D. E. Shaw & Co. Inc. cut its holdings in shares of Rambus Inc. (NASDAQ:RMBS - Free Report) by 50.7% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 394,352 shares of the semiconductor company's stock after selling 406,347 shares during the period. D. E. Shaw & Co. Inc. owned 0.37% of Rambus worth $20,845,000 as of its most recent filing with the Securities and Exchange Commission.

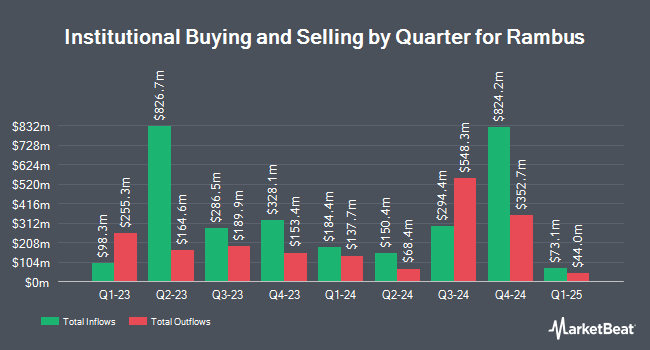

A number of other large investors also recently added to or reduced their stakes in the business. Price T Rowe Associates Inc. MD raised its position in shares of Rambus by 442.8% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 5,449,128 shares of the semiconductor company's stock valued at $288,042,000 after acquiring an additional 4,445,146 shares during the period. Invesco Ltd. increased its stake in Rambus by 72.1% during the 4th quarter. Invesco Ltd. now owns 4,999,748 shares of the semiconductor company's stock worth $264,287,000 after purchasing an additional 2,093,953 shares in the last quarter. Norges Bank acquired a new stake in Rambus during the 4th quarter worth approximately $94,368,000. Raymond James Financial Inc. acquired a new stake in Rambus during the 4th quarter worth approximately $51,500,000. Finally, Congress Asset Management Co. acquired a new stake in Rambus during the 4th quarter worth approximately $45,778,000. 88.54% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts have commented on the stock. Susquehanna raised their target price on shares of Rambus from $66.00 to $70.00 and gave the stock a "positive" rating in a report on Tuesday, February 4th. Robert W. Baird set a $90.00 price target on shares of Rambus in a research note on Monday, February 3rd. Wells Fargo & Company raised their price target on shares of Rambus from $62.00 to $73.00 and gave the stock an "overweight" rating in a research note on Tuesday, February 4th. StockNews.com raised shares of Rambus from a "hold" rating to a "buy" rating in a research note on Sunday, May 4th. Finally, Rosenblatt Securities reaffirmed a "buy" rating and set a $80.00 price target on shares of Rambus in a research note on Tuesday, April 29th. Seven analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Buy" and an average price target of $75.00.

Read Our Latest Stock Report on Rambus

Rambus Trading Down 1.5%

RMBS stock traded down $0.88 during trading on Thursday, hitting $56.77. The company had a trading volume of 1,155,202 shares, compared to its average volume of 1,295,061. The stock has a market cap of $6.10 billion, a PE ratio of 34.20 and a beta of 1.24. Rambus Inc. has a one year low of $37.43 and a one year high of $69.15. The business has a 50-day moving average of $50.80 and a 200-day moving average of $55.15.

Insiders Place Their Bets

In other news, CEO Luc Seraphin sold 6,348 shares of the firm's stock in a transaction on Wednesday, April 23rd. The stock was sold at an average price of $46.97, for a total transaction of $298,165.56. Following the completion of the sale, the chief executive officer now directly owns 319,241 shares of the company's stock, valued at $14,994,749.77. This trade represents a 1.95% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, COO Xianzhi Sean Fan sold 52,327 shares of Rambus stock in a transaction dated Wednesday, February 19th. The stock was sold at an average price of $68.02, for a total value of $3,559,282.54. Following the completion of the sale, the chief operating officer now directly owns 93,841 shares of the company's stock, valued at approximately $6,383,064.82. This trade represents a 35.80% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 113,300 shares of company stock worth $6,745,221. Corporate insiders own 1.00% of the company's stock.

Rambus Company Profile

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

See Also

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.