Leeward Investments LLC MA boosted its holdings in shares of Cabot Corporation (NYSE:CBT - Free Report) by 13.3% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 181,619 shares of the specialty chemicals company's stock after buying an additional 21,373 shares during the quarter. Leeward Investments LLC MA owned approximately 0.33% of Cabot worth $15,100,000 as of its most recent SEC filing.

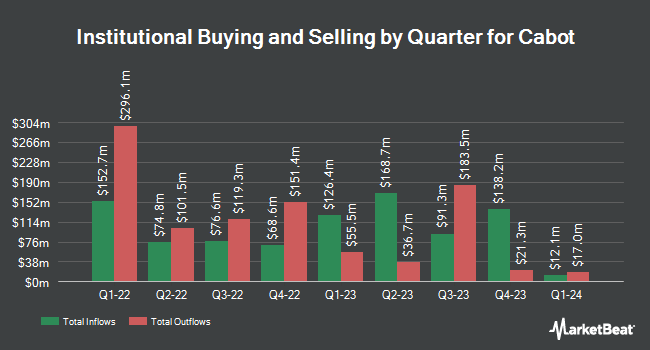

Several other institutional investors also recently bought and sold shares of CBT. Norges Bank purchased a new position in Cabot during the fourth quarter valued at approximately $37,961,000. Millennium Management LLC boosted its position in shares of Cabot by 67.7% in the 4th quarter. Millennium Management LLC now owns 349,369 shares of the specialty chemicals company's stock worth $31,901,000 after purchasing an additional 141,050 shares in the last quarter. GAMMA Investing LLC boosted its position in shares of Cabot by 10,385.0% in the 1st quarter. GAMMA Investing LLC now owns 141,338 shares of the specialty chemicals company's stock worth $11,751,000 after purchasing an additional 139,990 shares in the last quarter. American Century Companies Inc. boosted its position in shares of Cabot by 8.5% in the 4th quarter. American Century Companies Inc. now owns 1,323,347 shares of the specialty chemicals company's stock worth $120,835,000 after purchasing an additional 103,380 shares in the last quarter. Finally, JPMorgan Chase & Co. boosted its position in shares of Cabot by 27.1% in the 4th quarter. JPMorgan Chase & Co. now owns 451,513 shares of the specialty chemicals company's stock worth $41,228,000 after purchasing an additional 96,179 shares in the last quarter. 93.18% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on the company. UBS Group lowered their price objective on Cabot from $93.00 to $83.00 and set a "neutral" rating for the company in a research report on Monday, April 7th. Wall Street Zen cut Cabot from a "buy" rating to a "hold" rating in a research report on Wednesday, May 7th.

View Our Latest Analysis on CBT

Cabot Stock Performance

Shares of CBT traded down $2.01 during trading hours on Monday, reaching $76.36. 271,268 shares of the company traded hands, compared to its average volume of 409,385. The stock has a market capitalization of $4.10 billion, a P/E ratio of 9.88, a P/E/G ratio of 0.71 and a beta of 0.85. The company has a quick ratio of 1.30, a current ratio of 1.96 and a debt-to-equity ratio of 0.69. Cabot Corporation has a 12-month low of $71.64 and a 12-month high of $117.46. The business has a fifty day moving average price of $75.62 and a 200-day moving average price of $81.83.

Cabot (NYSE:CBT - Get Free Report) last announced its quarterly earnings data on Monday, May 5th. The specialty chemicals company reported $1.90 earnings per share for the quarter, beating analysts' consensus estimates of $1.86 by $0.04. The firm had revenue of $936.00 million for the quarter, compared to analyst estimates of $1.02 billion. Cabot had a net margin of 11.08% and a return on equity of 26.76%. The business's quarterly revenue was down 8.1% compared to the same quarter last year. During the same period in the previous year, the company earned $1.78 earnings per share. Equities analysts anticipate that Cabot Corporation will post 7.57 EPS for the current fiscal year.

Cabot Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Friday, May 30th were issued a dividend of $0.45 per share. The ex-dividend date of this dividend was Friday, May 30th. This is a positive change from Cabot's previous quarterly dividend of $0.43. This represents a $1.80 dividend on an annualized basis and a dividend yield of 2.36%. Cabot's payout ratio is 23.29%.

Cabot Company Profile

(

Free Report)

Cabot Corporation operates as a specialty chemicals and performance materials company. The company operates through two segments, Reinforcement Materials and Performance Chemicals. It offers reinforcing carbons that are used in tires as a rubber reinforcing agent and performance additive, as well as in industrial products, such as hoses, belts, extruded profiles, and molded goods; and engineered elastomer composites solutions.

Read More

Before you consider Cabot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabot wasn't on the list.

While Cabot currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.