Chicago Capital LLC purchased a new position in shares of Fortive Corporation (NYSE:FTV - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 4,352 shares of the technology company's stock, valued at approximately $318,000.

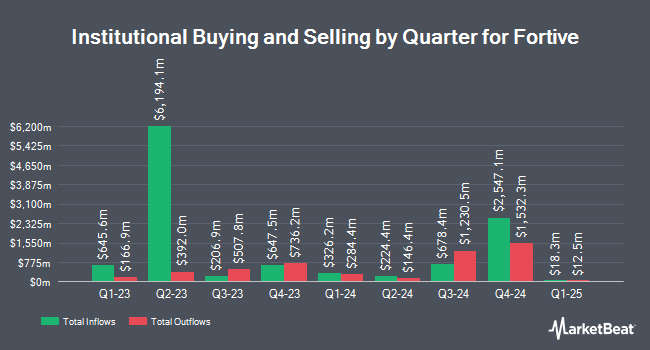

A number of other institutional investors and hedge funds have also recently modified their holdings of FTV. Asahi Life Asset Management CO. LTD. purchased a new position in Fortive during the 4th quarter worth $358,000. OFI Invest Asset Management purchased a new position in Fortive during the 4th quarter worth $17,750,000. Raymond James Financial Inc. purchased a new position in Fortive during the 4th quarter worth $22,412,000. Barrow Hanley Mewhinney & Strauss LLC purchased a new position in Fortive during the 4th quarter worth $136,794,000. Finally, Allstate Corp purchased a new position in Fortive during the 4th quarter worth $795,000. 94.94% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

Several research firms have recently commented on FTV. BNP Paribas reissued a "neutral" rating on shares of Fortive in a research report on Thursday, June 12th. Citigroup reduced their price target on Fortive from $84.00 to $69.00 and set a "neutral" rating for the company in a research report on Monday, April 14th. JPMorgan Chase & Co. boosted their price target on Fortive from $73.00 to $87.00 and gave the stock an "overweight" rating in a research report on Friday, May 16th. Robert W. Baird reduced their target price on Fortive from $88.00 to $82.00 and set an "outperform" rating on the stock in a research report on Wednesday, May 7th. Finally, Royal Bank Of Canada upped their target price on Fortive from $78.00 to $79.00 and gave the company a "sector perform" rating in a research report on Monday, June 9th. Eight investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $82.62.

Read Our Latest Stock Analysis on FTV

Fortive Stock Performance

Shares of FTV traded down $0.28 during mid-day trading on Friday, reaching $69.55. The company had a trading volume of 3,266,230 shares, compared to its average volume of 2,658,947. The stock has a market capitalization of $23.64 billion, a P/E ratio of 30.51, a PEG ratio of 2.89 and a beta of 1.11. Fortive Corporation has a 52-week low of $60.39 and a 52-week high of $83.32. The stock has a 50 day moving average of $69.75 and a two-hundred day moving average of $73.99. The company has a quick ratio of 0.78, a current ratio of 0.99 and a debt-to-equity ratio of 0.29.

Fortive (NYSE:FTV - Get Free Report) last posted its earnings results on Thursday, May 1st. The technology company reported $0.85 EPS for the quarter, hitting the consensus estimate of $0.85. The firm had revenue of $1.47 billion for the quarter, compared to analyst estimates of $1.49 billion. Fortive had a return on equity of 13.19% and a net margin of 12.90%. Fortive's revenue for the quarter was down 3.3% compared to the same quarter last year. During the same period last year, the company earned $0.83 earnings per share. On average, analysts expect that Fortive Corporation will post 4.05 earnings per share for the current year.

Fortive Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, June 27th. Investors of record on Wednesday, April 30th will be issued a dividend of $0.08 per share. This represents a $0.32 annualized dividend and a yield of 0.46%. The ex-dividend date is Friday, May 30th. Fortive's dividend payout ratio (DPR) is 14.04%.

Fortive declared that its Board of Directors has initiated a share repurchase program on Tuesday, May 27th that allows the company to buyback 15,630,000 outstanding shares. This buyback authorization allows the technology company to reacquire shares of its stock through open market purchases. Stock buyback programs are typically a sign that the company's management believes its stock is undervalued.

Insider Buying and Selling

In other Fortive news, SVP Peter C. Underwood sold 14,327 shares of the stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $73.88, for a total transaction of $1,058,478.76. Following the transaction, the senior vice president now owns 51,750 shares in the company, valued at approximately $3,823,290. This represents a 21.68% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO James A. Lico sold 175,000 shares of the stock in a transaction that occurred on Thursday, May 15th. The stock was sold at an average price of $72.40, for a total value of $12,670,000.00. Following the transaction, the chief executive officer now owns 428,585 shares in the company, valued at $31,029,554. This represents a 28.99% decrease in their position. The disclosure for this sale can be found here. 0.92% of the stock is owned by corporate insiders.

Fortive Profile

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

See Also

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report