Focus Partners Wealth bought a new position in Nordson Co. (NASDAQ:NDSN - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 1,444 shares of the industrial products company's stock, valued at approximately $302,000.

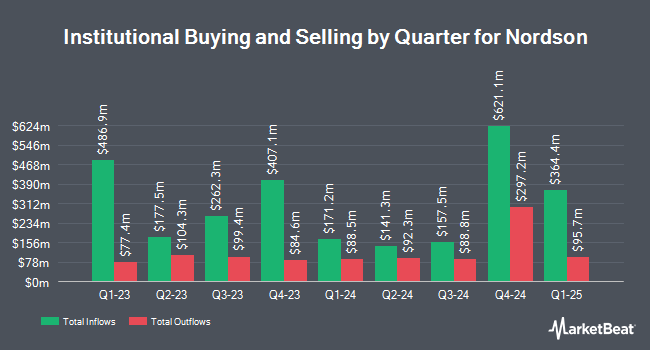

Several other large investors also recently modified their holdings of the business. Vanguard Group Inc. grew its stake in shares of Nordson by 1.5% in the fourth quarter. Vanguard Group Inc. now owns 6,226,757 shares of the industrial products company's stock worth $1,302,887,000 after purchasing an additional 93,146 shares during the last quarter. Geode Capital Management LLC boosted its position in Nordson by 0.9% during the 4th quarter. Geode Capital Management LLC now owns 1,455,956 shares of the industrial products company's stock valued at $303,918,000 after acquiring an additional 12,590 shares in the last quarter. Champlain Investment Partners LLC boosted its position in Nordson by 2.9% during the 4th quarter. Champlain Investment Partners LLC now owns 860,430 shares of the industrial products company's stock valued at $180,036,000 after acquiring an additional 24,030 shares in the last quarter. FMR LLC boosted its position in Nordson by 19.2% during the 4th quarter. FMR LLC now owns 693,627 shares of the industrial products company's stock valued at $145,135,000 after acquiring an additional 111,538 shares in the last quarter. Finally, Norges Bank bought a new stake in Nordson during the 4th quarter valued at approximately $142,670,000. 72.11% of the stock is owned by institutional investors.

Nordson Stock Up 2.4%

Shares of NDSN traded up $4.63 during mid-day trading on Tuesday, reaching $198.01. The company had a trading volume of 354,283 shares, compared to its average volume of 302,301. The company has a debt-to-equity ratio of 0.72, a quick ratio of 1.51 and a current ratio of 2.53. The firm has a 50-day moving average price of $191.64 and a 200 day moving average price of $212.58. Nordson Co. has a 52 week low of $165.03 and a 52 week high of $266.86. The company has a market capitalization of $11.27 billion, a price-to-earnings ratio of 25.19, a price-to-earnings-growth ratio of 1.65 and a beta of 0.90.

Nordson Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, April 3rd. Stockholders of record on Thursday, March 20th were given a $0.78 dividend. The ex-dividend date of this dividend was Thursday, March 20th. This represents a $3.12 dividend on an annualized basis and a dividend yield of 1.58%. Nordson's dividend payout ratio is currently 39.69%.

Wall Street Analyst Weigh In

NDSN has been the topic of several research reports. KeyCorp cut their price objective on Nordson from $260.00 to $230.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 8th. BNP Paribas cut Nordson from an "outperform" rating to a "neutral" rating and set a $219.00 price objective on the stock. in a research report on Monday, February 24th. Four analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $250.20.

Read Our Latest Stock Analysis on NDSN

Nordson Profile

(

Free Report)

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Featured Stories

Before you consider Nordson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordson wasn't on the list.

While Nordson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.