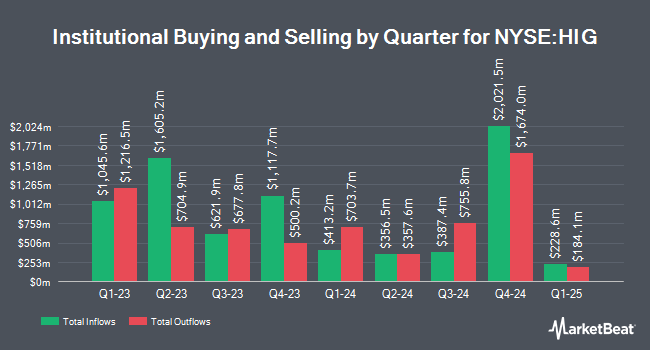

Ensign Peak Advisors Inc lifted its stake in The Hartford Financial Services Group, Inc. (NYSE:HIG - Free Report) by 5.2% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 417,008 shares of the insurance provider's stock after acquiring an additional 20,535 shares during the period. Ensign Peak Advisors Inc owned approximately 0.14% of The Hartford Financial Services Group worth $45,621,000 at the end of the most recent reporting period.

Several other hedge funds also recently made changes to their positions in HIG. Ethic Inc. grew its holdings in The Hartford Financial Services Group by 9.9% during the 4th quarter. Ethic Inc. now owns 55,765 shares of the insurance provider's stock valued at $6,101,000 after buying an additional 5,040 shares in the last quarter. Fred Alger Management LLC raised its holdings in shares of The Hartford Financial Services Group by 10.3% in the 4th quarter. Fred Alger Management LLC now owns 34,540 shares of the insurance provider's stock valued at $3,795,000 after acquiring an additional 3,212 shares in the last quarter. Clark Capital Management Group Inc. boosted its position in shares of The Hartford Financial Services Group by 38.8% during the 4th quarter. Clark Capital Management Group Inc. now owns 5,301 shares of the insurance provider's stock valued at $580,000 after acquiring an additional 1,483 shares during the last quarter. Deutsche Bank AG grew its holdings in shares of The Hartford Financial Services Group by 16.5% during the fourth quarter. Deutsche Bank AG now owns 1,121,087 shares of the insurance provider's stock worth $122,647,000 after purchasing an additional 159,028 shares in the last quarter. Finally, Dean Capital Management lifted its position in The Hartford Financial Services Group by 1.2% during the fourth quarter. Dean Capital Management now owns 16,049 shares of the insurance provider's stock valued at $1,756,000 after purchasing an additional 189 shares during the last quarter. 93.42% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several analysts have recently weighed in on the stock. Barclays raised their price objective on shares of The Hartford Financial Services Group from $140.00 to $145.00 and gave the company an "overweight" rating in a research report on Friday, April 25th. Jefferies Financial Group cut their price target on shares of The Hartford Financial Services Group from $118.00 to $117.00 and set a "hold" rating for the company in a research report on Friday, April 11th. Piper Sandler lifted their price objective on The Hartford Financial Services Group from $130.00 to $145.00 and gave the stock an "overweight" rating in a report on Tuesday, April 1st. JPMorgan Chase & Co. increased their target price on The Hartford Financial Services Group from $125.00 to $129.00 and gave the company a "neutral" rating in a report on Tuesday, April 8th. Finally, Wells Fargo & Company reduced their price target on The Hartford Financial Services Group from $126.00 to $125.00 and set an "overweight" rating on the stock in a research report on Thursday, April 10th. Eight research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $126.87.

Get Our Latest Research Report on HIG

Insider Buying and Selling at The Hartford Financial Services Group

In related news, CEO Christopher Swift sold 98,061 shares of the firm's stock in a transaction that occurred on Monday, March 17th. The shares were sold at an average price of $120.39, for a total value of $11,805,563.79. Following the transaction, the chief executive officer now owns 211,082 shares of the company's stock, valued at approximately $25,412,161.98. This trade represents a 31.72% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, EVP Robert W. Paiano sold 13,138 shares of the firm's stock in a transaction on Tuesday, March 11th. The stock was sold at an average price of $117.20, for a total value of $1,539,773.60. Following the completion of the transaction, the executive vice president now directly owns 31,678 shares in the company, valued at approximately $3,712,661.60. This represents a 29.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 113,429 shares of company stock valued at $13,618,028. Corporate insiders own 1.50% of the company's stock.

The Hartford Financial Services Group Stock Up 2.3%

Shares of HIG stock traded up $2.92 during midday trading on Thursday, reaching $129.06. 1,005,925 shares of the stock were exchanged, compared to its average volume of 1,576,705. The Hartford Financial Services Group, Inc. has a 1 year low of $98.16 and a 1 year high of $129.75. The firm has a market cap of $36.67 billion, a PE ratio of 12.45, a price-to-earnings-growth ratio of 1.12 and a beta of 0.70. The company's 50 day moving average is $120.15 and its two-hundred day moving average is $116.01. The company has a current ratio of 0.32, a quick ratio of 0.32 and a debt-to-equity ratio of 0.27.

The Hartford Financial Services Group (NYSE:HIG - Get Free Report) last issued its quarterly earnings results on Thursday, April 24th. The insurance provider reported $2.20 earnings per share for the quarter, topping the consensus estimate of $2.15 by $0.05. The company had revenue of $6.81 billion for the quarter, compared to analysts' expectations of $6.97 billion. The Hartford Financial Services Group had a return on equity of 19.55% and a net margin of 11.72%. The firm's revenue for the quarter was up 6.1% on a year-over-year basis. During the same period in the prior year, the firm earned $2.34 earnings per share. On average, equities research analysts predict that The Hartford Financial Services Group, Inc. will post 11.11 EPS for the current year.

The Hartford Financial Services Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, April 2nd. Investors of record on Monday, March 3rd were paid a dividend of $0.52 per share. This represents a $2.08 annualized dividend and a yield of 1.61%. The ex-dividend date was Monday, March 3rd. The Hartford Financial Services Group's payout ratio is currently 20.74%.

The Hartford Financial Services Group Profile

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

See Also

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report