Corebridge Financial (NYSE:CRBG - Get Free Report) had its target price boosted by equities researchers at Keefe, Bruyette & Woods from $39.00 to $42.00 in a report issued on Wednesday,Benzinga reports. The firm currently has an "outperform" rating on the stock. Keefe, Bruyette & Woods' price objective would indicate a potential upside of 22.07% from the company's previous close.

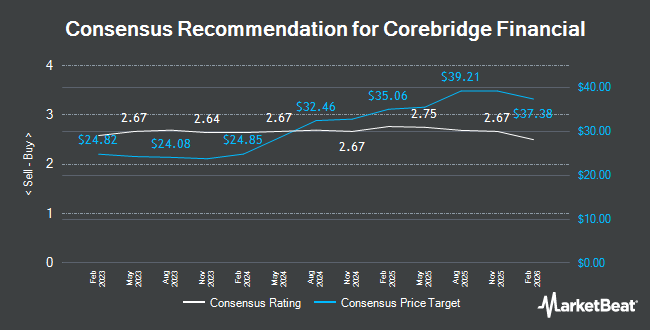

CRBG has been the topic of several other reports. Piper Sandler upped their price objective on shares of Corebridge Financial from $38.00 to $40.00 and gave the stock an "overweight" rating in a research report on Thursday, July 3rd. Wells Fargo & Company upped their target price on Corebridge Financial from $37.00 to $42.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 2nd. UBS Group lowered Corebridge Financial from a "buy" rating to a "sell" rating and cut their target price for the stock from $40.00 to $28.00 in a research note on Wednesday, April 2nd. Morgan Stanley upped their target price on Corebridge Financial from $37.00 to $40.00 and gave the stock an "overweight" rating in a research note on Friday, June 27th. Finally, JPMorgan Chase & Co. upped their target price on Corebridge Financial from $34.00 to $40.00 and gave the stock a "neutral" rating in a research note on Tuesday. Four analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $39.75.

Get Our Latest Report on Corebridge Financial

Corebridge Financial Price Performance

Shares of CRBG traded down $0.15 during midday trading on Wednesday, hitting $34.41. 565,497 shares of the company traded hands, compared to its average volume of 3,258,327. The stock has a 50-day moving average of $32.98 and a 200-day moving average of $31.76. Corebridge Financial has a one year low of $23.69 and a one year high of $36.08. The firm has a market cap of $18.91 billion, a P/E ratio of 29.16, a PEG ratio of 0.56 and a beta of 1.06. The company has a debt-to-equity ratio of 0.96, a current ratio of 0.14 and a quick ratio of 0.14.

Corebridge Financial (NYSE:CRBG - Get Free Report) last posted its quarterly earnings data on Monday, May 5th. The company reported $1.16 earnings per share for the quarter, topping the consensus estimate of $1.15 by $0.01. The company had revenue of $4.74 billion for the quarter, compared to analysts' expectations of $5.28 billion. Corebridge Financial had a net margin of 3.73% and a return on equity of 22.19%. During the same period in the prior year, the business earned $1.10 earnings per share. As a group, sell-side analysts predict that Corebridge Financial will post 5.43 EPS for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the company. US Bancorp DE lifted its position in shares of Corebridge Financial by 7,525.1% during the 4th quarter. US Bancorp DE now owns 21,579 shares of the company's stock valued at $646,000 after buying an additional 21,296 shares in the last quarter. Smartleaf Asset Management LLC raised its stake in Corebridge Financial by 112.4% during the 4th quarter. Smartleaf Asset Management LLC now owns 907 shares of the company's stock valued at $27,000 after purchasing an additional 480 shares during the period. Charles Schwab Investment Management Inc. raised its stake in Corebridge Financial by 11.1% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,931,608 shares of the company's stock valued at $57,813,000 after purchasing an additional 193,445 shares during the period. Raymond James Financial Inc. bought a new stake in Corebridge Financial during the 4th quarter valued at approximately $31,844,000. Finally, PNC Financial Services Group Inc. raised its stake in Corebridge Financial by 70.5% during the 4th quarter. PNC Financial Services Group Inc. now owns 4,322 shares of the company's stock valued at $129,000 after purchasing an additional 1,787 shares during the period. 98.25% of the stock is owned by hedge funds and other institutional investors.

About Corebridge Financial

(

Get Free Report)

Corebridge Financial, Inc provides retirement solutions and insurance products in the United States. The company operates through Individual Retirement, Group Retirement, Life Insurance, and Institutional Markets segments. The Individual Retirement segment provides fixed annuities, fixed index annuities, variable annuities, and retail mutual funds.

See Also

Before you consider Corebridge Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corebridge Financial wasn't on the list.

While Corebridge Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.