Envestnet Asset Management Inc. cut its holdings in shares of Koninklijke Philips (NYSE:PHG - Free Report) by 3.2% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,368,018 shares of the technology company's stock after selling 44,991 shares during the period. Envestnet Asset Management Inc. owned about 0.15% of Koninklijke Philips worth $34,638,000 as of its most recent SEC filing.

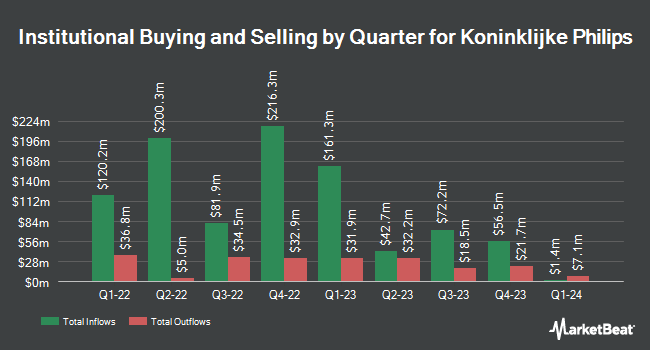

Several other institutional investors have also recently added to or reduced their stakes in PHG. Charles Schwab Investment Management Inc. increased its holdings in shares of Koninklijke Philips by 26.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 55,290 shares of the technology company's stock worth $1,809,000 after acquiring an additional 11,538 shares during the period. BNP Paribas Financial Markets lifted its holdings in shares of Koninklijke Philips by 22.1% during the 3rd quarter. BNP Paribas Financial Markets now owns 20,057 shares of the technology company's stock valued at $656,000 after buying an additional 3,629 shares during the last quarter. Stifel Financial Corp raised its position in Koninklijke Philips by 16.4% during the third quarter. Stifel Financial Corp now owns 195,222 shares of the technology company's stock valued at $6,388,000 after acquiring an additional 27,536 shares in the last quarter. State Street Corp raised its holdings in shares of Koninklijke Philips by 1.0% during the 3rd quarter. State Street Corp now owns 82,518 shares of the technology company's stock valued at $2,809,000 after purchasing an additional 844 shares in the last quarter. Finally, Jane Street Group LLC raised its holdings in Koninklijke Philips by 787.9% during the third quarter. Jane Street Group LLC now owns 128,686 shares of the technology company's stock valued at $4,211,000 after buying an additional 114,193 shares in the last quarter. 13.67% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on PHG. Sanford C. Bernstein raised Koninklijke Philips from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, March 18th. UBS Group raised Koninklijke Philips from a "neutral" rating to a "buy" rating in a report on Thursday, February 20th. BNP Paribas upgraded Koninklijke Philips from a "neutral" rating to an "outperform" rating in a research note on Tuesday, February 25th. Finally, StockNews.com raised shares of Koninklijke Philips from a "hold" rating to a "buy" rating in a report on Saturday, March 8th. Two investment analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy".

View Our Latest Analysis on Koninklijke Philips

Koninklijke Philips Price Performance

NYSE PHG traded down $0.02 during trading hours on Thursday, reaching $23.70. 286,319 shares of the company's stock were exchanged, compared to its average volume of 893,223. The firm has a fifty day moving average of $25.65 and a 200-day moving average of $26.83. The company has a current ratio of 1.23, a quick ratio of 0.74 and a debt-to-equity ratio of 0.59. Koninklijke Philips has a one year low of $19.25 and a one year high of $32.91. The stock has a market cap of $22.28 billion, a PE ratio of -28.26, a price-to-earnings-growth ratio of 0.82 and a beta of 0.81.

Koninklijke Philips (NYSE:PHG - Get Free Report) last released its earnings results on Wednesday, February 19th. The technology company reported $0.54 earnings per share for the quarter, missing analysts' consensus estimates of $0.55 by ($0.01). The firm had revenue of $5.38 billion for the quarter, compared to the consensus estimate of $5.10 billion. Koninklijke Philips had a positive return on equity of 10.85% and a negative net margin of 3.88%. On average, equities research analysts predict that Koninklijke Philips will post 1.63 earnings per share for the current fiscal year.

Koninklijke Philips Cuts Dividend

The company also recently disclosed an annual dividend, which will be paid on Friday, June 6th. Investors of record on Tuesday, May 13th will be paid a dividend of $0.886 per share. This represents a yield of 2.9%. The ex-dividend date of this dividend is Tuesday, May 13th. Koninklijke Philips's payout ratio is -89.29%.

Koninklijke Philips Profile

(

Free Report)

Koninklijke Philips N.V. operates as a health technology company in North America, the Greater China, and internationally. The company operates through Diagnosis & Treatment Businesses, Connected Care Businesses, and Personal Health Businesses segments. It also provides diagnostic imaging solutions, includes magnetic resonance imaging, X-ray systems, and computed tomography (CT) systems and software comprising detector-based spectral CT solutions, as well as molecular and hybrid imaging solutions for nuclear medicine; echography solutions focused on diagnosis, treatment planning and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications; integrated interventional systems, and interventional diagnostic and therapeutic devices to treat coronary artery and peripheral vascular disease.

See Also

Before you consider Koninklijke Philips, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Koninklijke Philips wasn't on the list.

While Koninklijke Philips currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.