Eagle Global Advisors LLC acquired a new stake in shares of Ryanair Holdings plc (NASDAQ:RYAAY - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 25,000 shares of the transportation company's stock, valued at approximately $1,090,000.

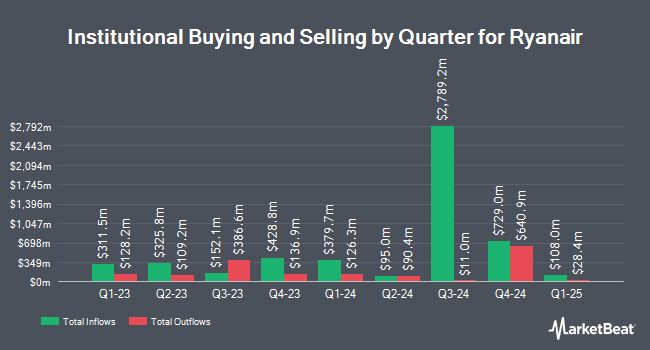

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in RYAAY. National Bank of Canada FI raised its holdings in shares of Ryanair by 198.6% in the fourth quarter. National Bank of Canada FI now owns 657 shares of the transportation company's stock worth $29,000 after buying an additional 437 shares during the period. EverSource Wealth Advisors LLC increased its position in Ryanair by 32.9% during the 4th quarter. EverSource Wealth Advisors LLC now owns 954 shares of the transportation company's stock valued at $42,000 after purchasing an additional 236 shares during the period. R Squared Ltd purchased a new position in shares of Ryanair in the 4th quarter valued at $42,000. Redwood Park Advisors LLC purchased a new position in shares of Ryanair in the 4th quarter valued at $43,000. Finally, Pinnacle Bancorp Inc. grew its position in shares of Ryanair by 150.0% in the 4th quarter. Pinnacle Bancorp Inc. now owns 1,075 shares of the transportation company's stock worth $47,000 after buying an additional 645 shares during the last quarter. 43.66% of the stock is currently owned by hedge funds and other institutional investors.

Ryanair Price Performance

Shares of Ryanair stock traded up $0.02 on Tuesday, reaching $49.62. The company's stock had a trading volume of 868,442 shares, compared to its average volume of 1,645,351. The company has a market capitalization of $26.39 billion, a P/E ratio of 15.21, a PEG ratio of 2.01 and a beta of 1.37. The stock has a 50-day moving average price of $45.82 and a 200-day moving average price of $45.31. The company has a quick ratio of 0.86, a current ratio of 0.86 and a debt-to-equity ratio of 0.21. Ryanair Holdings plc has a 52-week low of $36.96 and a 52-week high of $52.11.

Analyst Ratings Changes

Several research analysts recently issued reports on the company. Deutsche Bank Aktiengesellschaft raised Ryanair from a "hold" rating to a "buy" rating in a research report on Thursday, March 27th. StockNews.com lowered shares of Ryanair from a "buy" rating to a "hold" rating in a research note on Thursday, February 6th. Three analysts have rated the stock with a hold rating, three have assigned a buy rating and three have issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and an average target price of $147.00.

Read Our Latest Report on RYAAY

Ryanair Profile

(

Free Report)

Ryanair Holdings plc, together with its subsidiaries, provides scheduled-passenger airline services in Ireland, the United Kingdom, Italy, Spain, and internationally. It is also involved in the provision of various ancillary services, such as non-flight scheduled and Internet-related services, as well as in-flight sale of beverages, food, duty-free, and merchandise; and markets car hire, travel insurance, and accommodation services through its website and mobile app.

Read More

Before you consider Ryanair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryanair wasn't on the list.

While Ryanair currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.