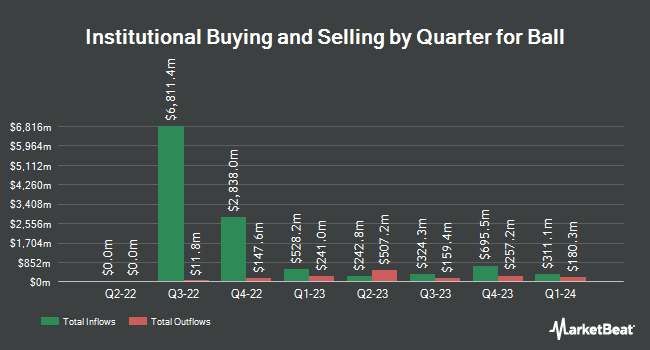

DekaBank Deutsche Girozentrale grew its holdings in shares of Ball Corporation (NYSE:BALL - Free Report) by 359.3% in the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 1,184,629 shares of the company's stock after purchasing an additional 926,728 shares during the period. DekaBank Deutsche Girozentrale owned approximately 0.42% of Ball worth $60,299,000 as of its most recent SEC filing.

Other large investors have also recently made changes to their positions in the company. Franklin Resources Inc. raised its position in Ball by 11.6% in the fourth quarter. Franklin Resources Inc. now owns 7,758,604 shares of the company's stock worth $427,732,000 after acquiring an additional 803,728 shares during the period. Invesco Ltd. lifted its position in Ball by 25.3% during the fourth quarter. Invesco Ltd. now owns 4,159,436 shares of the company's stock valued at $229,310,000 after purchasing an additional 840,357 shares in the last quarter. Norges Bank purchased a new position in Ball during the fourth quarter valued at $190,105,000. Dimensional Fund Advisors LP lifted its position in Ball by 13.7% during the fourth quarter. Dimensional Fund Advisors LP now owns 3,055,441 shares of the company's stock valued at $168,447,000 after purchasing an additional 367,798 shares in the last quarter. Finally, London Co. of Virginia lifted its position in Ball by 61.1% during the fourth quarter. London Co. of Virginia now owns 3,054,393 shares of the company's stock valued at $168,389,000 after purchasing an additional 1,158,668 shares in the last quarter. 86.51% of the stock is currently owned by hedge funds and other institutional investors.

Ball Trading Down 0.2%

Shares of BALL traded down $0.10 during mid-day trading on Friday, reaching $58.30. 1,691,300 shares of the company's stock traded hands, compared to its average volume of 2,221,140. The stock has a market cap of $16.17 billion, a P/E ratio of 34.70, a P/E/G ratio of 1.55 and a beta of 1.08. The stock's 50-day moving average is $54.70 and its two-hundred day moving average is $52.75. Ball Corporation has a 12 month low of $43.51 and a 12 month high of $68.12. The company has a debt-to-equity ratio of 1.10, a current ratio of 1.04 and a quick ratio of 0.70.

Ball (NYSE:BALL - Get Free Report) last released its quarterly earnings data on Tuesday, May 6th. The company reported $0.76 EPS for the quarter, topping the consensus estimate of $0.69 by $0.07. The company had revenue of $3.10 billion for the quarter, compared to the consensus estimate of $2.91 billion. Ball had a return on equity of 15.41% and a net margin of 4.18%. Ball's quarterly revenue was up 7.8% on a year-over-year basis. During the same period last year, the business posted $0.68 EPS. Research analysts forecast that Ball Corporation will post 3.48 earnings per share for the current fiscal year.

Ball Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, June 16th. Shareholders of record on Monday, June 2nd were given a dividend of $0.20 per share. The ex-dividend date was Monday, June 2nd. This represents a $0.80 annualized dividend and a yield of 1.37%. Ball's dividend payout ratio (DPR) is presently 47.62%.

Analyst Ratings Changes

BALL has been the topic of several analyst reports. Bank of America reiterated a "neutral" rating and set a $66.00 target price (down from $67.00) on shares of Ball in a research report on Wednesday. Loop Capital lowered their price objective on Ball from $83.00 to $78.00 and set a "buy" rating on the stock in a research report on Wednesday, May 7th. Wells Fargo & Company boosted their target price on Ball from $44.00 to $50.00 and gave the stock an "underweight" rating in a research report on Wednesday, May 7th. UBS Group boosted their target price on Ball from $54.00 to $60.00 and gave the stock a "neutral" rating in a research report on Wednesday. Finally, Citigroup boosted their target price on Ball from $55.00 to $63.00 and gave the stock a "neutral" rating in a research report on Thursday, July 3rd. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $63.36.

Get Our Latest Stock Analysis on BALL

About Ball

(

Free Report)

Ball Corporation supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally. The company manufactures and sells aluminum beverage containers to fillers of carbonated soft drinks, beer, energy drinks, and other beverages.

Read More

Before you consider Ball, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ball wasn't on the list.

While Ball currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.