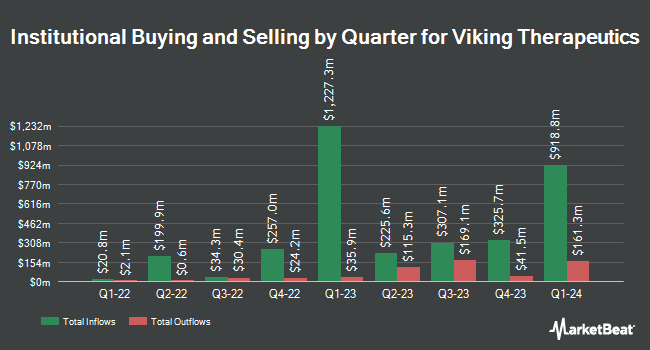

Dimensional Fund Advisors LP trimmed its holdings in shares of Viking Therapeutics, Inc. (NASDAQ:VKTX - Free Report) by 9.4% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 100,762 shares of the biotechnology company's stock after selling 10,394 shares during the quarter. Dimensional Fund Advisors LP owned about 0.09% of Viking Therapeutics worth $4,055,000 at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. Virtu Financial LLC acquired a new stake in shares of Viking Therapeutics in the fourth quarter valued at about $1,715,000. Institute for Wealth Management LLC. boosted its holdings in Viking Therapeutics by 122.4% during the fourth quarter. Institute for Wealth Management LLC. now owns 80,602 shares of the biotechnology company's stock valued at $3,243,000 after purchasing an additional 44,365 shares in the last quarter. Janney Montgomery Scott LLC boosted its holdings in Viking Therapeutics by 103.1% during the fourth quarter. Janney Montgomery Scott LLC now owns 42,612 shares of the biotechnology company's stock valued at $1,715,000 after purchasing an additional 21,627 shares in the last quarter. Wesbanco Bank Inc. acquired a new stake in Viking Therapeutics during the fourth quarter valued at approximately $475,000. Finally, Mirae Asset Global Investments Co. Ltd. acquired a new position in shares of Viking Therapeutics in the 4th quarter worth approximately $528,000. 76.03% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on VKTX shares. Maxim Group reduced their target price on Viking Therapeutics from $120.00 to $70.00 and set a "buy" rating on the stock in a report on Friday, February 7th. Truist Financial reissued a "buy" rating and issued a $75.00 price target (down previously from $95.00) on shares of Viking Therapeutics in a research note on Monday, April 28th. Piper Sandler lowered their price objective on shares of Viking Therapeutics from $74.00 to $71.00 and set an "overweight" rating for the company in a research report on Thursday, February 6th. Cantor Fitzgerald upgraded shares of Viking Therapeutics to a "strong-buy" rating in a research report on Tuesday, April 29th. Finally, Morgan Stanley lowered their target price on Viking Therapeutics from $105.00 to $102.00 and set an "overweight" rating for the company in a report on Thursday, April 24th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, ten have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $87.15.

View Our Latest Stock Analysis on Viking Therapeutics

Viking Therapeutics Stock Performance

NASDAQ:VKTX traded up $1.03 during mid-day trading on Friday, hitting $28.43. The stock had a trading volume of 3,221,637 shares, compared to its average volume of 4,093,824. Viking Therapeutics, Inc. has a twelve month low of $18.92 and a twelve month high of $81.73. The stock has a market cap of $3.19 billion, a price-to-earnings ratio of -28.43 and a beta of 0.75. The company's 50 day simple moving average is $26.15 and its 200 day simple moving average is $36.11.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last posted its quarterly earnings data on Wednesday, April 23rd. The biotechnology company reported ($0.41) earnings per share for the quarter, missing the consensus estimate of ($0.31) by ($0.10). The business's revenue was up .0% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.26) earnings per share. As a group, equities analysts forecast that Viking Therapeutics, Inc. will post -1.56 earnings per share for the current year.

Insider Activity

In other news, Director Sarah Kathryn Rouan acquired 1,240 shares of the firm's stock in a transaction that occurred on Monday, March 31st. The shares were acquired at an average cost of $24.15 per share, with a total value of $29,946.00. Following the completion of the purchase, the director now directly owns 1,240 shares of the company's stock, valued at $29,946. The trade was a ∞ increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 4.10% of the stock is owned by company insiders.

Viking Therapeutics Company Profile

(

Free Report)

Viking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Featured Articles

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.