Assenagon Asset Management S.A. trimmed its stake in shares of Walgreens Boots Alliance, Inc. (NASDAQ:WBA - Free Report) by 95.9% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 25,285 shares of the pharmacy operator's stock after selling 597,418 shares during the period. Assenagon Asset Management S.A.'s holdings in Walgreens Boots Alliance were worth $282,000 as of its most recent SEC filing.

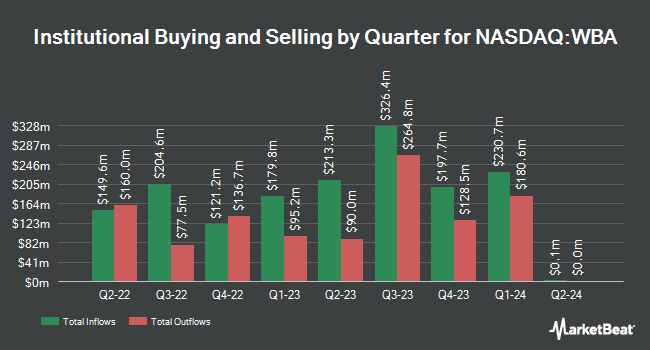

A number of other hedge funds and other institutional investors have also made changes to their positions in the stock. Raymond James Financial Inc. acquired a new stake in Walgreens Boots Alliance in the 4th quarter valued at $9,685,000. First Trust Advisors LP acquired a new stake in Walgreens Boots Alliance in the 4th quarter valued at $368,000. Venturi Wealth Management LLC acquired a new stake in Walgreens Boots Alliance in the 4th quarter valued at $28,000. Cibc World Markets Corp increased its stake in shares of Walgreens Boots Alliance by 15.2% during the 4th quarter. Cibc World Markets Corp now owns 282,286 shares of the pharmacy operator's stock worth $2,634,000 after purchasing an additional 37,141 shares during the last quarter. Finally, Y Intercept Hong Kong Ltd acquired a new position in shares of Walgreens Boots Alliance during the 4th quarter worth about $143,000. 58.59% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Walgreens Boots Alliance

In other news, Chairman Stefano Pessina acquired 832,258 shares of the company's stock in a transaction on Sunday, April 27th. The stock was bought at an average cost of $11.01 per share, with a total value of $9,163,160.58. Following the completion of the purchase, the chairman now directly owns 145,621,079 shares of the company's stock, valued at $1,603,288,079.79. This represents a 0.57% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 17.50% of the company's stock.

Analysts Set New Price Targets

Several brokerages recently commented on WBA. Wolfe Research raised shares of Walgreens Boots Alliance to a "hold" rating in a report on Monday, February 24th. Deutsche Bank Aktiengesellschaft downgraded shares of Walgreens Boots Alliance from a "hold" rating to a "sell" rating and reduced their target price for the stock from $11.00 to $9.00 in a report on Friday, February 28th. Finally, Wall Street Zen began coverage on shares of Walgreens Boots Alliance in a report on Wednesday, May 21st. They set a "hold" rating for the company. Four investment analysts have rated the stock with a sell rating, seven have given a hold rating and two have issued a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $10.59.

Check Out Our Latest Analysis on WBA

Walgreens Boots Alliance Price Performance

WBA opened at $11.39 on Friday. The firm has a 50-day moving average price of $11.15 and a 200-day moving average price of $10.73. The company has a quick ratio of 0.32, a current ratio of 0.61 and a debt-to-equity ratio of 0.92. Walgreens Boots Alliance, Inc. has a twelve month low of $8.08 and a twelve month high of $16.25. The company has a market capitalization of $9.86 billion, a price-to-earnings ratio of -1.70, a PEG ratio of 1.37 and a beta of 0.78.

Walgreens Boots Alliance (NASDAQ:WBA - Get Free Report) last announced its quarterly earnings data on Tuesday, April 8th. The pharmacy operator reported $0.63 earnings per share for the quarter, topping analysts' consensus estimates of $0.53 by $0.10. The firm had revenue of $38.59 billion during the quarter, compared to analyst estimates of $37.90 billion. Walgreens Boots Alliance had a negative net margin of 3.80% and a positive return on equity of 16.39%. The business's quarterly revenue was up 4.1% on a year-over-year basis. During the same period in the previous year, the business posted $1.20 EPS. Equities analysts expect that Walgreens Boots Alliance, Inc. will post 1.6 EPS for the current year.

Walgreens Boots Alliance Profile

(

Free Report)

Walgreens Boots Alliance, Inc operates as a healthcare, pharmacy, and retail company in the United States, the United Kingdom, Germany, and internationally. It operates through three segments: U.S. Retail Pharmacy, International, and U.S. Healthcare. The U.S. Retail Pharmacy segment engages in operation of the retail drugstores, health and wellness services, specialty, and home delivery pharmacy services, which offers health and wellness, beauty, personal care and consumables, and general merchandise.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walgreens Boots Alliance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walgreens Boots Alliance wasn't on the list.

While Walgreens Boots Alliance currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.