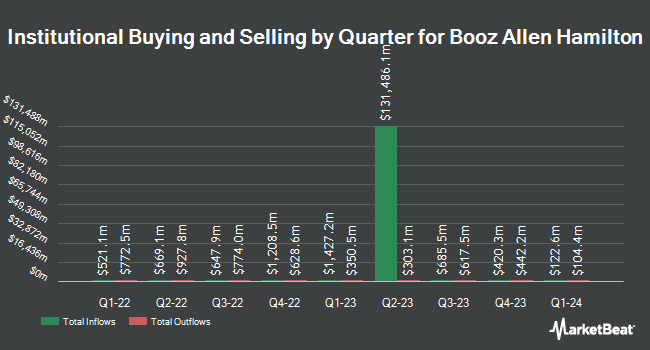

Deutsche Bank AG lifted its stake in shares of Booz Allen Hamilton Holding Co. (NYSE:BAH - Free Report) by 73.8% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 465,779 shares of the business services provider's stock after acquiring an additional 197,733 shares during the quarter. Deutsche Bank AG owned about 0.37% of Booz Allen Hamilton worth $59,946,000 as of its most recent filing with the SEC.

A number of other hedge funds have also made changes to their positions in BAH. Bogart Wealth LLC boosted its position in Booz Allen Hamilton by 387.5% during the fourth quarter. Bogart Wealth LLC now owns 195 shares of the business services provider's stock worth $25,000 after purchasing an additional 155 shares during the period. OFI Invest Asset Management bought a new stake in shares of Booz Allen Hamilton during the 4th quarter worth $25,000. EverSource Wealth Advisors LLC grew its stake in Booz Allen Hamilton by 144.1% in the 4th quarter. EverSource Wealth Advisors LLC now owns 227 shares of the business services provider's stock valued at $29,000 after buying an additional 134 shares during the last quarter. SRS Capital Advisors Inc. raised its holdings in Booz Allen Hamilton by 3,314.3% in the 4th quarter. SRS Capital Advisors Inc. now owns 239 shares of the business services provider's stock worth $31,000 after acquiring an additional 232 shares during the period. Finally, R Squared Ltd bought a new stake in Booz Allen Hamilton during the fourth quarter valued at about $31,000. Institutional investors and hedge funds own 91.82% of the company's stock.

Booz Allen Hamilton Price Performance

Booz Allen Hamilton stock opened at $124.61 on Tuesday. The business has a 50 day simple moving average of $112.85 and a 200 day simple moving average of $129.59. The company has a debt-to-equity ratio of 2.72, a current ratio of 1.57 and a quick ratio of 1.57. The company has a market capitalization of $15.78 billion, a PE ratio of 18.57, a price-to-earnings-growth ratio of 1.25 and a beta of 0.56. Booz Allen Hamilton Holding Co. has a one year low of $101.05 and a one year high of $190.59.

Analyst Upgrades and Downgrades

Several equities analysts recently weighed in on the company. William Blair cut Booz Allen Hamilton from an "outperform" rating to a "market perform" rating in a research report on Friday, February 21st. The Goldman Sachs Group reissued a "neutral" rating and issued a $109.00 price objective (down from $150.00) on shares of Booz Allen Hamilton in a research report on Friday, April 11th. Raymond James raised shares of Booz Allen Hamilton from a "market perform" rating to an "outperform" rating and set a $150.00 target price on the stock in a research report on Monday, February 3rd. Truist Financial decreased their price target on shares of Booz Allen Hamilton from $142.00 to $110.00 and set a "hold" rating on the stock in a research report on Monday, April 14th. Finally, Wells Fargo & Company cut their price objective on shares of Booz Allen Hamilton from $164.00 to $148.00 and set an "overweight" rating for the company in a research report on Tuesday, April 8th. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $146.45.

Check Out Our Latest Research Report on BAH

Booz Allen Hamilton Profile

(

Free Report)

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally. It focuses on artificial intelligence services comprising of machine learning, predictive modeling, automation and decision analytics, and quantum computing.

Recommended Stories

Want to see what other hedge funds are holding BAH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Booz Allen Hamilton Holding Co. (NYSE:BAH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Booz Allen Hamilton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booz Allen Hamilton wasn't on the list.

While Booz Allen Hamilton currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.