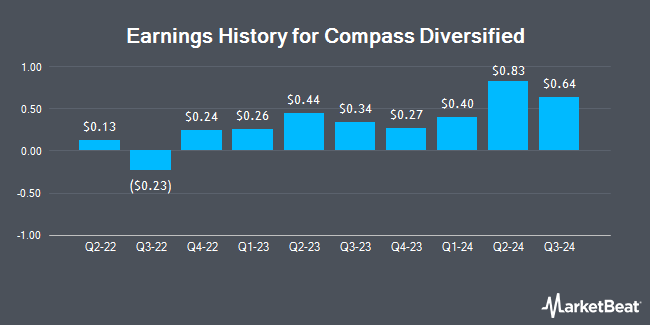

Compass Diversified (NYSE:CODI - Get Free Report) will likely be issuing its Q1 2025 quarterly earnings data before the market opens on Wednesday, May 7th. Analysts expect the company to announce earnings of $0.54 per share and revenue of $575.82 million for the quarter.

Compass Diversified Stock Performance

NYSE CODI opened at $17.33 on Wednesday. Compass Diversified has a fifty-two week low of $15.64 and a fifty-two week high of $24.59. The stock's fifty day moving average is $18.51 and its two-hundred day moving average is $20.89. The firm has a market capitalization of $1.30 billion, a P/E ratio of 36.10, a price-to-earnings-growth ratio of 1.25 and a beta of 1.55. The company has a debt-to-equity ratio of 1.51, a quick ratio of 1.62 and a current ratio of 4.22.

Compass Diversified Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, April 24th. Stockholders of record on Thursday, April 17th were paid a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 5.77%. The ex-dividend date of this dividend was Thursday, April 17th. Compass Diversified's dividend payout ratio (DPR) is presently -78.13%.

Analyst Ratings Changes

Several brokerages have recently commented on CODI. William Blair reaffirmed an "outperform" rating on shares of Compass Diversified in a research note on Friday, February 28th. B. Riley raised Compass Diversified to a "strong-buy" rating in a research note on Tuesday, January 7th.

Check Out Our Latest Stock Analysis on Compass Diversified

Compass Diversified Company Profile

(

Get Free Report)

Compass Diversified is a private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage and middle market investments. It seeks to invest in niche industrial or branded consumer companies, manufacturing, distribution, consumer products, business services sector, healthcare, safety & security, electronic components, food and foodservice.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Compass Diversified, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Diversified wasn't on the list.

While Compass Diversified currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.