Childress Capital Advisors LLC lowered its position in shares of Main Street Capital Corporation (NYSE:MAIN - Free Report) by 3.8% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 112,210 shares of the financial services provider's stock after selling 4,400 shares during the period. Main Street Capital accounts for approximately 1.8% of Childress Capital Advisors LLC's investment portfolio, making the stock its 13th biggest holding. Childress Capital Advisors LLC owned approximately 0.13% of Main Street Capital worth $6,347,000 at the end of the most recent reporting period.

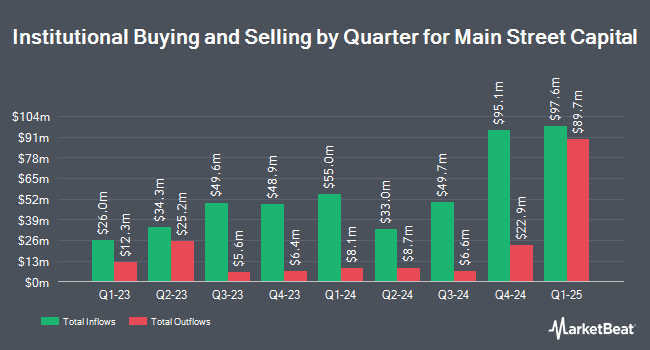

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in MAIN. Brighton Jones LLC bought a new stake in Main Street Capital during the fourth quarter worth about $304,000. Private Advisor Group LLC raised its stake in Main Street Capital by 9.5% during the fourth quarter. Private Advisor Group LLC now owns 146,954 shares of the financial services provider's stock worth $8,609,000 after acquiring an additional 12,729 shares in the last quarter. Sigma Planning Corp increased its position in Main Street Capital by 10.8% during the 4th quarter. Sigma Planning Corp now owns 44,706 shares of the financial services provider's stock worth $2,619,000 after purchasing an additional 4,342 shares in the last quarter. Union Bancaire Privee UBP SA bought a new position in Main Street Capital in the 4th quarter valued at approximately $910,000. Finally, Bank of New York Mellon Corp boosted its position in Main Street Capital by 56.8% in the fourth quarter. Bank of New York Mellon Corp now owns 29,316 shares of the financial services provider's stock valued at $1,717,000 after buying an additional 10,625 shares in the last quarter. 20.31% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts recently weighed in on the company. UBS Group cut their price objective on Main Street Capital from $55.00 to $54.00 and set a "neutral" rating on the stock in a report on Thursday, April 17th. B. Riley upgraded shares of Main Street Capital to a "hold" rating in a research report on Monday, June 16th. Oppenheimer reaffirmed a "market perform" rating on shares of Main Street Capital in a research note on Tuesday, May 13th. Wall Street Zen downgraded Main Street Capital from a "hold" rating to a "sell" rating in a report on Saturday, May 31st. Finally, Truist Financial cut their target price on Main Street Capital from $62.00 to $54.00 and set a "hold" rating on the stock in a report on Monday, May 12th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat.com, Main Street Capital currently has a consensus rating of "Hold" and a consensus price target of $52.80.

View Our Latest Analysis on Main Street Capital

Main Street Capital Stock Down 0.4%

NYSE:MAIN traded down $0.25 during trading hours on Wednesday, reaching $58.32. The company had a trading volume of 268,040 shares, compared to its average volume of 471,834. Main Street Capital Corporation has a twelve month low of $45.00 and a twelve month high of $63.32. The company has a quick ratio of 0.10, a current ratio of 0.10 and a debt-to-equity ratio of 0.12. The firm has a market cap of $5.19 billion, a price-to-earnings ratio of 9.90 and a beta of 0.82. The business's 50-day simple moving average is $55.57 and its two-hundred day simple moving average is $57.11.

Main Street Capital (NYSE:MAIN - Get Free Report) last issued its earnings results on Thursday, May 8th. The financial services provider reported $1.01 EPS for the quarter, beating analysts' consensus estimates of $1.00 by $0.01. Main Street Capital had a return on equity of 13.02% and a net margin of 94.61%. The business had revenue of $137.05 million during the quarter, compared to analyst estimates of $137.50 million. On average, equities analysts expect that Main Street Capital Corporation will post 4.11 earnings per share for the current year.

Main Street Capital Increases Dividend

The firm also recently disclosed a dividend, which will be paid on Friday, June 27th. Shareholders of record on Monday, June 23rd will be issued a dividend of $0.30 per share. This is an increase from Main Street Capital's previous dividend of $0.25. The ex-dividend date of this dividend is Friday, June 20th. This represents a yield of 7.26%. Main Street Capital's dividend payout ratio is presently 50.93%.

Main Street Capital Profile

(

Free Report)

Main Street Capital Corporation is a business development company specializes in equity capital to lower middle market companies. The firm specializing in recapitalizations, management buyouts, refinancing, family estate planning, management buyouts, refinancing, industry consolidation, mature, later stage emerging growth.

Read More

Before you consider Main Street Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Main Street Capital wasn't on the list.

While Main Street Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.