Annex Advisory Services LLC boosted its position in shares of Hawkins, Inc. (NASDAQ:HWKN - Free Report) by 18.9% in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 24,312 shares of the specialty chemicals company's stock after purchasing an additional 3,864 shares during the period. Annex Advisory Services LLC owned about 0.12% of Hawkins worth $2,575,000 at the end of the most recent quarter.

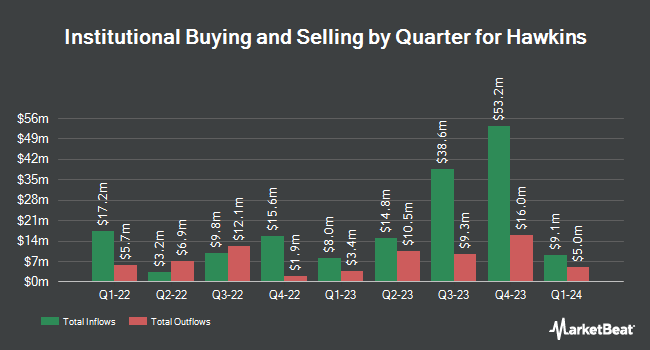

Other institutional investors have also recently added to or reduced their stakes in the company. Barclays PLC lifted its holdings in Hawkins by 180.1% during the 3rd quarter. Barclays PLC now owns 39,728 shares of the specialty chemicals company's stock valued at $5,064,000 after purchasing an additional 25,545 shares during the last quarter. Tudor Investment Corp ET AL lifted its holdings in Hawkins by 67.3% during the 4th quarter. Tudor Investment Corp ET AL now owns 67,038 shares of the specialty chemicals company's stock valued at $8,224,000 after purchasing an additional 26,970 shares during the last quarter. Vaughan Nelson Investment Management L.P. lifted its holdings in Hawkins by 487.7% during the 4th quarter. Vaughan Nelson Investment Management L.P. now owns 254,837 shares of the specialty chemicals company's stock valued at $31,260,000 after purchasing an additional 211,472 shares during the last quarter. Proficio Capital Partners LLC bought a new position in Hawkins during the 4th quarter valued at about $2,984,000. Finally, Cynosure Group LLC bought a new position in Hawkins during the 4th quarter valued at about $299,000. 69.71% of the stock is owned by institutional investors.

Hawkins Price Performance

Shares of NASDAQ HWKN traded up $1.81 during trading on Thursday, reaching $135.45. The company had a trading volume of 86,213 shares, compared to its average volume of 125,350. Hawkins, Inc. has a 52 week low of $83.88 and a 52 week high of $139.55. The stock has a market cap of $2.82 billion, a PE ratio of 34.55, a PEG ratio of 3.80 and a beta of 0.85. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.53 and a current ratio of 2.50. The business's 50 day moving average price is $121.22 and its 200-day moving average price is $118.23.

Hawkins (NASDAQ:HWKN - Get Free Report) last announced its quarterly earnings data on Wednesday, May 14th. The specialty chemicals company reported $0.78 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.74 by $0.04. The firm had revenue of $245.32 million for the quarter, compared to analysts' expectations of $230.69 million. Hawkins had a net margin of 8.60% and a return on equity of 18.95%. Analysts expect that Hawkins, Inc. will post 4 earnings per share for the current year.

Hawkins Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, June 13th. Stockholders of record on Friday, May 30th will be paid a $0.18 dividend. This represents a $0.72 dividend on an annualized basis and a dividend yield of 0.53%. The ex-dividend date is Friday, May 30th. Hawkins's dividend payout ratio (DPR) is currently 17.82%.

Analyst Upgrades and Downgrades

Several equities analysts recently issued reports on the stock. BWS Financial reissued a "buy" rating and set a $160.00 price target on shares of Hawkins in a report on Thursday, May 15th. CJS Securities assumed coverage on shares of Hawkins in a research note on Tuesday, April 1st. They issued a "market outperform" rating and a $125.00 target price for the company. Finally, Wall Street Zen downgraded shares of Hawkins from a "buy" rating to a "hold" rating in a research note on Saturday, May 24th.

Check Out Our Latest Stock Report on HWKN

About Hawkins

(

Free Report)

Hawkins, Inc operates as a specialty chemical and ingredients company in the United States. It operates through three segments: Industrial, Water Treatment, and Health and Nutrition. The Industrial segment offers industrial chemicals, products, and services to agriculture, chemical processing, electronics, energy, food, pharmaceutical, and plating industries.

Featured Articles

Before you consider Hawkins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawkins wasn't on the list.

While Hawkins currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.