Consolidated Edison (NYSE:ED - Free Report) had its price objective lowered by Morgan Stanley from $94.00 to $93.00 in a research report report published on Thursday morning,Benzinga reports. The brokerage currently has an underweight rating on the utilities provider's stock.

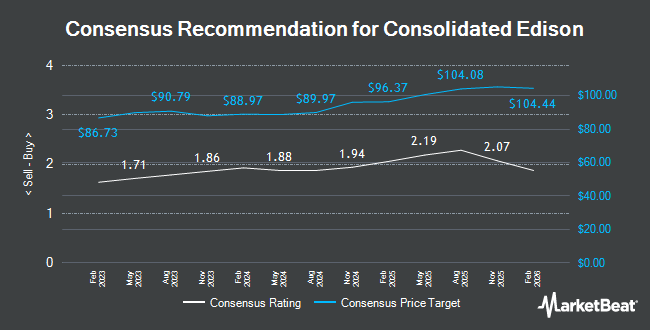

ED has been the topic of several other reports. KeyCorp downgraded Consolidated Edison from a "sector weight" rating to an "underweight" rating and set a $90.00 price objective on the stock. in a research report on Wednesday, May 14th. Mizuho upped their price objective on Consolidated Edison from $92.00 to $95.00 and gave the company a "neutral" rating in a research report on Monday, February 3rd. Scotiabank upped their price objective on Consolidated Edison from $100.00 to $101.00 and gave the company a "sector perform" rating in a research report on Monday, February 24th. Citigroup upped their price objective on Consolidated Edison from $116.00 to $120.00 and gave the company a "buy" rating in a research report on Wednesday, April 9th. Finally, Barclays upped their price objective on Consolidated Edison from $100.00 to $101.00 and gave the company an "underweight" rating in a research report on Monday, May 5th. Three analysts have rated the stock with a sell rating, seven have given a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average price target of $104.27.

View Our Latest Stock Analysis on ED

Consolidated Edison Price Performance

Shares of ED traded down $0.40 on Thursday, reaching $103.70. The stock had a trading volume of 578,436 shares, compared to its average volume of 2,280,899. The firm has a market capitalization of $37.36 billion, a PE ratio of 19.82, a PEG ratio of 3.05 and a beta of 0.29. The company has a quick ratio of 0.93, a current ratio of 1.01 and a debt-to-equity ratio of 1.07. The firm has a 50-day moving average of $108.26 and a 200 day moving average of $100.04. Consolidated Edison has a twelve month low of $87.28 and a twelve month high of $114.87.

Consolidated Edison (NYSE:ED - Get Free Report) last released its quarterly earnings results on Thursday, May 1st. The utilities provider reported $2.25 earnings per share for the quarter, missing analysts' consensus estimates of $2.30 by ($0.05). Consolidated Edison had a return on equity of 8.62% and a net margin of 11.93%. The firm had revenue of $4.80 billion during the quarter, compared to analyst estimates of $4.21 billion. During the same quarter in the prior year, the company earned $2.15 EPS. Sell-side analysts expect that Consolidated Edison will post 5.62 EPS for the current year.

Consolidated Edison Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, June 16th. Investors of record on Wednesday, May 14th will be given a $0.85 dividend. This represents a $3.40 annualized dividend and a dividend yield of 3.28%. The ex-dividend date of this dividend is Wednesday, May 14th. Consolidated Edison's dividend payout ratio (DPR) is currently 62.85%.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in ED. Norges Bank purchased a new position in shares of Consolidated Edison in the 4th quarter worth $399,824,000. ATLAS Infrastructure Partners UK Ltd. purchased a new position in shares of Consolidated Edison in the 1st quarter worth $254,205,000. Deutsche Bank AG raised its position in shares of Consolidated Edison by 130.6% in the 1st quarter. Deutsche Bank AG now owns 3,926,814 shares of the utilities provider's stock worth $434,266,000 after buying an additional 2,223,959 shares during the period. JPMorgan Chase & Co. raised its position in shares of Consolidated Edison by 106.9% in the 1st quarter. JPMorgan Chase & Co. now owns 2,790,876 shares of the utilities provider's stock worth $308,643,000 after buying an additional 1,441,785 shares during the period. Finally, Nuveen LLC purchased a new position in shares of Consolidated Edison in the 1st quarter worth $146,073,000. 66.29% of the stock is owned by hedge funds and other institutional investors.

Consolidated Edison Company Profile

(

Get Free Report)

Consolidated Edison, Inc, through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States. It offers electric services to approximately 3.7 million customers in New York City and Westchester County; gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County; and steam to approximately 1,530 customers in parts of Manhattan.

Read More

Before you consider Consolidated Edison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Edison wasn't on the list.

While Consolidated Edison currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.