DoorDash (NASDAQ:DASH - Get Free Report) had its target price lifted by Bank of America from $230.00 to $245.00 in a report released on Thursday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Bank of America's target price suggests a potential upside of 13.11% from the company's previous close.

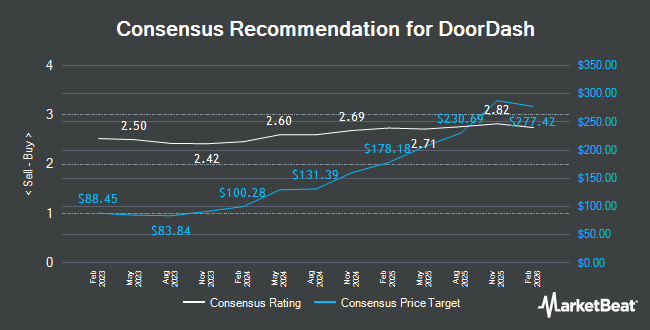

DASH has been the topic of a number of other research reports. Morgan Stanley cut their price target on shares of DoorDash from $245.00 to $210.00 and set an "overweight" rating on the stock in a research note on Thursday, April 17th. DA Davidson boosted their price objective on shares of DoorDash from $150.00 to $190.00 and gave the company a "neutral" rating in a report on Tuesday, May 6th. Wedbush reissued an "outperform" rating on shares of DoorDash in a research report on Wednesday, May 7th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $230.00 price target on shares of DoorDash in a research report on Wednesday, May 7th. Finally, Roth Mkm boosted their price target on DoorDash from $165.00 to $193.00 and gave the company a "neutral" rating in a research note on Wednesday, February 12th. Eleven equities research analysts have rated the stock with a hold rating and twenty-five have given a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $210.21.

Read Our Latest Report on DASH

DoorDash Price Performance

DoorDash stock traded down $1.20 during midday trading on Thursday, reaching $216.60. The company's stock had a trading volume of 2,510,505 shares, compared to its average volume of 4,203,649. The stock's 50-day simple moving average is $194.44 and its 200-day simple moving average is $187.25. DoorDash has a 52-week low of $99.32 and a 52-week high of $220.88. The stock has a market capitalization of $91.78 billion, a P/E ratio of 802.22 and a beta of 1.67.

DoorDash (NASDAQ:DASH - Get Free Report) last posted its quarterly earnings data on Tuesday, May 6th. The company reported $0.44 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.39 by $0.05. The firm had revenue of $3.03 billion for the quarter, compared to the consensus estimate of $3.10 billion. DoorDash had a net margin of 1.15% and a return on equity of 1.67%. The company's revenue for the quarter was up 20.7% compared to the same quarter last year. During the same quarter in the prior year, the company posted ($0.06) earnings per share. As a group, equities research analysts expect that DoorDash will post 2.22 earnings per share for the current fiscal year.

Insider Activity

In related news, COO Prabir Adarkar sold 62,267 shares of the business's stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $202.67, for a total value of $12,619,652.89. Following the completion of the sale, the chief operating officer now owns 942,554 shares of the company's stock, valued at approximately $191,027,419.18. The trade was a 6.20% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Andy Fang sold 30,000 shares of the stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $217.52, for a total transaction of $6,525,600.00. Following the transaction, the director now directly owns 22,545 shares in the company, valued at approximately $4,903,988.40. The trade was a 57.09% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 298,030 shares of company stock worth $59,433,406 over the last three months. 5.83% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Brighton Jones LLC raised its holdings in shares of DoorDash by 24.0% during the fourth quarter. Brighton Jones LLC now owns 9,336 shares of the company's stock valued at $1,566,000 after acquiring an additional 1,807 shares during the last quarter. Principal Financial Group Inc. boosted its stake in shares of DoorDash by 2.9% in the fourth quarter. Principal Financial Group Inc. now owns 93,382 shares of the company's stock worth $15,665,000 after acquiring an additional 2,596 shares during the last quarter. Jones Financial Companies Lllp increased its position in shares of DoorDash by 36.2% during the fourth quarter. Jones Financial Companies Lllp now owns 1,926 shares of the company's stock worth $323,000 after purchasing an additional 512 shares in the last quarter. Truist Financial Corp raised its stake in DoorDash by 35.1% in the 4th quarter. Truist Financial Corp now owns 8,597 shares of the company's stock valued at $1,442,000 after purchasing an additional 2,233 shares during the last quarter. Finally, Allworth Financial LP raised its stake in DoorDash by 26.9% in the 4th quarter. Allworth Financial LP now owns 840 shares of the company's stock valued at $149,000 after purchasing an additional 178 shares during the last quarter. 90.64% of the stock is owned by hedge funds and other institutional investors.

About DoorDash

(

Get Free Report)

DoorDash, Inc, together with its subsidiaries, operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally. The company operates DoorDash Marketplace and Wolt Marketplace, which provide various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

Featured Stories

Before you consider DoorDash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoorDash wasn't on the list.

While DoorDash currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.