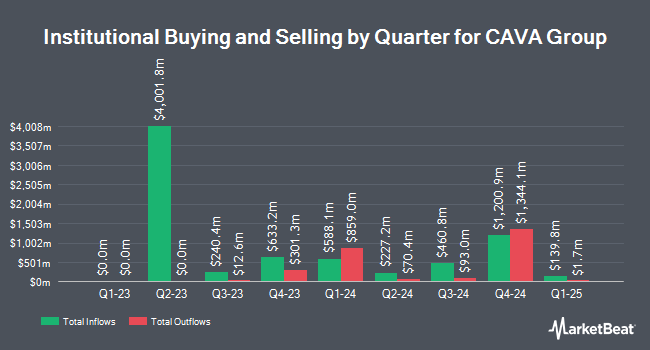

Several other institutional investors and hedge funds have also recently modified their holdings of the business. Vanguard Group Inc. raised its holdings in shares of CAVA Group by 20.4% during the 4th quarter. Vanguard Group Inc. now owns 8,011,602 shares of the company's stock valued at $903,709,000 after buying an additional 1,357,187 shares in the last quarter. FMR LLC grew its position in CAVA Group by 14.1% during the 4th quarter. FMR LLC now owns 3,976,353 shares of the company's stock worth $448,533,000 after acquiring an additional 491,320 shares during the last quarter. Jennison Associates LLC grew its position in CAVA Group by 36,658.7% during the 4th quarter. Jennison Associates LLC now owns 2,461,732 shares of the company's stock worth $277,683,000 after acquiring an additional 2,455,035 shares during the last quarter. Federated Hermes Inc. grew its position in CAVA Group by 33.0% during the 4th quarter. Federated Hermes Inc. now owns 1,464,987 shares of the company's stock worth $165,243,000 after acquiring an additional 363,814 shares during the last quarter. Finally, Lord Abbett & CO. LLC grew its position in CAVA Group by 1.5% during the 3rd quarter. Lord Abbett & CO. LLC now owns 1,358,250 shares of the company's stock worth $168,219,000 after acquiring an additional 19,493 shares during the last quarter. Hedge funds and other institutional investors own 73.15% of the company's stock.

CAVA Group Price Performance

CAVA stock traded up $2.31 during trading on Monday, hitting $93.11. 2,644,950 shares of the stock traded hands, compared to its average volume of 3,113,971. CAVA Group, Inc. has a 1 year low of $66.15 and a 1 year high of $172.43. The firm's 50 day moving average is $87.24 and its two-hundred day moving average is $115.51. The stock has a market cap of $10.76 billion, a price-to-earnings ratio of 202.41 and a beta of 3.33.

CAVA Group (NYSE:CAVA - Get Free Report) last announced its quarterly earnings data on Tuesday, February 25th. The company reported $0.05 EPS for the quarter, missing the consensus estimate of $0.06 by ($0.01). The firm had revenue of $227.40 million for the quarter, compared to analysts' expectations of $223.34 million. CAVA Group had a net margin of 5.88% and a return on equity of 9.10%. As a group, analysts anticipate that CAVA Group, Inc. will post 0.5 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

CAVA has been the topic of several recent research reports. Piper Sandler upgraded CAVA Group from a "neutral" rating to an "overweight" rating and reduced their price target for the stock from $142.00 to $115.00 in a research report on Friday, February 28th. Barclays reduced their price target on CAVA Group from $104.00 to $90.00 and set an "equal weight" rating on the stock in a research report on Tuesday, April 22nd. William Blair restated an "outperform" rating on shares of CAVA Group in a research report on Wednesday, February 26th. Wedbush reiterated an "outperform" rating and issued a $150.00 price objective on shares of CAVA Group in a research report on Wednesday, February 26th. Finally, Loop Capital cut their price objective on CAVA Group from $147.00 to $100.00 and set a "hold" rating on the stock in a research report on Thursday, February 27th. Five equities research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $124.19.

Read Our Latest Stock Report on CAVA Group

CAVA Group Profile

(

Free Report)

CAVA Group, Inc owns and operates a chain of restaurants under the CAVA brand in the United States. The company also offers dips, spreads, and dressings through grocery stores. In addition, the company provides online and mobile ordering platforms. Cava Group, Inc was founded in 2006 and is headquartered in Washington, the District of Columbia.

Featured Articles

Before you consider CAVA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAVA Group wasn't on the list.

While CAVA Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.