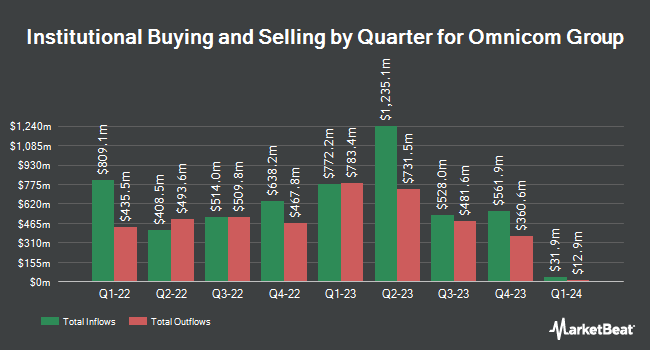

Eisler Capital Management Ltd. purchased a new position in Omnicom Group Inc. (NYSE:OMC - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund purchased 23,100 shares of the business services provider's stock, valued at approximately $1,998,000.

Other large investors have also bought and sold shares of the company. Franklin Resources Inc. increased its stake in Omnicom Group by 19.7% in the 3rd quarter. Franklin Resources Inc. now owns 231,068 shares of the business services provider's stock worth $23,860,000 after purchasing an additional 38,022 shares during the period. Fort Washington Investment Advisors Inc. OH increased its stake in shares of Omnicom Group by 15.4% during the fourth quarter. Fort Washington Investment Advisors Inc. OH now owns 376,701 shares of the business services provider's stock valued at $32,411,000 after buying an additional 50,153 shares during the period. Avanza Fonder AB purchased a new position in shares of Omnicom Group during the fourth quarter valued at approximately $1,544,000. LVM Capital Management Ltd. MI purchased a new position in shares of Omnicom Group during the fourth quarter valued at approximately $585,000. Finally, Compagnie Lombard Odier SCmA bought a new stake in Omnicom Group in the fourth quarter worth $366,000. 91.97% of the stock is owned by hedge funds and other institutional investors.

Omnicom Group Trading Up 2.2%

OMC traded up $1.66 during trading hours on Monday, reaching $77.61. 2,121,896 shares of the company's stock traded hands, compared to its average volume of 2,225,998. The firm has a 50-day moving average price of $77.45 and a 200 day moving average price of $86.45. Omnicom Group Inc. has a 52-week low of $69.13 and a 52-week high of $107.00. The company has a quick ratio of 0.90, a current ratio of 1.00 and a debt-to-equity ratio of 1.27. The firm has a market capitalization of $15.14 billion, a PE ratio of 10.42, a PEG ratio of 1.94 and a beta of 0.95.

Omnicom Group (NYSE:OMC - Get Free Report) last posted its quarterly earnings data on Tuesday, April 15th. The business services provider reported $1.70 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.63 by $0.07. The company had revenue of $3.69 billion during the quarter, compared to analysts' expectations of $3.73 billion. Omnicom Group had a return on equity of 36.39% and a net margin of 9.44%. As a group, sell-side analysts predict that Omnicom Group Inc. will post 8.25 EPS for the current fiscal year.

Omnicom Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, July 9th. Shareholders of record on Tuesday, June 10th will be given a dividend of $0.70 per share. This represents a $2.80 dividend on an annualized basis and a yield of 3.61%. The ex-dividend date of this dividend is Tuesday, June 10th. Omnicom Group's dividend payout ratio (DPR) is presently 38.30%.

Analyst Ratings Changes

Several equities research analysts have commented on the company. JPMorgan Chase & Co. dropped their target price on Omnicom Group from $116.00 to $104.00 and set an "overweight" rating on the stock in a report on Wednesday, April 16th. Argus downgraded Omnicom Group from a "buy" rating to a "hold" rating in a report on Friday, February 14th. UBS Group reduced their price objective on Omnicom Group from $117.00 to $104.00 and set a "buy" rating for the company in a research report on Thursday, March 20th. Wells Fargo & Company reduced their price target on Omnicom Group from $99.00 to $84.00 and set an "equal weight" rating for the company in a research report on Wednesday, April 16th. Finally, Citigroup reiterated a "buy" rating and set a $103.00 target price on shares of Omnicom Group in a research report on Tuesday, April 15th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $101.29.

Check Out Our Latest Analysis on Omnicom Group

About Omnicom Group

(

Free Report)

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Further Reading

Before you consider Omnicom Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicom Group wasn't on the list.

While Omnicom Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.