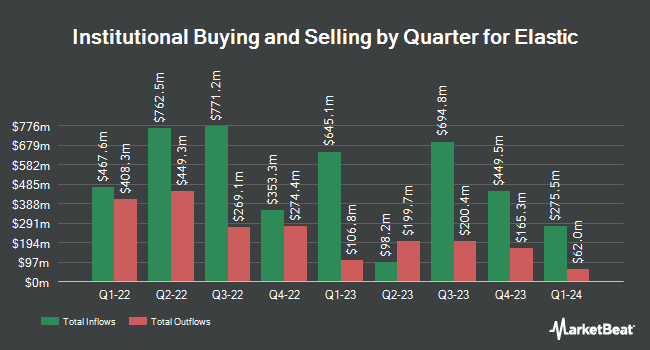

Twinbeech Capital LP purchased a new stake in Elastic (NYSE:ESTC - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund purchased 81,816 shares of the company's stock, valued at approximately $8,106,000. Twinbeech Capital LP owned approximately 0.08% of Elastic at the end of the most recent quarter.

Other institutional investors have also recently made changes to their positions in the company. Two Sigma Advisers LP grew its stake in shares of Elastic by 985.9% in the 4th quarter. Two Sigma Advisers LP now owns 346,400 shares of the company's stock valued at $34,321,000 after buying an additional 314,500 shares during the period. Two Sigma Investments LP grew its stake in shares of Elastic by 745.6% in the 4th quarter. Two Sigma Investments LP now owns 309,766 shares of the company's stock valued at $30,692,000 after buying an additional 273,134 shares during the period. Tairen Capital Ltd boosted its stake in Elastic by 185.7% during the 4th quarter. Tairen Capital Ltd now owns 40,000 shares of the company's stock valued at $3,963,000 after purchasing an additional 26,000 shares during the last quarter. Teza Capital Management LLC boosted its stake in Elastic by 425.5% during the 4th quarter. Teza Capital Management LLC now owns 75,456 shares of the company's stock valued at $7,476,000 after purchasing an additional 61,097 shares during the last quarter. Finally, Troluce Capital Advisors LLC acquired a new position in Elastic during the 4th quarter valued at about $99,000. Institutional investors and hedge funds own 97.03% of the company's stock.

Elastic Stock Down 0.3%

ESTC opened at $92.08 on Tuesday. The company has a fifty day moving average price of $86.43 and a 200-day moving average price of $97.44. The firm has a market capitalization of $9.61 billion, a P/E ratio of 167.42 and a beta of 1.20. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.99 and a quick ratio of 1.99. Elastic has a one year low of $69.00 and a one year high of $123.96.

Elastic (NYSE:ESTC - Get Free Report) last announced its earnings results on Thursday, February 27th. The company reported ($0.01) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.47 by ($0.48). Elastic had a negative return on equity of 13.20% and a net margin of 4.39%. The company had revenue of $382.08 million during the quarter, compared to analysts' expectations of $368.85 million. Equities research analysts expect that Elastic will post -0.77 earnings per share for the current fiscal year.

Analysts Set New Price Targets

ESTC has been the subject of a number of analyst reports. Canaccord Genuity Group lifted their price target on Elastic from $130.00 to $135.00 and gave the company a "buy" rating in a research note on Friday, February 28th. Barclays cut their target price on Elastic from $138.00 to $124.00 and set an "overweight" rating on the stock in a research note on Friday. UBS Group boosted their target price on Elastic from $140.00 to $148.00 and gave the stock a "buy" rating in a research note on Friday, February 28th. Piper Sandler lifted their price target on shares of Elastic from $130.00 to $135.00 and gave the stock an "overweight" rating in a report on Friday, February 28th. Finally, Jefferies Financial Group lowered their price target on shares of Elastic from $125.00 to $110.00 and set a "buy" rating on the stock in a report on Monday, April 7th. Seven analysts have rated the stock with a hold rating, eighteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $126.87.

Get Our Latest Stock Analysis on ESTC

Insider Buying and Selling

In other Elastic news, CTO Shay Banon sold 25,668 shares of the business's stock in a transaction on Sunday, March 2nd. The shares were sold at an average price of $112.53, for a total value of $2,888,420.04. Following the completion of the sale, the chief technology officer now directly owns 2,408,541 shares of the company's stock, valued at $271,033,118.73. The trade was a 1.05% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CRO Mark Eugene Dodds sold 2,755 shares of the business's stock in a transaction on Monday, March 10th. The stock was sold at an average price of $90.77, for a total transaction of $250,071.35. Following the completion of the sale, the executive now directly owns 96,484 shares of the company's stock, valued at $8,757,852.68. This represents a 2.78% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 198,304 shares of company stock worth $20,847,452. Corporate insiders own 15.90% of the company's stock.

Elastic Company Profile

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.