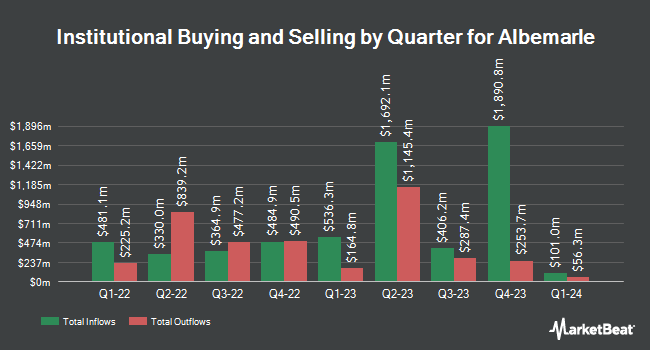

Siemens Fonds Invest GmbH purchased a new stake in shares of Albemarle Co. (NYSE:ALB - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 9,720 shares of the specialty chemicals company's stock, valued at approximately $837,000.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. MassMutual Private Wealth & Trust FSB boosted its stake in Albemarle by 48.9% during the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 414 shares of the specialty chemicals company's stock valued at $36,000 after purchasing an additional 136 shares during the period. Metis Global Partners LLC boosted its position in shares of Albemarle by 3.9% in the fourth quarter. Metis Global Partners LLC now owns 3,908 shares of the specialty chemicals company's stock valued at $336,000 after acquiring an additional 148 shares during the period. SlateStone Wealth LLC grew its stake in shares of Albemarle by 3.3% in the fourth quarter. SlateStone Wealth LLC now owns 4,655 shares of the specialty chemicals company's stock worth $401,000 after acquiring an additional 150 shares during the last quarter. Wilmington Savings Fund Society FSB grew its stake in shares of Albemarle by 5.6% in the fourth quarter. Wilmington Savings Fund Society FSB now owns 2,982 shares of the specialty chemicals company's stock worth $257,000 after acquiring an additional 158 shares during the last quarter. Finally, Lindbrook Capital LLC increased its position in Albemarle by 34.0% during the fourth quarter. Lindbrook Capital LLC now owns 626 shares of the specialty chemicals company's stock worth $54,000 after acquiring an additional 159 shares during the period. 92.87% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research firms have issued reports on ALB. Royal Bank of Canada decreased their price target on shares of Albemarle from $133.00 to $114.00 and set an "overweight" rating on the stock in a research report on Wednesday, February 12th. Robert W. Baird lowered their price target on Albemarle from $77.00 to $60.00 and set a "neutral" rating on the stock in a research note on Tuesday, April 15th. Deutsche Bank Aktiengesellschaft cut their price target on Albemarle from $109.00 to $105.00 in a report on Wednesday, February 12th. Evercore ISI lowered Albemarle from an "outperform" rating to an "inline" rating in a report on Wednesday, February 5th. Finally, Citigroup dropped their price target on shares of Albemarle from $85.00 to $64.00 and set a "neutral" rating for the company in a research report on Tuesday, April 15th. Three equities research analysts have rated the stock with a sell rating, fourteen have issued a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $92.43.

Read Our Latest Research Report on ALB

Albemarle Stock Performance

Shares of NYSE:ALB opened at $60.15 on Friday. The business has a fifty day moving average of $63.20 and a 200-day moving average of $81.68. The firm has a market cap of $7.08 billion, a PE ratio of -5.37 and a beta of 1.71. The company has a debt-to-equity ratio of 0.39, a quick ratio of 1.19 and a current ratio of 1.95. Albemarle Co. has a twelve month low of $49.43 and a twelve month high of $131.00.

Albemarle (NYSE:ALB - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The specialty chemicals company reported ($0.18) earnings per share for the quarter, beating the consensus estimate of ($0.62) by $0.44. Albemarle had a negative net margin of 21.93% and a negative return on equity of 1.72%. The firm had revenue of $1.08 billion during the quarter, compared to analysts' expectations of $1.18 billion. During the same quarter last year, the company posted $0.26 EPS. The company's quarterly revenue was down 20.9% compared to the same quarter last year. On average, equities research analysts predict that Albemarle Co. will post -0.04 EPS for the current fiscal year.

Albemarle Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Shareholders of record on Friday, June 13th will be issued a dividend of $0.405 per share. This represents a $1.62 annualized dividend and a yield of 2.69%. The ex-dividend date is Friday, June 13th. Albemarle's dividend payout ratio is -14.57%.

Albemarle Company Profile

(

Free Report)

Albemarle Corporation develops, manufactures, and markets engineered specialty chemicals worldwide. It operates through three segments: Energy Storage, Specialties and Ketjen. The Energy Storage segment offers lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride; technical services for the handling and use of reactive lithium products; and lithium-containing by-products recycling services.

Further Reading

Want to see what other hedge funds are holding ALB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Albemarle Co. (NYSE:ALB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Albemarle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albemarle wasn't on the list.

While Albemarle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.