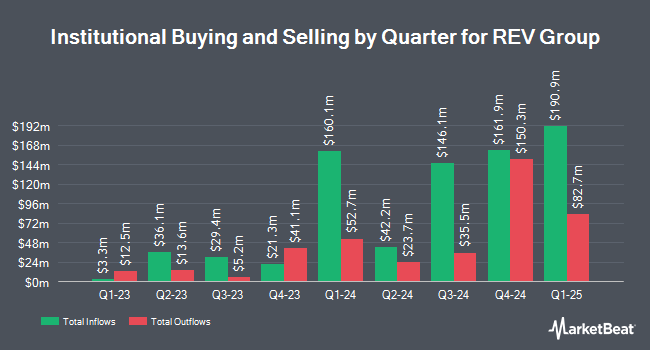

Point72 Asset Management L.P. acquired a new position in shares of REV Group, Inc. (NYSE:REVG - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 305,907 shares of the company's stock, valued at approximately $9,749,000. Point72 Asset Management L.P. owned about 0.59% of REV Group as of its most recent filing with the SEC.

A number of other large investors also recently bought and sold shares of REVG. Barclays PLC raised its position in REV Group by 355.5% during the 3rd quarter. Barclays PLC now owns 89,619 shares of the company's stock worth $2,515,000 after buying an additional 69,946 shares during the last quarter. Ellsworth Advisors LLC purchased a new position in REV Group during the 4th quarter worth $681,000. Janney Montgomery Scott LLC raised its position in REV Group by 2.9% during the 4th quarter. Janney Montgomery Scott LLC now owns 30,700 shares of the company's stock worth $978,000 after buying an additional 859 shares during the last quarter. Planning Center Inc. purchased a new position in REV Group during the 4th quarter worth $223,000. Finally, Legato Capital Management LLC raised its position in REV Group by 113.0% during the 4th quarter. Legato Capital Management LLC now owns 111,318 shares of the company's stock worth $3,548,000 after buying an additional 59,066 shares during the last quarter.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on REVG shares. Wall Street Zen raised shares of REV Group from a "hold" rating to a "buy" rating in a research note on Thursday. Morgan Stanley cut shares of REV Group from an "equal weight" rating to an "underweight" rating and set a $33.00 price target on the stock. in a research note on Wednesday, April 16th. Two analysts have rated the stock with a sell rating and three have given a buy rating to the company. According to data from MarketBeat, REV Group has a consensus rating of "Hold" and an average target price of $34.63.

Check Out Our Latest Report on REVG

REV Group Price Performance

Shares of NYSE:REVG traded down $0.13 on Friday, reaching $37.00. 544,205 shares of the company were exchanged, compared to its average volume of 695,448. The company has a current ratio of 1.72, a quick ratio of 0.43 and a debt-to-equity ratio of 0.20. REV Group, Inc. has a 1-year low of $21.54 and a 1-year high of $38.78. The firm has a market cap of $1.91 billion, a price-to-earnings ratio of 8.24 and a beta of 1.12. The company has a 50-day moving average of $33.19 and a 200-day moving average of $32.37.

REV Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, April 11th. Investors of record on Friday, March 28th were paid a $0.06 dividend. The ex-dividend date was Friday, March 28th. This represents a $0.24 dividend on an annualized basis and a yield of 0.65%. REV Group's payout ratio is 13.48%.

REV Group Company Profile

(

Free Report)

REV Group, Inc, together with its subsidiaries, designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in the United States, Canada, and internationally. It operates through three segments: Fire & Emergency, Commercial, and Recreation. The Fire & Emergency segment provides fire apparatus equipment under the Emergency One, Kovatch Mobile Equipment, Ferrara, Spartan Emergency Response, Smeal, Spartan Fire Chassis, and Ladder Tower brand names; and ambulances under the American Emergency Vehicles, Horton Emergency Vehicles, Leader Emergency Vehicles, Road Rescue, and Wheeled Coach brand names.

Recommended Stories

Before you consider REV Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REV Group wasn't on the list.

While REV Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.