DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main grew its stake in Booz Allen Hamilton Holding Co. (NYSE:BAH - Free Report) by 3.0% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 111,555 shares of the business services provider's stock after acquiring an additional 3,301 shares during the quarter. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main owned 0.09% of Booz Allen Hamilton worth $14,357,000 at the end of the most recent quarter.

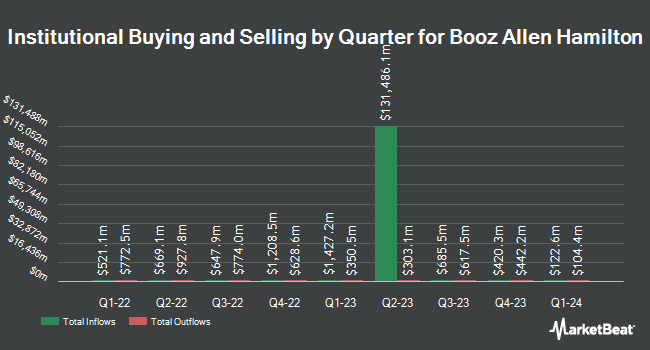

Several other hedge funds have also added to or reduced their stakes in BAH. Norges Bank bought a new stake in Booz Allen Hamilton in the fourth quarter worth $196,578,000. Raymond James Financial Inc. bought a new position in shares of Booz Allen Hamilton during the fourth quarter valued at $173,055,000. Bank of America Corp DE lifted its holdings in shares of Booz Allen Hamilton by 61.4% during the fourth quarter. Bank of America Corp DE now owns 1,552,217 shares of the business services provider's stock valued at $199,770,000 after purchasing an additional 590,655 shares in the last quarter. Renaissance Technologies LLC lifted its holdings in shares of Booz Allen Hamilton by 1,111.3% during the fourth quarter. Renaissance Technologies LLC now owns 606,794 shares of the business services provider's stock valued at $78,094,000 after purchasing an additional 556,700 shares in the last quarter. Finally, JPMorgan Chase & Co. lifted its holdings in shares of Booz Allen Hamilton by 12.5% during the fourth quarter. JPMorgan Chase & Co. now owns 4,518,386 shares of the business services provider's stock valued at $581,516,000 after purchasing an additional 501,725 shares in the last quarter. 91.82% of the stock is owned by institutional investors.

Booz Allen Hamilton Price Performance

Shares of NYSE:BAH traded up $0.82 during midday trading on Monday, hitting $124.61. The company had a trading volume of 1,294,873 shares, compared to its average volume of 1,542,890. Booz Allen Hamilton Holding Co. has a twelve month low of $101.05 and a twelve month high of $190.59. The company has a debt-to-equity ratio of 2.72, a current ratio of 1.57 and a quick ratio of 1.57. The stock has a market cap of $15.78 billion, a price-to-earnings ratio of 18.57, a price-to-earnings-growth ratio of 1.25 and a beta of 0.56. The business's 50-day simple moving average is $112.85 and its 200-day simple moving average is $129.59.

Analyst Upgrades and Downgrades

BAH has been the topic of a number of research analyst reports. Truist Financial lowered their price target on Booz Allen Hamilton from $142.00 to $110.00 and set a "hold" rating on the stock in a report on Monday, April 14th. William Blair cut Booz Allen Hamilton from an "outperform" rating to a "market perform" rating in a research report on Friday, February 21st. Wells Fargo & Company reduced their price objective on Booz Allen Hamilton from $164.00 to $148.00 and set an "overweight" rating for the company in a research report on Tuesday, April 8th. Raymond James upgraded Booz Allen Hamilton from a "market perform" rating to an "outperform" rating and set a $150.00 price objective for the company in a research report on Monday, February 3rd. Finally, JPMorgan Chase & Co. reduced their price objective on Booz Allen Hamilton from $140.00 to $120.00 and set an "underweight" rating for the company in a research report on Tuesday, April 15th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating, four have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $146.45.

View Our Latest Research Report on BAH

About Booz Allen Hamilton

(

Free Report)

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally. It focuses on artificial intelligence services comprising of machine learning, predictive modeling, automation and decision analytics, and quantum computing.

Featured Articles

Before you consider Booz Allen Hamilton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booz Allen Hamilton wasn't on the list.

While Booz Allen Hamilton currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.