Cim LLC reduced its holdings in Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 49.4% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 4,021 shares of the company's stock after selling 3,918 shares during the quarter. Cim LLC's holdings in Medpace were worth $1,336,000 at the end of the most recent quarter.

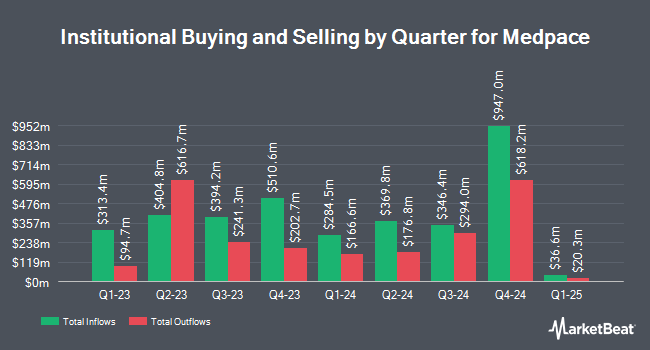

Several other large investors have also recently added to or reduced their stakes in MEDP. Invesco Ltd. increased its position in Medpace by 91.8% in the 4th quarter. Invesco Ltd. now owns 1,084,753 shares of the company's stock valued at $360,387,000 after acquiring an additional 519,186 shares during the period. Proficio Capital Partners LLC increased its position in Medpace by 34,497.4% in the 4th quarter. Proficio Capital Partners LLC now owns 242,528 shares of the company's stock valued at $80,575,000 after acquiring an additional 241,827 shares during the period. Raymond James Financial Inc. acquired a new stake in Medpace in the 4th quarter valued at approximately $78,144,000. Norges Bank acquired a new stake in Medpace in the 4th quarter valued at approximately $69,859,000. Finally, GW&K Investment Management LLC increased its position in Medpace by 93.9% in the 4th quarter. GW&K Investment Management LLC now owns 275,460 shares of the company's stock valued at $91,516,000 after acquiring an additional 133,379 shares during the period. 77.98% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several analysts recently commented on MEDP shares. Leerink Partnrs upgraded Medpace to a "hold" rating in a research report on Monday, March 24th. William Blair reiterated a "market perform" rating on shares of Medpace in a research report on Tuesday, April 22nd. Mizuho lowered their price target on Medpace from $400.00 to $355.00 and set an "outperform" rating on the stock in a research report on Wednesday, April 9th. Leerink Partners started coverage on Medpace in a research report on Monday, March 24th. They set a "market perform" rating and a $330.00 price target on the stock. Finally, Truist Financial lowered their price target on Medpace from $333.00 to $300.00 and set a "hold" rating on the stock in a research report on Wednesday, April 23rd. Eleven analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $349.30.

View Our Latest Analysis on MEDP

Insider Transactions at Medpace

In other news, Director Fred B. Davenport, Jr. sold 1,712 shares of the firm's stock in a transaction on Thursday, April 24th. The stock was sold at an average price of $301.82, for a total value of $516,715.84. Following the completion of the sale, the director now owns 2,998 shares of the company's stock, valued at $904,856.36. This trade represents a 36.35% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. 20.30% of the stock is currently owned by insiders.

Medpace Price Performance

Shares of MEDP traded down $0.60 during trading hours on Friday, hitting $296.45. 315,099 shares of the company were exchanged, compared to its average volume of 354,653. The company has a market capitalization of $8.52 billion, a PE ratio of 23.47, a PEG ratio of 3.81 and a beta of 1.55. The firm has a fifty day simple moving average of $298.92 and a 200-day simple moving average of $324.80. Medpace Holdings, Inc. has a one year low of $250.05 and a one year high of $459.77.

Medpace (NASDAQ:MEDP - Get Free Report) last released its quarterly earnings data on Monday, April 21st. The company reported $3.67 earnings per share for the quarter, topping the consensus estimate of $3.06 by $0.61. The business had revenue of $558.57 million during the quarter, compared to analyst estimates of $528.38 million. Medpace had a return on equity of 51.48% and a net margin of 19.17%. During the same period last year, the company posted $3.20 EPS. Sell-side analysts expect that Medpace Holdings, Inc. will post 12.29 EPS for the current year.

About Medpace

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

Featured Stories

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.