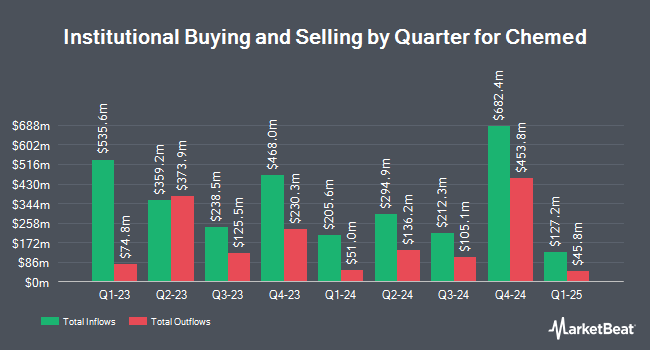

Barclays PLC increased its holdings in Chemed Co. (NYSE:CHE - Free Report) by 20.2% in the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 11,778 shares of the company's stock after purchasing an additional 1,983 shares during the period. Barclays PLC owned approximately 0.08% of Chemed worth $6,240,000 as of its most recent SEC filing.

A number of other institutional investors also recently made changes to their positions in CHE. Norges Bank purchased a new stake in shares of Chemed in the 4th quarter valued at $95,872,000. Raymond James Financial Inc. purchased a new stake in shares of Chemed in the 4th quarter valued at $42,023,000. FMR LLC boosted its stake in shares of Chemed by 18.9% in the 4th quarter. FMR LLC now owns 283,790 shares of the company's stock valued at $150,352,000 after purchasing an additional 45,174 shares in the last quarter. Principal Financial Group Inc. boosted its stake in shares of Chemed by 114.1% in the 4th quarter. Principal Financial Group Inc. now owns 74,658 shares of the company's stock valued at $39,554,000 after purchasing an additional 39,791 shares in the last quarter. Finally, Segall Bryant & Hamill LLC purchased a new stake in shares of Chemed in the 4th quarter valued at $12,880,000. Hedge funds and other institutional investors own 95.85% of the company's stock.

Chemed Price Performance

CHE traded up $4.73 during trading on Wednesday, hitting $579.69. 169,818 shares of the stock traded hands, compared to its average volume of 99,302. Chemed Co. has a 12-month low of $512.12 and a 12-month high of $623.61. The firm has a market capitalization of $8.47 billion, a P/E ratio of 29.29, a price-to-earnings-growth ratio of 2.15 and a beta of 0.49. The firm has a 50-day moving average of $589.04 and a 200 day moving average of $566.71.

Chemed (NYSE:CHE - Get Free Report) last issued its quarterly earnings data on Wednesday, April 23rd. The company reported $5.63 EPS for the quarter, topping the consensus estimate of $5.59 by $0.04. Chemed had a net margin of 12.69% and a return on equity of 27.86%. The business had revenue of $646.94 million during the quarter, compared to analyst estimates of $641.78 million. During the same period in the prior year, the business earned $5.20 EPS. The company's revenue for the quarter was up 9.8% on a year-over-year basis. As a group, equities analysts predict that Chemed Co. will post 21.43 EPS for the current fiscal year.

Chemed Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, March 14th. Investors of record on Monday, February 24th were paid a $0.50 dividend. The ex-dividend date of this dividend was Monday, February 24th. This represents a $2.00 annualized dividend and a dividend yield of 0.35%. Chemed's payout ratio is 9.74%.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on CHE shares. StockNews.com raised shares of Chemed from a "hold" rating to a "buy" rating in a research report on Friday, March 7th. Royal Bank of Canada increased their price target on shares of Chemed from $667.00 to $674.00 and gave the company an "outperform" rating in a research report on Monday.

View Our Latest Stock Report on Chemed

Insider Buying and Selling

In related news, CEO Kevin J. Mcnamara sold 2,000 shares of the stock in a transaction dated Thursday, March 6th. The shares were sold at an average price of $593.67, for a total value of $1,187,340.00. Following the completion of the transaction, the chief executive officer now directly owns 102,679 shares in the company, valued at $60,957,441.93. This trade represents a 1.91 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 3.29% of the stock is owned by company insiders.

Chemed Company Profile

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

See Also

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.