Cooke & Bieler LP boosted its position in Weatherford International PLC (NASDAQ:WFRD - Free Report) by 15.1% in the first quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 284,550 shares of the company's stock after purchasing an additional 37,410 shares during the quarter. Cooke & Bieler LP owned approximately 0.39% of Weatherford International worth $15,238,000 at the end of the most recent reporting period.

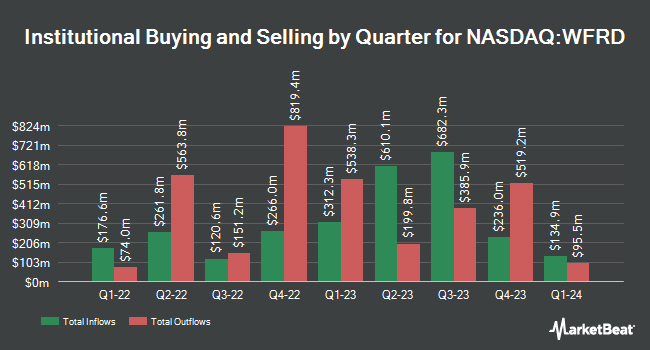

A number of other large investors have also added to or reduced their stakes in the company. Xponance Inc. raised its holdings in Weatherford International by 1.0% in the fourth quarter. Xponance Inc. now owns 17,072 shares of the company's stock worth $1,223,000 after purchasing an additional 167 shares in the last quarter. Treasurer of the State of North Carolina grew its stake in shares of Weatherford International by 0.6% during the fourth quarter. Treasurer of the State of North Carolina now owns 31,730 shares of the company's stock worth $2,273,000 after acquiring an additional 200 shares during the last quarter. Covestor Ltd grew its stake in shares of Weatherford International by 30.1% during the fourth quarter. Covestor Ltd now owns 926 shares of the company's stock worth $66,000 after acquiring an additional 214 shares during the last quarter. Gradient Investments LLC grew its stake in shares of Weatherford International by 1.4% during the first quarter. Gradient Investments LLC now owns 16,080 shares of the company's stock worth $861,000 after acquiring an additional 228 shares during the last quarter. Finally, GAMMA Investing LLC grew its stake in shares of Weatherford International by 55.8% during the first quarter. GAMMA Investing LLC now owns 645 shares of the company's stock worth $35,000 after acquiring an additional 231 shares during the last quarter. 97.23% of the stock is currently owned by institutional investors.

Insider Activity

In other Weatherford International news, Director Neal P. Goldman acquired 12,000 shares of the business's stock in a transaction that occurred on Thursday, April 24th. The stock was purchased at an average cost of $42.04 per share, with a total value of $504,480.00. Following the transaction, the director owned 25,311 shares of the company's stock, valued at $1,064,074.44. This trade represents a 90.15% increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Insiders own 2.09% of the company's stock.

Analysts Set New Price Targets

WFRD has been the topic of a number of research analyst reports. Citigroup dropped their price target on Weatherford International from $90.00 to $70.00 and set a "buy" rating on the stock in a research note on Tuesday, May 13th. Barclays dropped their price target on Weatherford International from $85.00 to $77.00 and set an "overweight" rating on the stock in a research note on Friday, April 25th. Raymond James Financial downgraded shares of Weatherford International from a "strong-buy" rating to an "outperform" rating and cut their price target for the stock from $73.00 to $69.00 in a report on Thursday, April 24th. Finally, Piper Sandler cut their price target on shares of Weatherford International from $80.00 to $62.00 and set a "neutral" rating on the stock in a report on Thursday, April 24th. Two research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $96.63.

Get Our Latest Research Report on WFRD

Weatherford International Price Performance

Shares of NASDAQ:WFRD traded down $0.14 during midday trading on Friday, reaching $53.57. 1,078,710 shares of the company's stock traded hands, compared to its average volume of 1,186,155. Weatherford International PLC has a 1 year low of $36.74 and a 1 year high of $134.39. The company has a market cap of $3.89 billion, a P/E ratio of 8.57, a PEG ratio of 1.50 and a beta of 0.76. The company has a debt-to-equity ratio of 1.16, a quick ratio of 1.52 and a current ratio of 2.08. The company has a fifty day simple moving average of $50.09 and a two-hundred day simple moving average of $55.08.

Weatherford International (NASDAQ:WFRD - Get Free Report) last issued its quarterly earnings data on Tuesday, April 22nd. The company reported $1.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.89 by $0.14. The firm had revenue of $1.19 billion during the quarter, compared to the consensus estimate of $1.21 billion. Weatherford International had a return on equity of 35.88% and a net margin of 8.79%. Equities analysts predict that Weatherford International PLC will post 5.89 EPS for the current fiscal year.

Weatherford International Company Profile

(

Free Report)

Weatherford International plc, an energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide. The company operates through three segments: Drilling and Evaluation; Well Construction and Completions; and Production and Intervention.

See Also

Before you consider Weatherford International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weatherford International wasn't on the list.

While Weatherford International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.