Assenagon Asset Management S.A. cut its stake in shares of Addus HomeCare Corporation (NASDAQ:ADUS - Free Report) by 91.6% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 6,087 shares of the company's stock after selling 66,196 shares during the period. Assenagon Asset Management S.A.'s holdings in Addus HomeCare were worth $602,000 as of its most recent SEC filing.

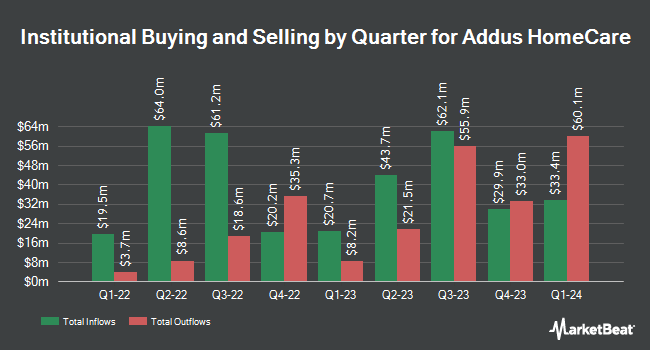

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Natixis raised its stake in Addus HomeCare by 111.9% during the 4th quarter. Natixis now owns 250 shares of the company's stock valued at $31,000 after acquiring an additional 132 shares during the last quarter. Smartleaf Asset Management LLC raised its stake in Addus HomeCare by 324.2% during the 4th quarter. Smartleaf Asset Management LLC now owns 280 shares of the company's stock valued at $35,000 after acquiring an additional 214 shares during the last quarter. Parkside Financial Bank & Trust raised its stake in Addus HomeCare by 38.6% during the 4th quarter. Parkside Financial Bank & Trust now owns 531 shares of the company's stock valued at $67,000 after acquiring an additional 148 shares during the last quarter. Meeder Asset Management Inc. purchased a new stake in Addus HomeCare during the 4th quarter valued at approximately $77,000. Finally, Harvest Fund Management Co. Ltd purchased a new stake in Addus HomeCare during the 4th quarter valued at approximately $86,000. 95.35% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, EVP Michael D. Wattenbarger sold 2,045 shares of the company's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $115.00, for a total value of $235,175.00. Following the sale, the executive vice president now owns 7,796 shares in the company, valued at $896,540. This represents a 20.78% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Insiders own 4.60% of the company's stock.

Addus HomeCare Stock Performance

NASDAQ ADUS traded down $1.37 on Friday, hitting $113.79. 195,824 shares of the company's stock were exchanged, compared to its average volume of 170,637. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.74 and a quick ratio of 1.74. The firm's 50-day moving average price is $108.91 and its two-hundred day moving average price is $111.90. Addus HomeCare Corporation has a fifty-two week low of $88.96 and a fifty-two week high of $136.72. The firm has a market cap of $2.09 billion, a price-to-earnings ratio of 25.69, a P/E/G ratio of 1.61 and a beta of 0.81.

Addus HomeCare (NASDAQ:ADUS - Get Free Report) last released its quarterly earnings results on Monday, May 5th. The company reported $1.42 earnings per share for the quarter, topping analysts' consensus estimates of $1.33 by $0.09. The business had revenue of $337.71 million for the quarter, compared to analysts' expectations of $341.66 million. Addus HomeCare had a return on equity of 9.23% and a net margin of 6.52%. The company's revenue was up 20.3% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $1.21 EPS. On average, research analysts expect that Addus HomeCare Corporation will post 4.59 EPS for the current year.

Analyst Ratings Changes

ADUS has been the subject of several analyst reports. Macquarie reaffirmed an "outperform" rating and set a $133.00 price objective on shares of Addus HomeCare in a research note on Tuesday, June 10th. Stephens reaffirmed an "overweight" rating and set a $142.00 price objective on shares of Addus HomeCare in a research note on Wednesday, March 12th. Wall Street Zen cut Addus HomeCare from a "buy" rating to a "hold" rating in a research report on Saturday. Finally, JMP Securities reiterated a "market outperform" rating and set a $150.00 target price on shares of Addus HomeCare in a research report on Friday. One research analyst has rated the stock with a hold rating, six have assigned a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Buy" and a consensus target price of $142.57.

Check Out Our Latest Report on Addus HomeCare

Addus HomeCare Company Profile

(

Free Report)

Addus HomeCare Corporation, together with its subsidiaries, provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States. The company operates through three segments: Personal Care, Hospice, and Home Health.

Read More

Before you consider Addus HomeCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Addus HomeCare wasn't on the list.

While Addus HomeCare currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.