Enphase Energy (NASDAQ:ENPH - Get Free Report) had its price target decreased by equities research analysts at Mizuho from $53.00 to $50.00 in a report released on Monday,Benzinga reports. The firm currently has an "outperform" rating on the semiconductor company's stock. Mizuho's price target indicates a potential upside of 27.64% from the company's previous close.

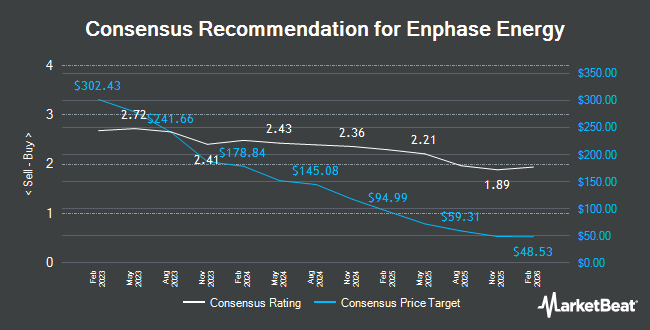

ENPH has been the topic of several other reports. KeyCorp reissued an "underweight" rating and set a $31.00 target price on shares of Enphase Energy in a research note on Tuesday, June 17th. BNP Paribas cut shares of Enphase Energy from an "outperform" rating to an "underperform" rating in a research report on Tuesday, May 13th. Susquehanna lowered their price objective on Enphase Energy from $59.00 to $51.00 and set a "neutral" rating on the stock in a research note on Wednesday, April 23rd. The Goldman Sachs Group reiterated a "sell" rating and issued a $32.00 price objective (down from $77.00) on shares of Enphase Energy in a report on Wednesday, July 9th. Finally, BNP Paribas Exane lowered Enphase Energy from a "neutral" rating to an "underperform" rating and set a $40.00 price target on the stock. in a research note on Tuesday, May 13th. Thirteen analysts have rated the stock with a sell rating, thirteen have issued a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $61.20.

View Our Latest Analysis on ENPH

Enphase Energy Stock Performance

NASDAQ:ENPH traded up $0.14 during midday trading on Monday, hitting $39.17. The company's stock had a trading volume of 3,512,230 shares, compared to its average volume of 5,037,448. Enphase Energy has a fifty-two week low of $33.01 and a fifty-two week high of $130.08. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.90 and a quick ratio of 1.77. The firm has a market cap of $5.14 billion, a P/E ratio of 36.18 and a beta of 1.67. The firm's 50 day moving average is $42.43 and its 200-day moving average is $53.77.

Insider Buying and Selling at Enphase Energy

In other Enphase Energy news, CEO Badrinarayanan Kothandaraman bought 4,000 shares of the business's stock in a transaction dated Friday, April 25th. The shares were acquired at an average price of $46.35 per share, with a total value of $185,400.00. Following the transaction, the chief executive officer owned 1,598,696 shares of the company's stock, valued at approximately $74,099,559.60. The trade was a 0.25% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through the SEC website. Insiders own 3.10% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. Woodline Partners LP acquired a new stake in shares of Enphase Energy in the 4th quarter valued at about $557,000. Teacher Retirement System of Texas purchased a new stake in Enphase Energy during the 1st quarter valued at approximately $1,609,000. QRG Capital Management Inc. purchased a new stake in shares of Enphase Energy during the first quarter worth approximately $512,000. Bouvel Investment Partners LLC acquired a new position in Enphase Energy in the 1st quarter valued at $847,000. Finally, Norges Bank purchased a new position in Enphase Energy during the fourth quarter worth about $46,339,000. 72.12% of the stock is owned by hedge funds and other institutional investors.

Enphase Energy Company Profile

(

Get Free Report)

Enphase Energy, Inc, together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control.

See Also

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.