GAMMA Investing LLC boosted its holdings in Advance Auto Parts, Inc. (NYSE:AAP - Free Report) by 12,026.5% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 190,992 shares of the company's stock after purchasing an additional 189,417 shares during the period. GAMMA Investing LLC owned approximately 0.32% of Advance Auto Parts worth $7,489,000 at the end of the most recent reporting period.

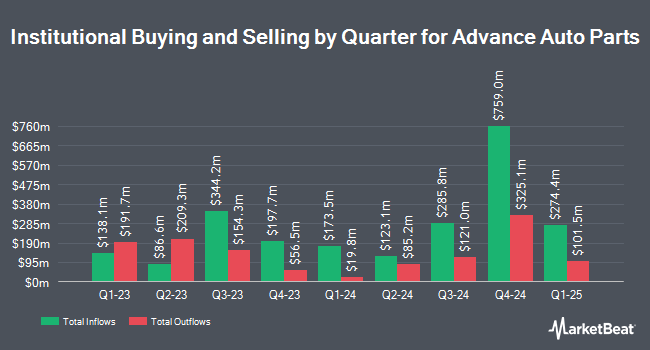

Other institutional investors have also added to or reduced their stakes in the company. Annandale Capital LLC lifted its stake in shares of Advance Auto Parts by 46.6% in the 4th quarter. Annandale Capital LLC now owns 109,241 shares of the company's stock valued at $5,166,000 after acquiring an additional 34,746 shares during the last quarter. Raymond James Financial Inc. purchased a new position in Advance Auto Parts in the 4th quarter worth approximately $8,822,000. Commonwealth Equity Services LLC lifted its position in Advance Auto Parts by 97.2% in the fourth quarter. Commonwealth Equity Services LLC now owns 305,622 shares of the company's stock valued at $14,453,000 after purchasing an additional 150,604 shares during the last quarter. Segall Bryant & Hamill LLC purchased a new stake in shares of Advance Auto Parts during the fourth quarter valued at approximately $34,586,000. Finally, Charles Schwab Investment Management Inc. grew its holdings in shares of Advance Auto Parts by 18.3% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 649,919 shares of the company's stock worth $30,735,000 after purchasing an additional 100,445 shares during the last quarter. 88.75% of the stock is currently owned by hedge funds and other institutional investors.

Advance Auto Parts Stock Down 1.7%

Advance Auto Parts stock traded down $0.86 during mid-day trading on Thursday, reaching $50.66. The stock had a trading volume of 1,829,267 shares, compared to its average volume of 2,471,090. Advance Auto Parts, Inc. has a one year low of $28.89 and a one year high of $67.03. The company has a 50-day moving average price of $37.98 and a two-hundred day moving average price of $41.40. The company has a market capitalization of $3.04 billion, a price-to-earnings ratio of 69.40, a PEG ratio of 1.98 and a beta of 1.06. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.34 and a quick ratio of 0.62.

Advance Auto Parts (NYSE:AAP - Get Free Report) last issued its earnings results on Thursday, May 22nd. The company reported ($0.22) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.81) by $0.59. The firm had revenue of $2.58 billion for the quarter, compared to the consensus estimate of $2.51 billion. Advance Auto Parts had a net margin of 0.41% and a return on equity of 1.82%. The business's revenue was down 24.2% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.67 earnings per share. On average, analysts expect that Advance Auto Parts, Inc. will post -0.46 EPS for the current fiscal year.

Advance Auto Parts Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, July 25th. Stockholders of record on Friday, July 11th will be paid a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 1.97%. The ex-dividend date of this dividend is Friday, July 11th. Advance Auto Parts's dividend payout ratio is currently -17.04%.

Wall Street Analysts Forecast Growth

Several equities research analysts have weighed in on AAP shares. DA Davidson increased their price target on shares of Advance Auto Parts from $45.00 to $47.00 and gave the company a "neutral" rating in a research report on Friday, May 23rd. Evercore ISI upped their target price on Advance Auto Parts from $35.00 to $45.00 and gave the company an "in-line" rating in a report on Friday, May 23rd. Redburn Atlantic upgraded shares of Advance Auto Parts from a "sell" rating to a "neutral" rating and lifted their price target for the company from $28.00 to $45.00 in a report on Tuesday, June 3rd. Morgan Stanley boosted their price objective on shares of Advance Auto Parts from $45.00 to $48.00 and gave the company an "equal weight" rating in a research report on Friday, May 23rd. Finally, Wedbush reaffirmed an "outperform" rating and issued a $55.00 target price on shares of Advance Auto Parts in a research report on Monday, March 3rd. One research analyst has rated the stock with a sell rating, twenty have issued a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat, Advance Auto Parts currently has an average rating of "Hold" and a consensus price target of $46.01.

Check Out Our Latest Stock Analysis on Advance Auto Parts

Advance Auto Parts Company Profile

(

Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Read More

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.