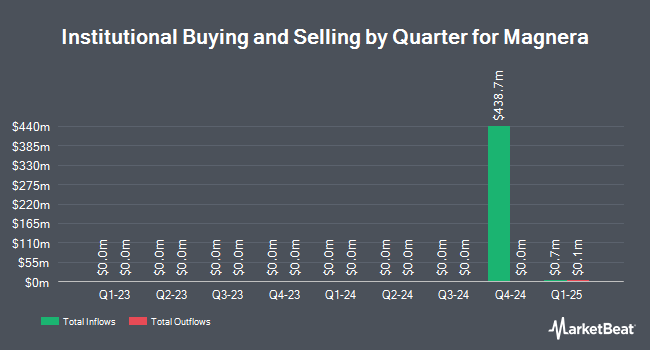

Engine Capital Management LP acquired a new stake in Magnera Corp (NYSE:MAGN - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 2,358,341 shares of the company's stock, valued at approximately $42,851,000. Magnera accounts for approximately 7.8% of Engine Capital Management LP's holdings, making the stock its 4th largest holding. Engine Capital Management LP owned about 67.38% of Magnera at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently made changes to their positions in MAGN. Vanguard Group Inc. acquired a new stake in Magnera during the fourth quarter worth approximately $52,408,000. Ancora Advisors LLC acquired a new stake in Magnera during the fourth quarter worth approximately $30,047,000. Khrom Capital Management LLC acquired a new stake in Magnera during the fourth quarter worth approximately $23,777,000. Fuller & Thaler Asset Management Inc. acquired a new stake in Magnera during the fourth quarter worth approximately $23,657,000. Finally, LSV Asset Management acquired a new stake in Magnera during the fourth quarter worth approximately $18,382,000. Institutional investors and hedge funds own 76.92% of the company's stock.

Insider Transactions at Magnera

In other Magnera news, CEO Curt Begle acquired 20,275 shares of the stock in a transaction dated Friday, May 9th. The shares were acquired at an average cost of $14.01 per share, for a total transaction of $284,052.75. Following the completion of the transaction, the chief executive officer now directly owns 44,341 shares of the company's stock, valued at approximately $621,217.41. The trade was a 84.25% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, Director Carl J. Rickertsen bought 20,000 shares of Magnera stock in a transaction dated Thursday, February 27th. The stock was purchased at an average cost of $20.33 per share, for a total transaction of $406,600.00. Following the completion of the acquisition, the director now directly owns 21,306 shares of the company's stock, valued at approximately $433,150.98. The trade was a 1,531.39% increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders bought 60,275 shares of company stock valued at $993,653. Corporate insiders own 2.26% of the company's stock.

Magnera Stock Down 6.1%

MAGN stock traded down $0.92 during midday trading on Wednesday, hitting $14.13. The company's stock had a trading volume of 520,610 shares, compared to its average volume of 540,116. The company's 50-day moving average is $16.31. The company has a current ratio of 2.45, a quick ratio of 1.52 and a debt-to-equity ratio of 1.80. Magnera Corp has a 1 year low of $12.20 and a 1 year high of $26.78. The stock has a market cap of $503.03 million, a PE ratio of -0.77 and a beta of 1.76.

Magnera (NYSE:MAGN - Get Free Report) last announced its earnings results on Wednesday, May 7th. The company reported ($1.15) earnings per share for the quarter, missing analysts' consensus estimates of $0.20 by ($1.35). The business had revenue of $824.00 million during the quarter. Magnera had a negative return on equity of 10.62% and a negative net margin of 6.97%. The business's revenue for the quarter was up 47.7% compared to the same quarter last year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on MAGN shares. Vertical Research started coverage on Magnera in a report on Wednesday, March 19th. They issued a "hold" rating and a $21.00 target price on the stock. Wells Fargo & Company downgraded Magnera from an "overweight" rating to a "reduce" rating in a report on Wednesday.

Get Our Latest Research Report on Magnera

About Magnera

(

Free Report)

Magnera's purpose is to better the world with new possibilities made real. By continuously co-creating and innovating with our partners, we develop original material solutions that make a brighter future possible. With a breadth of technologies and a passion for what we create, Magnera's solutions propel our customers' goals forward and solve end-users' problems, every day.

See Also

Before you consider Magnera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnera wasn't on the list.

While Magnera currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.