Bessemer Group Inc. lifted its holdings in shares of HealthEquity, Inc. (NASDAQ:HQY - Free Report) by 34.9% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 400,394 shares of the company's stock after buying an additional 103,566 shares during the period. Bessemer Group Inc. owned about 0.46% of HealthEquity worth $35,382,000 at the end of the most recent quarter.

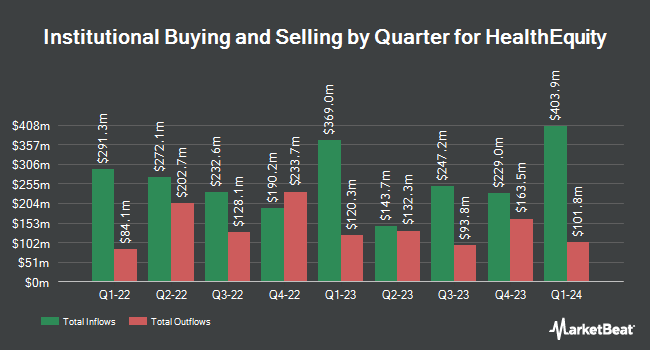

A number of other large investors also recently modified their holdings of HQY. Sanctuary Advisors LLC boosted its stake in shares of HealthEquity by 5.0% during the 4th quarter. Sanctuary Advisors LLC now owns 3,335 shares of the company's stock worth $320,000 after buying an additional 159 shares during the last quarter. New York State Common Retirement Fund boosted its stake in shares of HealthEquity by 142.6% during the 4th quarter. New York State Common Retirement Fund now owns 102,200 shares of the company's stock worth $9,806,000 after buying an additional 60,077 shares during the last quarter. Handelsbanken Fonder AB boosted its stake in shares of HealthEquity by 8.2% during the 4th quarter. Handelsbanken Fonder AB now owns 22,316 shares of the company's stock worth $2,141,000 after buying an additional 1,700 shares during the last quarter. First Horizon Advisors Inc. boosted its stake in shares of HealthEquity by 50.7% during the 4th quarter. First Horizon Advisors Inc. now owns 1,115 shares of the company's stock worth $107,000 after buying an additional 375 shares during the last quarter. Finally, Oregon Public Employees Retirement Fund boosted its stake in shares of HealthEquity by 0.6% during the 4th quarter. Oregon Public Employees Retirement Fund now owns 17,776 shares of the company's stock worth $1,706,000 after buying an additional 100 shares during the last quarter. 99.55% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities analysts have recently commented on HQY shares. Royal Bank Of Canada increased their price objective on shares of HealthEquity from $112.00 to $117.00 and gave the stock an "outperform" rating in a research note on Wednesday, June 4th. JMP Securities raised their target price on shares of HealthEquity from $110.00 to $117.00 and gave the company a "market outperform" rating in a research note on Wednesday, June 4th. KeyCorp cut their target price on shares of HealthEquity from $110.00 to $100.00 and set an "overweight" rating for the company in a research note on Wednesday, April 16th. Wall Street Zen upgraded shares of HealthEquity from a "hold" rating to a "buy" rating in a research note on Friday, June 6th. Finally, The Goldman Sachs Group raised their target price on shares of HealthEquity from $94.00 to $104.00 and gave the company a "neutral" rating in a research note on Wednesday, June 4th. One equities research analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $118.09.

Get Our Latest Analysis on HealthEquity

HealthEquity Stock Performance

HealthEquity stock traded up $0.02 during trading hours on Friday, hitting $104.88. The company had a trading volume of 958,705 shares, compared to its average volume of 855,203. The firm has a market cap of $9.07 billion, a PE ratio of 76.55, a PEG ratio of 1.61 and a beta of 0.49. The company has a debt-to-equity ratio of 0.50, a current ratio of 4.06 and a quick ratio of 4.06. HealthEquity, Inc. has a one year low of $65.01 and a one year high of $116.65. The firm has a 50-day moving average of $98.01 and a 200 day moving average of $98.02.

HealthEquity (NASDAQ:HQY - Get Free Report) last released its quarterly earnings results on Tuesday, June 3rd. The company reported $0.97 earnings per share for the quarter, beating the consensus estimate of $0.81 by $0.16. The firm had revenue of $330.80 million for the quarter, compared to analysts' expectations of $322.25 million. HealthEquity had a net margin of 9.80% and a return on equity of 11.01%. During the same period in the prior year, the firm earned $0.80 EPS. On average, sell-side analysts expect that HealthEquity, Inc. will post 2.32 earnings per share for the current year.

Insider Transactions at HealthEquity

In other news, EVP Michael Henry Fiore sold 8,881 shares of the firm's stock in a transaction that occurred on Friday, April 4th. The shares were sold at an average price of $78.26, for a total transaction of $695,027.06. Following the transaction, the executive vice president now directly owns 56,655 shares of the company's stock, valued at approximately $4,433,820.30. This trade represents a 13.55% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Robert W. Selander sold 5,750 shares of the firm's stock in a transaction that occurred on Wednesday, April 9th. The stock was sold at an average price of $77.65, for a total transaction of $446,487.50. Following the transaction, the director now directly owns 84,969 shares in the company, valued at $6,597,842.85. This represents a 6.34% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 304,581 shares of company stock valued at $33,664,018. 1.50% of the stock is currently owned by company insiders.

HealthEquity Profile

(

Free Report)

HealthEquity, Inc provides technology-enabled services platforms to consumers and employers in the United States. The company offers cloud-based platforms for individuals to make health saving and spending decisions, pay healthcare bills, receive personalized benefit information, earn wellness incentives, grow their savings, and make investment choices; and health savings accounts.

Featured Stories

Before you consider HealthEquity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HealthEquity wasn't on the list.

While HealthEquity currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.