BDF Gestion lessened its position in Caterpillar Inc. (NYSE:CAT - Free Report) by 11.5% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 7,964 shares of the industrial products company's stock after selling 1,036 shares during the period. BDF Gestion's holdings in Caterpillar were worth $2,627,000 at the end of the most recent reporting period.

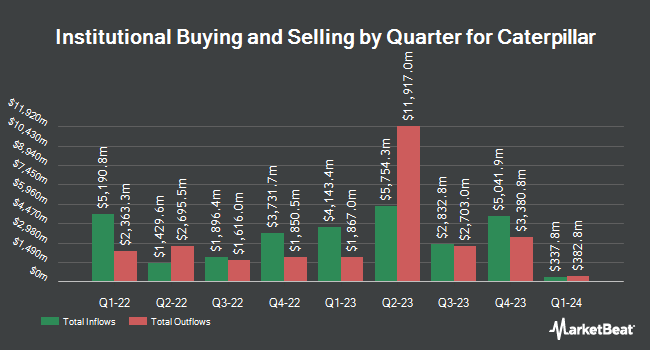

Other hedge funds also recently made changes to their positions in the company. Norges Bank purchased a new stake in shares of Caterpillar during the fourth quarter worth about $2,184,364,000. GAMMA Investing LLC grew its holdings in shares of Caterpillar by 43,447.3% during the first quarter. GAMMA Investing LLC now owns 3,730,259 shares of the industrial products company's stock worth $1,230,239,000 after buying an additional 3,721,693 shares in the last quarter. Capital Research Global Investors grew its holdings in shares of Caterpillar by 69.3% during the fourth quarter. Capital Research Global Investors now owns 2,924,054 shares of the industrial products company's stock worth $1,060,730,000 after buying an additional 1,196,861 shares in the last quarter. Raymond James Financial Inc. purchased a new stake in shares of Caterpillar during the fourth quarter worth about $353,231,000. Finally, Proficio Capital Partners LLC grew its holdings in shares of Caterpillar by 50,072.7% during the fourth quarter. Proficio Capital Partners LLC now owns 804,770 shares of the industrial products company's stock worth $291,938,000 after buying an additional 803,166 shares in the last quarter. Institutional investors and hedge funds own 70.98% of the company's stock.

Caterpillar Trading Down 1.2%

NYSE CAT opened at $356.79 on Monday. The company's fifty day simple moving average is $327.10 and its 200-day simple moving average is $347.86. Caterpillar Inc. has a 52 week low of $267.30 and a 52 week high of $418.50. The company has a current ratio of 1.42, a quick ratio of 0.89 and a debt-to-equity ratio of 1.40. The stock has a market cap of $168.06 billion, a P/E ratio of 16.17, a PEG ratio of 1.87 and a beta of 1.37.

Caterpillar (NYSE:CAT - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The industrial products company reported $4.25 earnings per share (EPS) for the quarter, missing the consensus estimate of $4.35 by ($0.10). The company had revenue of $14.25 billion during the quarter, compared to analyst estimates of $14.64 billion. Caterpillar had a net margin of 16.65% and a return on equity of 58.18%. The company's revenue was down 9.8% on a year-over-year basis. During the same period in the prior year, the company earned $5.60 earnings per share. Equities research analysts predict that Caterpillar Inc. will post 19.86 EPS for the current fiscal year.

Caterpillar Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, August 20th. Investors of record on Monday, July 21st will be issued a $1.51 dividend. The ex-dividend date is Monday, July 21st. This is a boost from Caterpillar's previous quarterly dividend of $1.41. This represents a $6.04 annualized dividend and a yield of 1.69%. Caterpillar's dividend payout ratio is currently 29.43%.

Insider Activity at Caterpillar

In other Caterpillar news, Director David Maclennan bought 375 shares of the stock in a transaction on Wednesday, May 7th. The stock was purchased at an average price of $320.70 per share, for a total transaction of $120,262.50. Following the completion of the purchase, the director now directly owns 6,653 shares in the company, valued at approximately $2,133,617.10. This trade represents a 5.97% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.33% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on CAT shares. Wall Street Zen downgraded shares of Caterpillar from a "buy" rating to a "hold" rating in a report on Tuesday, February 25th. JPMorgan Chase & Co. lowered their target price on shares of Caterpillar from $490.00 to $380.00 and set an "overweight" rating for the company in a report on Monday, April 14th. Robert W. Baird upgraded shares of Caterpillar from a "neutral" rating to an "outperform" rating and boosted their target price for the company from $309.00 to $395.00 in a report on Tuesday, May 13th. DA Davidson boosted their target price on shares of Caterpillar from $325.00 to $331.00 and gave the company a "neutral" rating in a report on Monday, May 5th. Finally, Baird R W upgraded shares of Caterpillar from a "hold" rating to a "strong-buy" rating in a report on Tuesday, May 13th. Six research analysts have rated the stock with a hold rating, nine have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, Caterpillar has a consensus rating of "Moderate Buy" and a consensus target price of $372.92.

Get Our Latest Stock Report on CAT

About Caterpillar

(

Free Report)

Caterpillar Inc manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in worldwide. Its Construction Industries segment offers asphalt pavers, compactors, road reclaimers, forestry machines, cold planers, material handlers, track-type tractors, excavators, telehandlers, motor graders, and pipelayers; compact track, wheel, track-type, backhoe, and skid steer loaders; and related parts and tools.

Featured Articles

Want to see what other hedge funds are holding CAT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Caterpillar Inc. (NYSE:CAT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Caterpillar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caterpillar wasn't on the list.

While Caterpillar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report