Domo (NASDAQ:DOMO - Get Free Report) is expected to be posting its Q1 2026 quarterly earnings results before the market opens on Wednesday, May 21st. Analysts expect Domo to post earnings of ($0.20) per share and revenue of $77.75 million for the quarter. Domo has set its Q1 2026 guidance at 0.180-0.220 EPS and its FY 2026 guidance at 0.290-0.390 EPS.

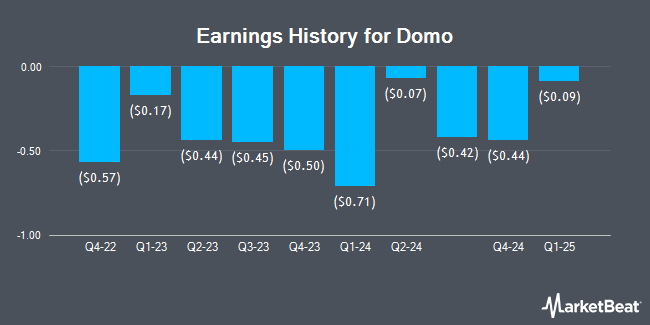

Domo (NASDAQ:DOMO - Get Free Report) last posted its earnings results on Thursday, March 6th. The company reported ($0.44) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.18) by ($0.26). The firm had revenue of $78.77 million for the quarter, compared to analysts' expectations of $77.95 million. On average, analysts expect Domo to post $-2 EPS for the current fiscal year and $-2 EPS for the next fiscal year.

Domo Stock Performance

Shares of DOMO stock opened at $8.63 on Wednesday. The company has a market capitalization of $344.68 million, a price-to-earnings ratio of -3.94 and a beta of 1.67. Domo has a 52-week low of $6.01 and a 52-week high of $10.15. The company has a 50-day simple moving average of $7.88 and a two-hundred day simple moving average of $8.02.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on DOMO. Lake Street Capital decreased their price objective on shares of Domo from $9.50 to $8.50 and set a "hold" rating for the company in a report on Friday, March 7th. Cowen reissued a "hold" rating on shares of Domo in a research report on Friday, March 7th. Morgan Stanley lowered their price target on shares of Domo from $9.00 to $8.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 16th. DA Davidson upgraded Domo to a "hold" rating in a research note on Monday, March 10th. Finally, Cantor Fitzgerald reissued an "overweight" rating and set a $11.00 price objective on shares of Domo in a report on Thursday, March 20th. Five analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $10.25.

View Our Latest Stock Analysis on DOMO

Insider Transactions at Domo

In other Domo news, Director Daniel David Daniel III purchased 120,000 shares of the stock in a transaction on Friday, April 4th. The stock was acquired at an average price of $6.44 per share, with a total value of $772,800.00. Following the transaction, the director now directly owns 781,400 shares of the company's stock, valued at approximately $5,032,216. This trade represents a 18.14% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. Also, Director David R. Jolley sold 25,000 shares of Domo stock in a transaction that occurred on Thursday, March 13th. The stock was sold at an average price of $8.31, for a total value of $207,750.00. Following the completion of the sale, the director now owns 255,743 shares in the company, valued at approximately $2,125,224.33. This represents a 8.90% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 14.04% of the company's stock.

About Domo

(

Get Free Report)

Domo, Inc, together with its subsidiaries, operates a cloud-based business intelligence platform in North America, Western Europe, Canada, Australia, and Japan. Its platform digitally connects from the chief executive officer to the frontline employee with the various people, data, and systems in an organization, as well as giving them access to real-time data and insights, and allowing them to manage business via various browsers and visualization engines accessible across laptops, TV screens, monitors, tablets, and smartphones.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Domo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Domo wasn't on the list.

While Domo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.