Tableaux LLC acquired a new stake in Eversource Energy (NYSE:ES - Free Report) in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 9,218 shares of the utilities provider's stock, valued at approximately $529,000.

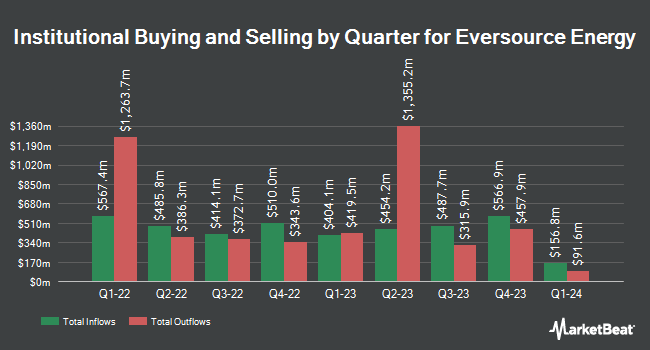

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in ES. Lansforsakringar Fondforvaltning AB publ acquired a new stake in shares of Eversource Energy in the fourth quarter valued at about $7,023,000. Siemens Fonds Invest GmbH grew its position in shares of Eversource Energy by 11.3% in the fourth quarter. Siemens Fonds Invest GmbH now owns 35,078 shares of the utilities provider's stock valued at $2,010,000 after purchasing an additional 3,551 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in shares of Eversource Energy in the fourth quarter valued at about $21,989,000. Great Valley Advisor Group Inc. grew its position in shares of Eversource Energy by 8.7% in the fourth quarter. Great Valley Advisor Group Inc. now owns 78,400 shares of the utilities provider's stock valued at $4,502,000 after purchasing an additional 6,275 shares during the period. Finally, Ascent Group LLC grew its position in shares of Eversource Energy by 1.2% in the fourth quarter. Ascent Group LLC now owns 19,663 shares of the utilities provider's stock valued at $1,129,000 after purchasing an additional 230 shares during the period. Hedge funds and other institutional investors own 79.99% of the company's stock.

Eversource Energy Trading Up 1.2%

Shares of NYSE ES traded up $0.79 during midday trading on Friday, reaching $64.88. 5,660,354 shares of the stock were exchanged, compared to its average volume of 2,437,082. The company has a 50 day simple moving average of $60.21 and a 200 day simple moving average of $59.93. The stock has a market capitalization of $23.84 billion, a P/E ratio of 28.09, a PEG ratio of 2.35 and a beta of 0.61. The company has a debt-to-equity ratio of 1.71, a quick ratio of 0.76 and a current ratio of 0.76. Eversource Energy has a twelve month low of $52.28 and a twelve month high of $69.01.

Eversource Energy (NYSE:ES - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The utilities provider reported $1.50 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $1.50. The business had revenue of $4.12 billion during the quarter, compared to the consensus estimate of $3.65 billion. Eversource Energy had a net margin of 6.82% and a return on equity of 10.99%. The business's revenue was up 23.6% compared to the same quarter last year. During the same quarter last year, the firm earned $1.49 EPS. As a group, equities analysts expect that Eversource Energy will post 4.75 earnings per share for the current year.

Eversource Energy Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, June 30th. Investors of record on Thursday, May 15th will be given a dividend of $0.7525 per share. The ex-dividend date of this dividend is Thursday, May 15th. This represents a $3.01 dividend on an annualized basis and a dividend yield of 4.64%. Eversource Energy's payout ratio is currently 129.74%.

Insider Buying and Selling

In related news, EVP Penelope M. Conner sold 2,600 shares of the stock in a transaction that occurred on Tuesday, May 20th. The shares were sold at an average price of $64.00, for a total transaction of $166,400.00. Following the completion of the transaction, the executive vice president now owns 10,988 shares of the company's stock, valued at approximately $703,232. This trade represents a 19.13% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 0.41% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Several analysts have recently issued reports on the stock. BMO Capital Markets lifted their target price on shares of Eversource Energy from $71.00 to $72.00 and gave the company a "market perform" rating in a research report on Monday, April 28th. Wells Fargo & Company lowered their price target on shares of Eversource Energy from $79.00 to $75.00 and set an "overweight" rating on the stock in a research report on Thursday, February 13th. Scotiabank lowered their price target on shares of Eversource Energy from $56.00 to $55.00 and set a "sector underperform" rating on the stock in a research report on Thursday, February 13th. Wall Street Zen upgraded shares of Eversource Energy from a "sell" rating to a "hold" rating in a research report on Friday, May 16th. Finally, Guggenheim restated a "buy" rating on shares of Eversource Energy in a research report on Monday, February 10th. Three equities research analysts have rated the stock with a sell rating, five have issued a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, Eversource Energy presently has an average rating of "Hold" and an average target price of $65.78.

Read Our Latest Research Report on ES

About Eversource Energy

(

Free Report)

Eversource Energy, a public utility holding company, engages in the energy delivery business. The company operates through Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution segments. It is involved in the transmission and distribution of electricity; solar power facilities; and distribution of natural gas.

Further Reading

Before you consider Eversource Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eversource Energy wasn't on the list.

While Eversource Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.