Ameriprise Financial Inc. increased its stake in shares of CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS - Free Report) by 42.3% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 986,831 shares of the company's stock after purchasing an additional 293,355 shares during the period. Ameriprise Financial Inc. owned approximately 0.15% of CCC Intelligent Solutions worth $11,576,000 as of its most recent SEC filing.

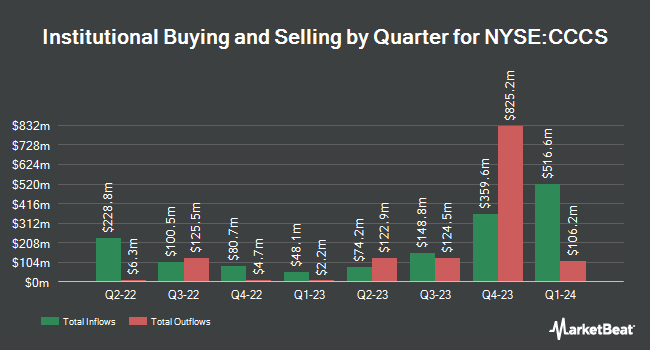

A number of other institutional investors have also made changes to their positions in the stock. CIBC Asset Management Inc grew its stake in shares of CCC Intelligent Solutions by 5.9% during the fourth quarter. CIBC Asset Management Inc now owns 19,046 shares of the company's stock worth $223,000 after purchasing an additional 1,054 shares during the period. Berry Wealth Group LP grew its stake in CCC Intelligent Solutions by 5.8% in the fourth quarter. Berry Wealth Group LP now owns 20,224 shares of the company's stock valued at $237,000 after acquiring an additional 1,109 shares during the period. Arizona State Retirement System grew its stake in CCC Intelligent Solutions by 1.0% in the fourth quarter. Arizona State Retirement System now owns 117,507 shares of the company's stock valued at $1,378,000 after acquiring an additional 1,150 shares during the period. Treasurer of the State of North Carolina grew its stake in CCC Intelligent Solutions by 0.6% in the fourth quarter. Treasurer of the State of North Carolina now owns 198,807 shares of the company's stock valued at $2,332,000 after acquiring an additional 1,250 shares during the period. Finally, Townsquare Capital LLC grew its stake in CCC Intelligent Solutions by 6.5% in the fourth quarter. Townsquare Capital LLC now owns 24,338 shares of the company's stock valued at $285,000 after acquiring an additional 1,475 shares during the period. 95.79% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of research firms have issued reports on CCCS. The Goldman Sachs Group decreased their target price on CCC Intelligent Solutions from $13.00 to $11.50 and set a "buy" rating for the company in a research note on Wednesday, May 7th. Barrington Research restated an "outperform" rating and issued a $14.00 price target on shares of CCC Intelligent Solutions in a report on Wednesday, May 7th. Piper Sandler cut their price target on CCC Intelligent Solutions from $11.00 to $9.00 and set a "neutral" rating on the stock in a report on Wednesday, May 7th. Morgan Stanley cut their price target on CCC Intelligent Solutions from $15.00 to $13.00 and set an "overweight" rating on the stock in a report on Wednesday, April 16th. Finally, Barclays cut their price target on CCC Intelligent Solutions from $13.00 to $11.00 and set an "equal weight" rating on the stock in a report on Monday, April 14th. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, CCC Intelligent Solutions currently has an average rating of "Moderate Buy" and a consensus target price of $12.19.

Read Our Latest Report on CCC Intelligent Solutions

Insider Buying and Selling at CCC Intelligent Solutions

In other CCC Intelligent Solutions news, CAO Rodney Christo sold 20,077 shares of the firm's stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $10.20, for a total value of $204,785.40. The sale was disclosed in a filing with the SEC, which is available at this link. Also, Director Eric Wei sold 42,000,000 shares of the firm's stock in a transaction on Monday, March 3rd. The shares were sold at an average price of $10.32, for a total value of $433,440,000.00. Following the completion of the sale, the director now directly owns 2,258,343 shares in the company, valued at approximately $23,306,099.76. This represents a 94.90% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 42,087,456 shares of company stock worth $434,240,401 over the last 90 days. Company insiders own 6.03% of the company's stock.

CCC Intelligent Solutions Stock Down 3.8%

CCCS traded down $0.33 on Friday, hitting $8.47. 8,634,940 shares of the company were exchanged, compared to its average volume of 5,019,348. CCC Intelligent Solutions Holdings Inc. has a 12 month low of $8.14 and a 12 month high of $12.88. The company has a market cap of $5.58 billion, a PE ratio of 423.71 and a beta of 0.76. The company has a debt-to-equity ratio of 0.39, a quick ratio of 3.19 and a current ratio of 3.19. The stock's fifty day moving average is $8.91 and its 200-day moving average is $10.44.

CCC Intelligent Solutions (NYSE:CCCS - Get Free Report) last released its earnings results on Tuesday, May 6th. The company reported $0.08 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.08. The business had revenue of $251.57 million for the quarter, compared to analyst estimates of $249.87 million. CCC Intelligent Solutions had a return on equity of 5.35% and a net margin of 5.02%. CCC Intelligent Solutions's revenue was up 10.7% on a year-over-year basis. During the same quarter in the prior year, the company posted $0.09 earnings per share. Equities research analysts predict that CCC Intelligent Solutions Holdings Inc. will post 0.17 EPS for the current fiscal year.

CCC Intelligent Solutions Profile

(

Free Report)

CCC Intelligent Solutions Holdings Inc, operates as a software as a service company for the property and casualty insurance economy in the United States and China. The company's cloud-based software as a service platform connects trading partners, facilitates commerce, and supports mission-critical, artificial intelligence enabled digital workflow across the insurance economy, including insurers, repairers, automakers, parts suppliers, lenders and more.

Further Reading

Before you consider CCC Intelligent Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CCC Intelligent Solutions wasn't on the list.

While CCC Intelligent Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.