Kenvue (NYSE:KVUE - Free Report) had its target price trimmed by Citigroup from $24.50 to $22.00 in a research report report published on Tuesday morning,Benzinga reports. The brokerage currently has a neutral rating on the stock.

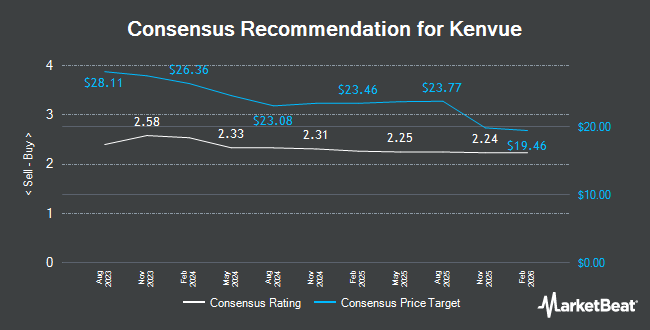

A number of other analysts have also recently weighed in on the company. Barclays decreased their price objective on Kenvue from $23.00 to $22.00 and set an "equal weight" rating for the company in a research report on Tuesday. Evercore ISI assumed coverage on Kenvue in a research note on Monday, March 24th. They set an "in-line" rating and a $25.00 target price for the company. Bank of America cut their target price on Kenvue from $27.00 to $25.00 and set a "buy" rating for the company in a research note on Tuesday. Redburn Atlantic assumed coverage on Kenvue in a research note on Thursday, April 10th. They set a "neutral" rating and a $23.50 target price for the company. Finally, UBS Group increased their target price on Kenvue from $24.00 to $25.00 and gave the stock a "neutral" rating in a research note on Friday, May 9th. Seven equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $24.71.

View Our Latest Analysis on Kenvue

Kenvue Stock Performance

Kenvue stock traded up $0.17 during mid-day trading on Tuesday, reaching $22.02. 5,211,828 shares of the company were exchanged, compared to its average volume of 16,271,595. Kenvue has a twelve month low of $17.85 and a twelve month high of $25.17. The firm's 50-day simple moving average is $22.24 and its two-hundred day simple moving average is $22.29. The company has a debt-to-equity ratio of 0.63, a quick ratio of 0.60 and a current ratio of 0.86. The firm has a market cap of $42.24 billion, a PE ratio of 40.01, a price-to-earnings-growth ratio of 3.40 and a beta of 0.83.

Kenvue (NYSE:KVUE - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The company reported $0.24 earnings per share for the quarter, topping analysts' consensus estimates of $0.23 by $0.01. Kenvue had a return on equity of 20.87% and a net margin of 6.90%. The company had revenue of $3.74 billion during the quarter, compared to analysts' expectations of $3.69 billion. During the same period last year, the firm earned $0.28 EPS. The firm's revenue for the quarter was down 3.9% on a year-over-year basis. Equities analysts predict that Kenvue will post 1.14 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Kenvue

A number of large investors have recently bought and sold shares of KVUE. Pittenger & Anderson Inc. acquired a new stake in Kenvue during the 1st quarter valued at $30,000. Trust Co. of Vermont boosted its holdings in Kenvue by 266.8% in the second quarter. Trust Co. of Vermont now owns 1,581 shares of the company's stock valued at $33,000 after acquiring an additional 1,150 shares during the last quarter. TruNorth Capital Management LLC purchased a new position in Kenvue in the first quarter valued at about $36,000. Truvestments Capital LLC purchased a new position in Kenvue in the first quarter valued at about $37,000. Finally, Clal Insurance Enterprises Holdings Ltd raised its position in Kenvue by 378.5% in the first quarter. Clal Insurance Enterprises Holdings Ltd now owns 1,627 shares of the company's stock valued at $39,000 after purchasing an additional 1,287 shares during the period. Institutional investors and hedge funds own 97.64% of the company's stock.

Kenvue Company Profile

(

Get Free Report)

Kenvue Inc operates as a consumer health company worldwide. The company operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. The Self Care segment offers cough, cold and allergy, pain care, digestive health, smoking cessation, eye care, and other products under the Tylenol, Motrin, Benadryl, Nicorette, Zarbee's, ORSLTM, Rhinocort, Calpol, and Zyrtec brands.

Featured Articles

Before you consider Kenvue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kenvue wasn't on the list.

While Kenvue currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.